Stock Analysis

- Hong Kong

- /

- Consumer Services

- /

- SEHK:2779

3 High Yield Dividend Stocks On SEHK With Up To 9.4% Yield

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, the Hong Kong stock exchange has shown resilience, with particular interest in high-yield dividend stocks. As investors seek stable returns in uncertain times, understanding the characteristics that make a good dividend stock becomes crucial.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| CITIC Telecom International Holdings (SEHK:1883) | 9.30% | ★★★★★★ |

| China Construction Bank (SEHK:939) | 7.65% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 8.82% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.68% | ★★★★★☆ |

| S.A.S. Dragon Holdings (SEHK:1184) | 8.77% | ★★★★★☆ |

| International Housewares Retail (SEHK:1373) | 9.11% | ★★★★★☆ |

| China Overseas Grand Oceans Group (SEHK:81) | 8.34% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.18% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.21% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.86% | ★★★★★☆ |

Click here to see the full list of 93 stocks from our Top SEHK Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

China Mengniu Dairy (SEHK:2319)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Mengniu Dairy Company Limited operates as an investment holding company that manufactures and distributes dairy products under the MENGNIU brand, both domestically in the People’s Republic of China and internationally, with a market capitalization of approximately HK$56.90 billion.

Operations: China Mengniu Dairy Company Limited generates revenue primarily through its Liquid Milk Business at CN¥83.20 billion, followed by the Ice Cream Business at CN¥6.08 billion, Cheese Business at CN¥4.38 billion, and Milk Powder Business at CN¥3.83 billion.

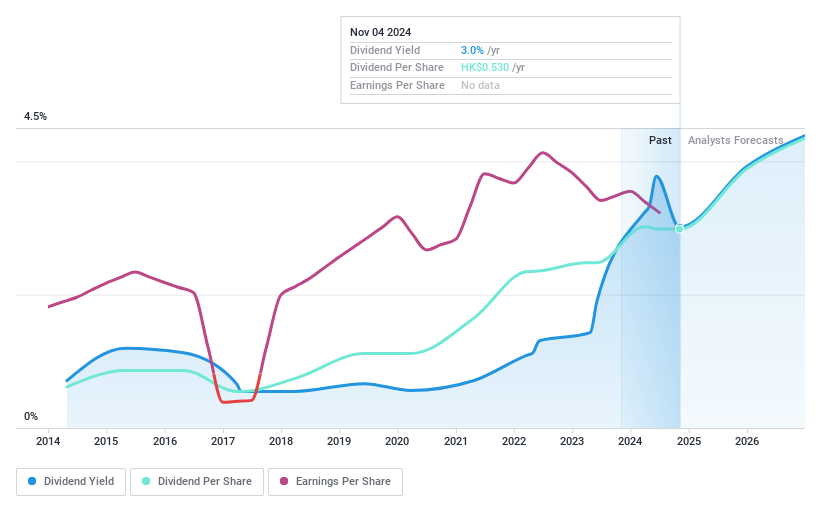

Dividend Yield: 3.6%

China Mengniu Dairy recently approved a final cash dividend of RMB 0.489 per share, indicating a commitment to returning value to shareholders. However, the company's dividend yield at 3.64% is relatively low compared to the top Hong Kong dividend payers at 7.9%. While dividends are supported by earnings and cash flows with payout ratios of 40.1% and 44.8% respectively, the historical volatility in payments suggests some risk for those seeking stable income streams. Additionally, recent executive changes and updates to company bylaws reflect ongoing corporate governance adjustments which could impact future performance and strategy execution.

- Click to explore a detailed breakdown of our findings in China Mengniu Dairy's dividend report.

- The analysis detailed in our China Mengniu Dairy valuation report hints at an deflated share price compared to its estimated value.

China Xinhua Education Group (SEHK:2779)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Xinhua Education Group Limited operates in the People's Republic of China, offering higher and secondary vocational education services, with a market capitalization of approximately HK$1.05 billion.

Operations: China Xinhua Education Group Limited generates CN¥0.64 billion from its provision of education services.

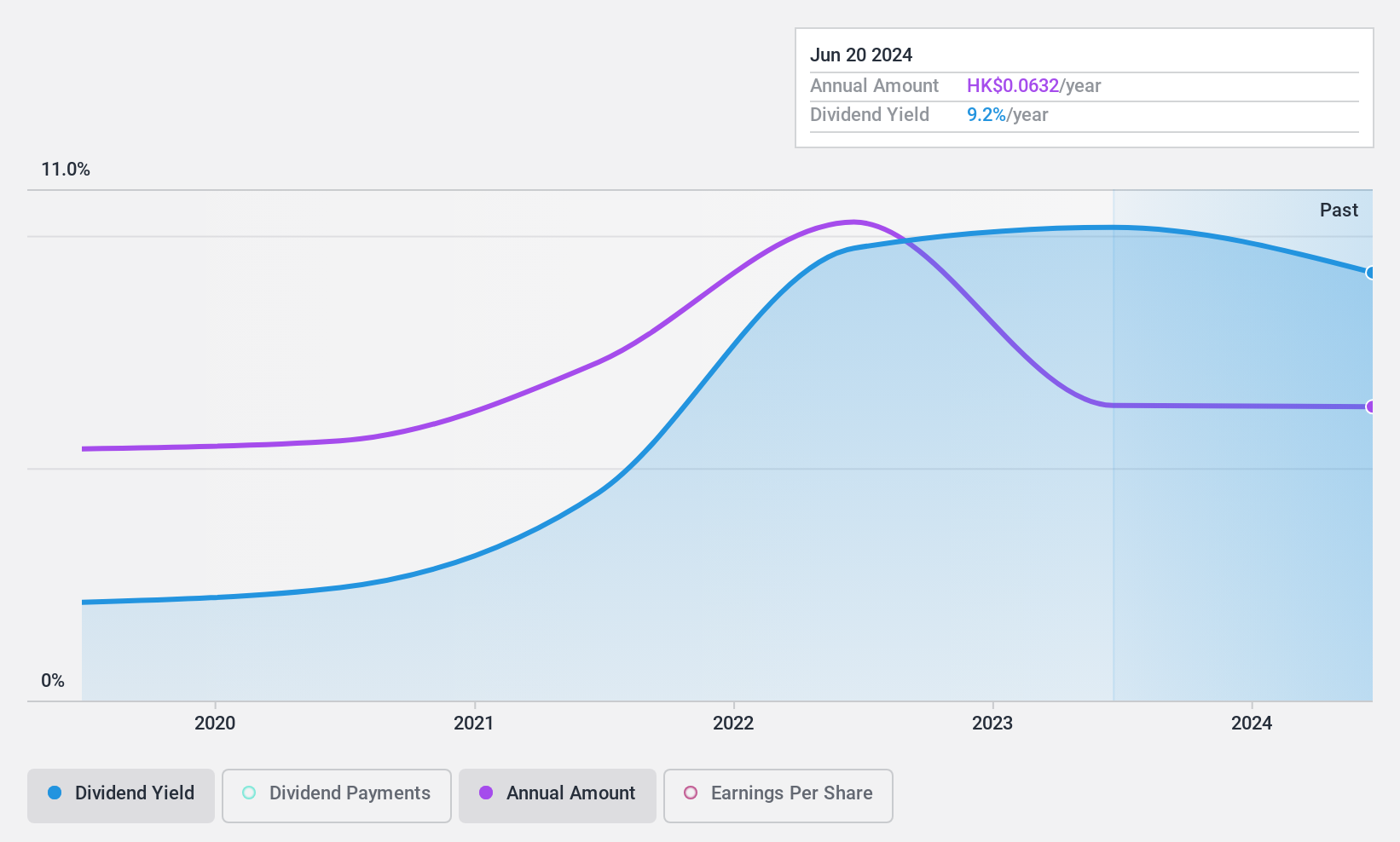

Dividend Yield: 9.5%

China Xinhua Education Group offers a dividend yield of 9.48%, ranking in the top 25% of Hong Kong payers. Despite this, its dividend history is marked by instability, including a significant drop announced on June 18, 2024. The dividends are supported by a payout ratio of 30% and cash payout ratio of 25.3%, suggesting coverage from both earnings and cash flows. However, the company's short dividend-paying history and recent decrease highlight potential concerns for reliability in future payouts.

- Click here to discover the nuances of China Xinhua Education Group with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that China Xinhua Education Group is trading behind its estimated value.

CIMC Enric Holdings (SEHK:3899)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CIMC Enric Holdings Limited, with a market cap of HK$15.01 billion, specializes in offering transportation, storage, and processing equipment and services across the clean energy, chemicals, environmental, and liquid food sectors globally.

Operations: CIMC Enric Holdings Limited generates CN¥14.91 billion from its clean energy segment, CN¥4.46 billion from its chemical and environmental sector, and CN¥4.29 billion from liquid food equipment and services.

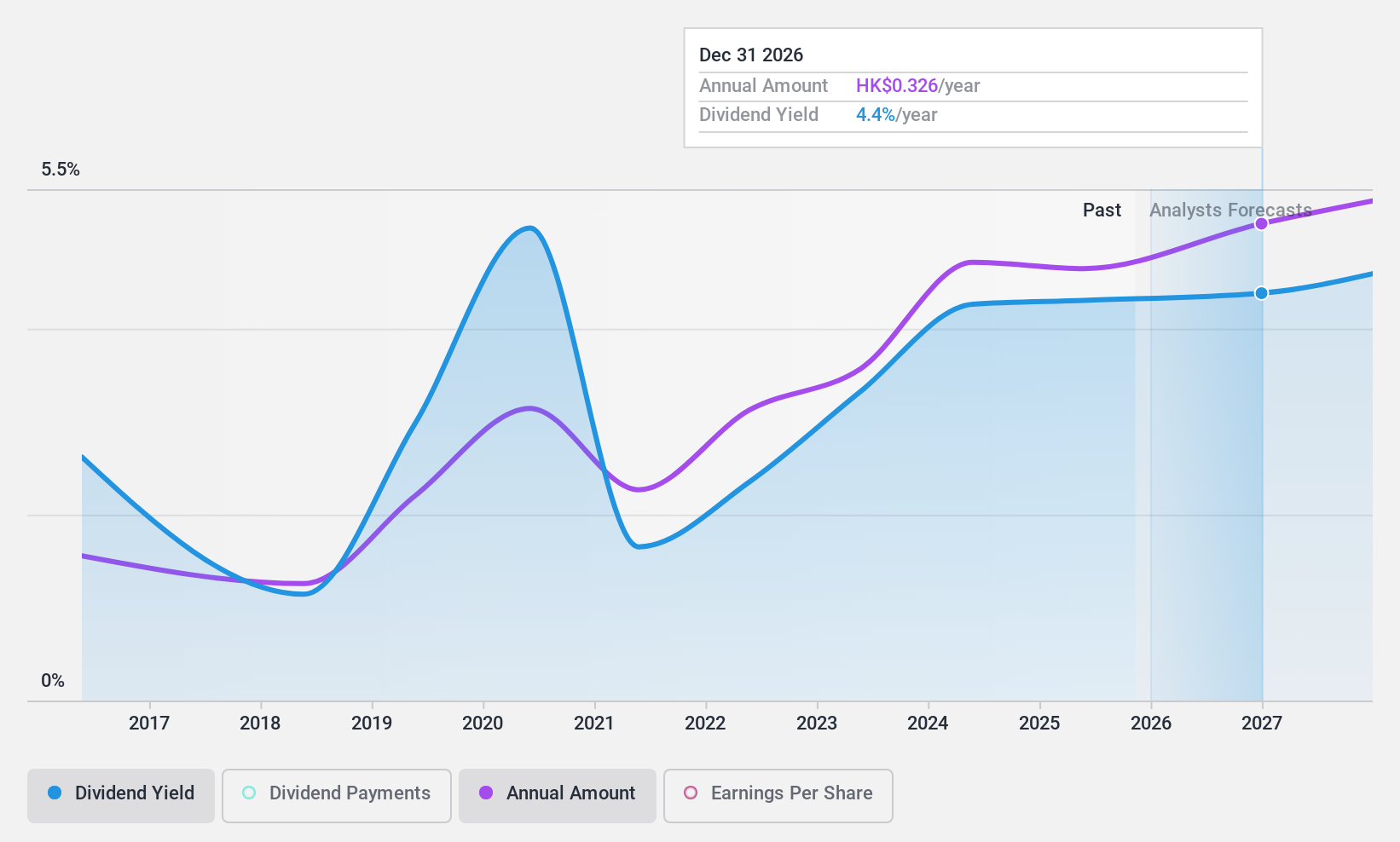

Dividend Yield: 3.9%

CIMC Enric Holdings has demonstrated a mixed performance in dividend reliability, with payments showing volatility over the past decade, including a significant annual drop. However, recent developments indicate improvement; at its 2024 AGM, CIMC Enric approved an increase to HK$0.30 per share for the final 2023 dividend. The company maintains a moderate payout ratio of 48.7% and cash payout ratio of 58.7%, suggesting that dividends are well-covered by both earnings and cash flows despite past inconsistencies.

- Click here and access our complete dividend analysis report to understand the dynamics of CIMC Enric Holdings.

- Our comprehensive valuation report raises the possibility that CIMC Enric Holdings is priced higher than what may be justified by its financials.

Taking Advantage

- Take a closer look at our Top SEHK Dividend Stocks list of 93 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2779

China Xinhua Education Group

Provides higher and secondary vocational education services in the People's Republic of China.

Solid track record with excellent balance sheet and pays a dividend.