- Hong Kong

- /

- Aerospace & Defense

- /

- SEHK:439

Discover 3 Promising Penny Stocks With Market Caps Over US$300M

Reviewed by Simply Wall St

As global markets experience a mix of rate cuts, sector rallies, and shifting economic indicators, investors are increasingly looking down the market cap spectrum for opportunities. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.60 | MYR2.96B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR337.78M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.74 | MYR128.18M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.905 | MYR300.41M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB2.44 | THB1.98B | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.23 | CN¥2.07B | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.58 | MYR2.59B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.355 | £433.13M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$128.44M | ★★★★☆☆ |

Click here to see the full list of 5,781 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

China Wantian Holdings (SEHK:1854)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Wantian Holdings Limited operates in the green food supply and catering chain, as well as environmental protection and technology sectors in Hong Kong and the People’s Republic of China, with a market capitalization of approximately HK$2.37 billion.

Operations: The company's revenue is primarily derived from its food supply segment, generating HK$360.98 million, followed by catering services at HK$20.02 million, and environmental protection and technology services contributing HK$0.85 million.

Market Cap: HK$2.37B

China Wantian Holdings Limited, with a market cap of HK$2.37 billion, primarily generates revenue from its food supply segment. Despite being unprofitable and experiencing increased losses over the past five years, the company has reduced its debt to equity ratio significantly from 23.4% to 5.1%. It maintains more cash than total debt and covers both short-term and long-term liabilities with its assets. Recent inclusion in the S&P Global BMI Index highlights some recognition within financial markets, although significant insider selling in recent months may raise concerns for potential investors evaluating this penny stock opportunity.

- Dive into the specifics of China Wantian Holdings here with our thorough balance sheet health report.

- Evaluate China Wantian Holdings' historical performance by accessing our past performance report.

KuangChi Science (SEHK:439)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: KuangChi Science Limited is an investment holding company focused on developing artificial intelligence technology and related products in China, Hong Kong, and internationally, with a market cap of HK$1.23 billion.

Operations: The company generates revenue from its Aerospace & Defense segment, amounting to HK$81.71 million.

Market Cap: HK$1.23B

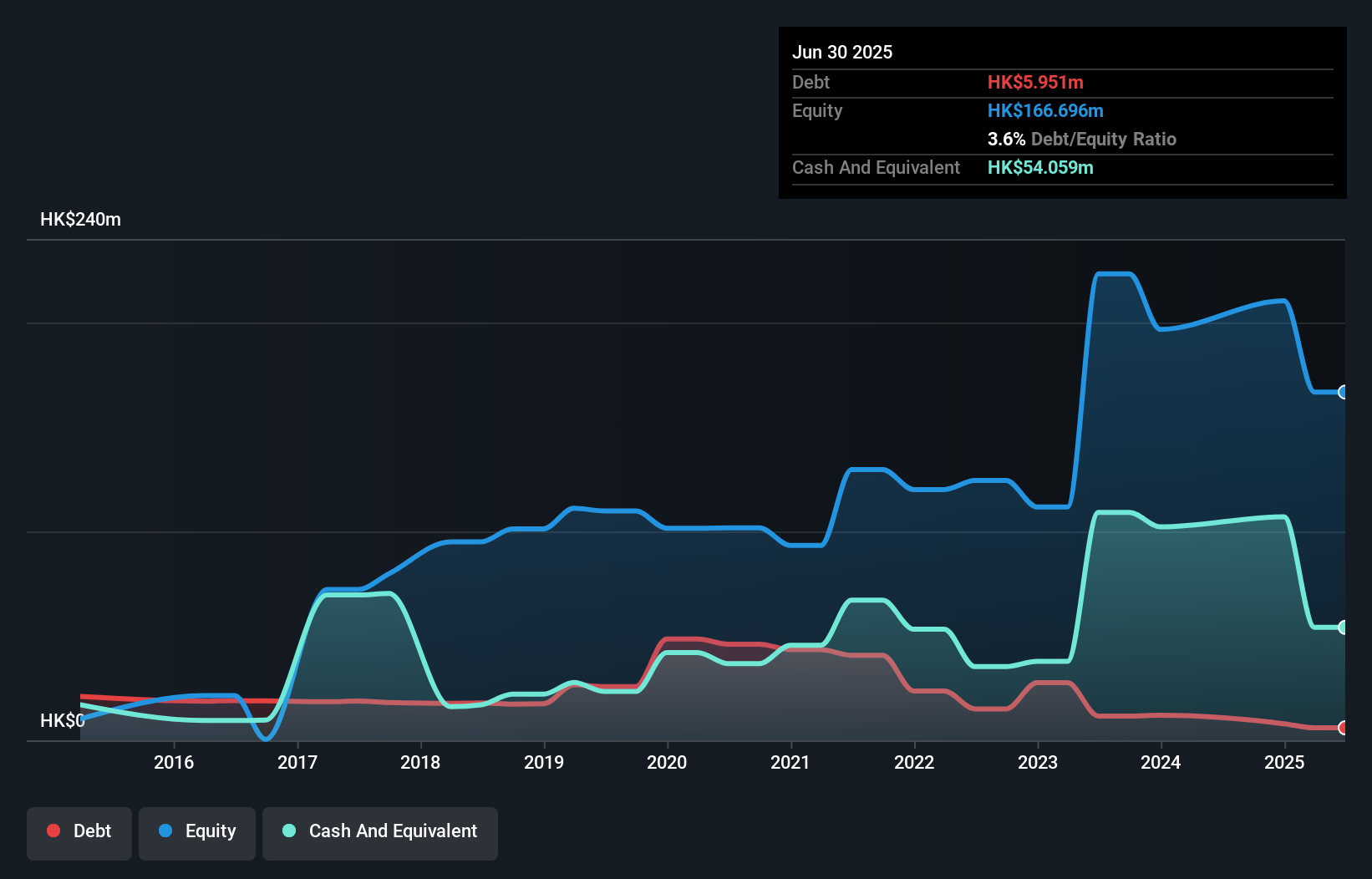

KuangChi Science Limited, with a market cap of HK$1.23 billion, operates in the Aerospace & Defense sector and reported half-year sales of HK$32.03 million, slightly down from the previous year. Despite being unprofitable, it has reduced its net loss to HK$5.23 million and improved its debt position significantly over five years, now holding more cash than total debt. The company's short-term assets cover both short-term and long-term liabilities comfortably. Recent leadership changes saw Dr. Zhang Yangyang appointed as Chairman, bringing extensive experience in advanced technologies which may influence future strategic directions positively for this investment holding company.

- Click to explore a detailed breakdown of our findings in KuangChi Science's financial health report.

- Gain insights into KuangChi Science's past trends and performance with our report on the company's historical track record.

Wee Hur Holdings (SGX:E3B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wee Hur Holdings Ltd. is an investment holding company involved in general building and civil engineering construction in Singapore and Australia, with a market cap of SGD395.28 million.

Operations: The company's revenue segments include Building Construction (SGD121.19 million), Workers Dormitory (SGD76.45 million), Property Development in Singapore (SGD50.76 million), Fund Management (SGD5.81 million), PBSA Operations (SGD1.84 million), Corporate Segment (SGD2.20 million), and Property Development in Australia (SGD0.81 million).

Market Cap: SGD395.28M

Wee Hur Holdings Ltd., with a market cap of SGD395.28 million, has demonstrated financial resilience and growth. The company recently reported a significant turnaround, achieving net income of SGD66.5 million for the first half of 2024 compared to a net loss last year. Its debt to equity ratio has improved markedly over five years, now holding more cash than total debt, and its interest payments are well covered by EBIT. With short-term assets exceeding both long and short-term liabilities, Wee Hur's financial health appears robust. Additionally, it proposed an interim dividend for FY2024, reflecting confidence in its cash flow stability.

- Navigate through the intricacies of Wee Hur Holdings with our comprehensive balance sheet health report here.

- Understand Wee Hur Holdings' track record by examining our performance history report.

Seize The Opportunity

- Discover the full array of 5,781 Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KuangChi Science might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:439

KuangChi Science

An investment holding company, engages in the development of artificial intelligence (AI) technology and related products in the People’s Republic of China, Hong Kong, and internationally.

Excellent balance sheet very low.