- China

- /

- Retail Distributors

- /

- SHSE:600704

3 Asian Dividend Stocks Yielding Up To 4.9%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed economic signals, Asia's stock markets have shown resilience, with notable performances in Japan and China amid evolving monetary policies and economic data. In this dynamic environment, dividend stocks can offer investors a measure of stability and income potential; identifying those with strong fundamentals and attractive yields becomes particularly valuable.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.22% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.78% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.21% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.92% | ★★★★★★ |

| NCD (TSE:4783) | 4.37% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.90% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.02% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| Daicel (TSE:4202) | 4.50% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.48% | ★★★★★★ |

Click here to see the full list of 1072 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

CIMC Enric Holdings (SEHK:3899)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CIMC Enric Holdings Limited offers transportation, storage, and processing equipment and services across the clean energy, chemicals, environmental, and liquid food sectors globally with a market cap of HK$16.67 billion.

Operations: CIMC Enric Holdings Limited generates revenue from its key segments, including CN¥18.93 billion from Clean Energy, CN¥4.02 billion from Liquid Food, and CN¥2.98 billion from Chemical and Environmental sectors.

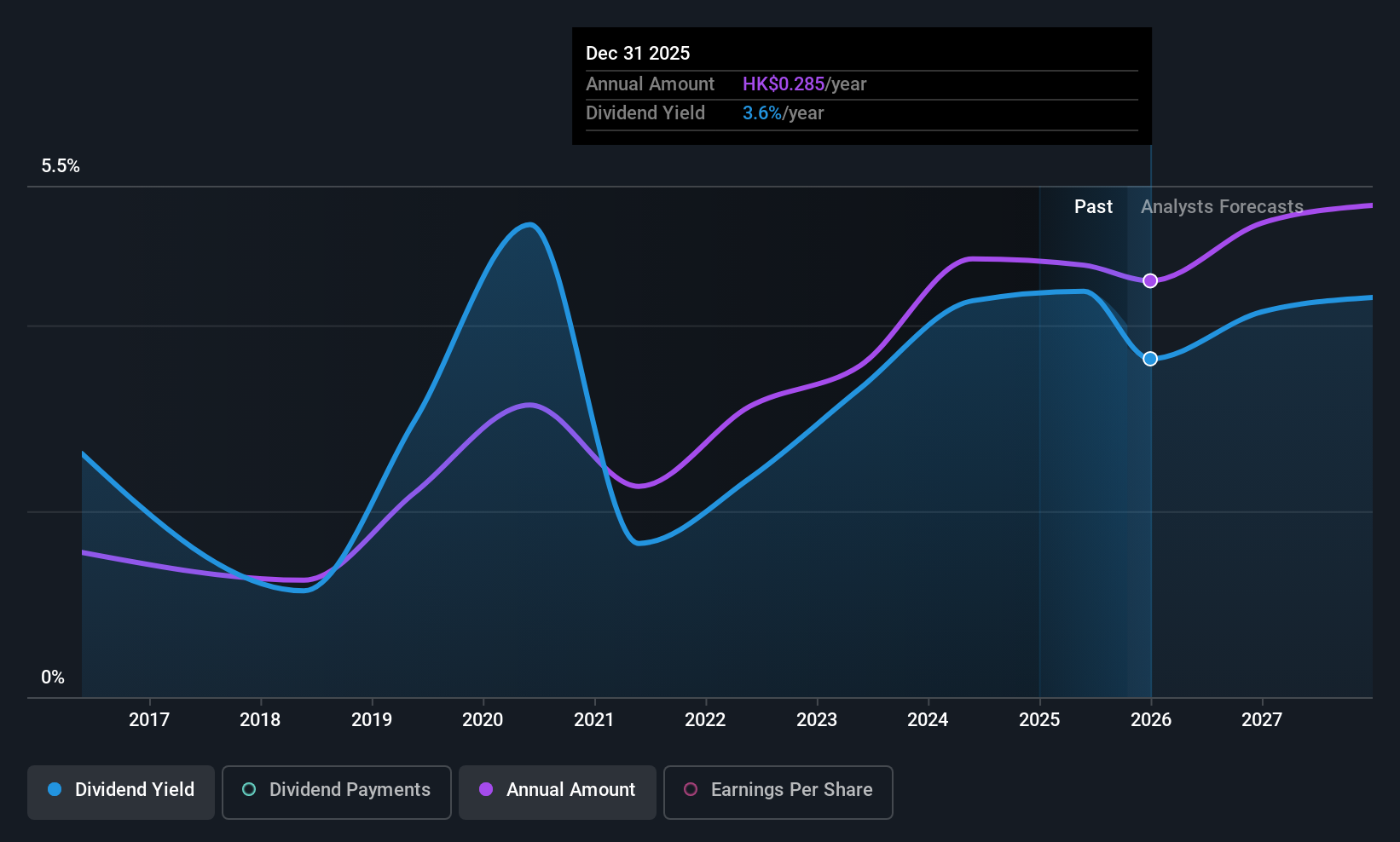

Dividend Yield: 3.6%

CIMC Enric Holdings has shown a mixed dividend profile. While its dividend payments have grown over the past decade, they have been volatile, experiencing significant annual drops. The current yield of 3.59% is below the top quartile in Hong Kong. However, dividends are well-covered by earnings and cash flows with payout ratios of 46.7% and 65.4%, respectively. Recent earnings growth supports potential future stability despite historical volatility concerns.

- Click here and access our complete dividend analysis report to understand the dynamics of CIMC Enric Holdings.

- According our valuation report, there's an indication that CIMC Enric Holdings' share price might be on the cheaper side.

Wuchan Zhongda GroupLtd (SHSE:600704)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wuchan Zhongda Group Co., Ltd., along with its subsidiaries, offers bulk commodity supply chain integration services both in China and internationally, with a market cap of CN¥31.08 billion.

Operations: Wuchan Zhongda Group Co., Ltd. generates revenue through its bulk commodity supply chain integration services across domestic and international markets.

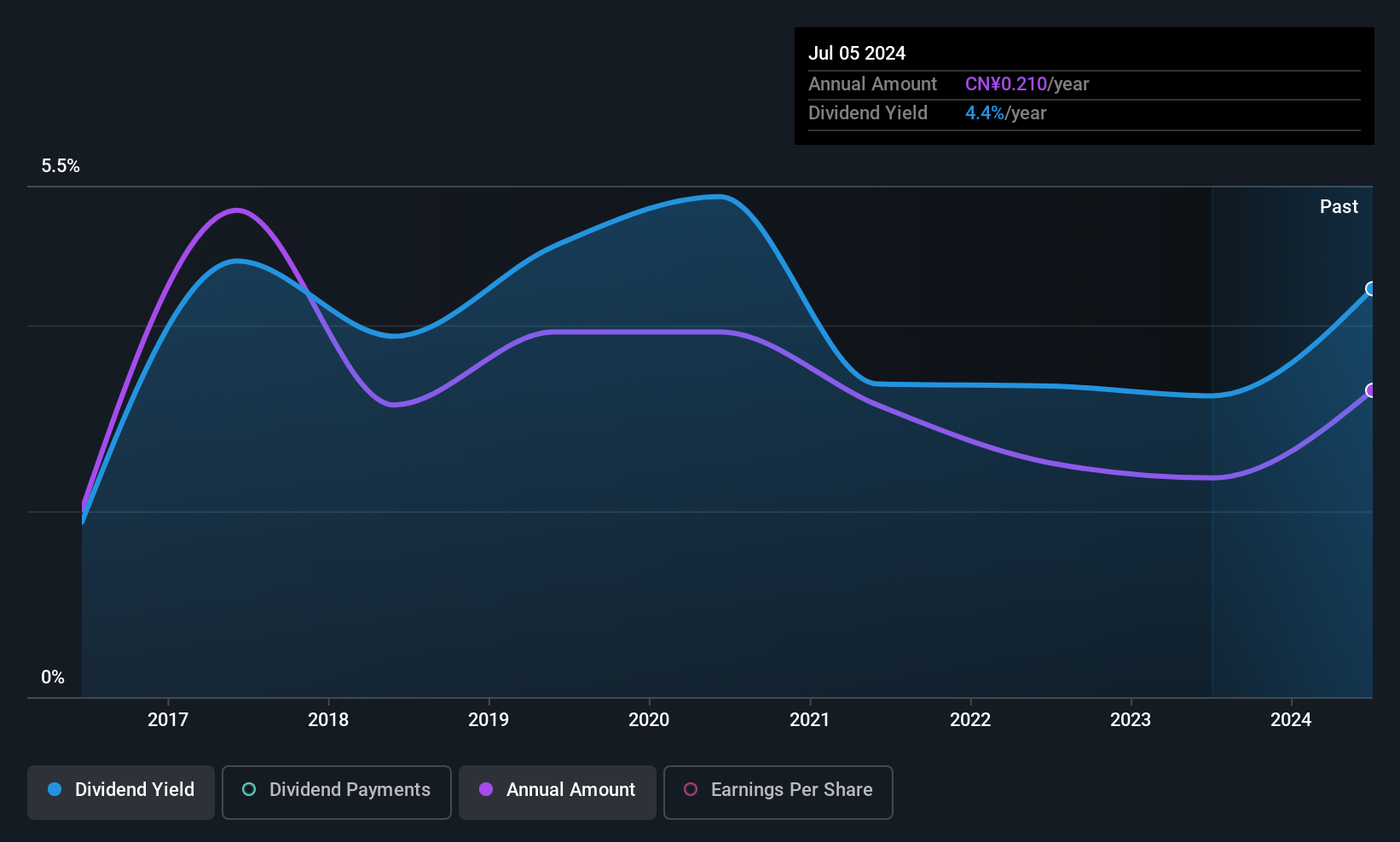

Dividend Yield: 3.5%

Wuchan Zhongda Group offers a compelling dividend yield of 3.49%, ranking in the top 25% of CN market payers, though its history shows volatility. Despite unstable past dividends, recent growth in earnings and revenue suggests potential stability. The company's payout ratios are low at 30.9% for earnings and 23% for cash flows, indicating strong coverage. Recent reports show net income rose to CNY 2.04 billion, reflecting a positive trend in profitability despite slight revenue declines.

- Click to explore a detailed breakdown of our findings in Wuchan Zhongda GroupLtd's dividend report.

- Upon reviewing our latest valuation report, Wuchan Zhongda GroupLtd's share price might be too pessimistic.

Argosy Research (TPEX:3217)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Argosy Research Inc. manufactures and sells electronic components and connectors across Asia, the United States, and internationally, with a market cap of NT$15.97 billion.

Operations: Argosy Research Inc. generates revenue primarily through its manufacturing and sales of electronic component products, amounting to NT$3.98 billion.

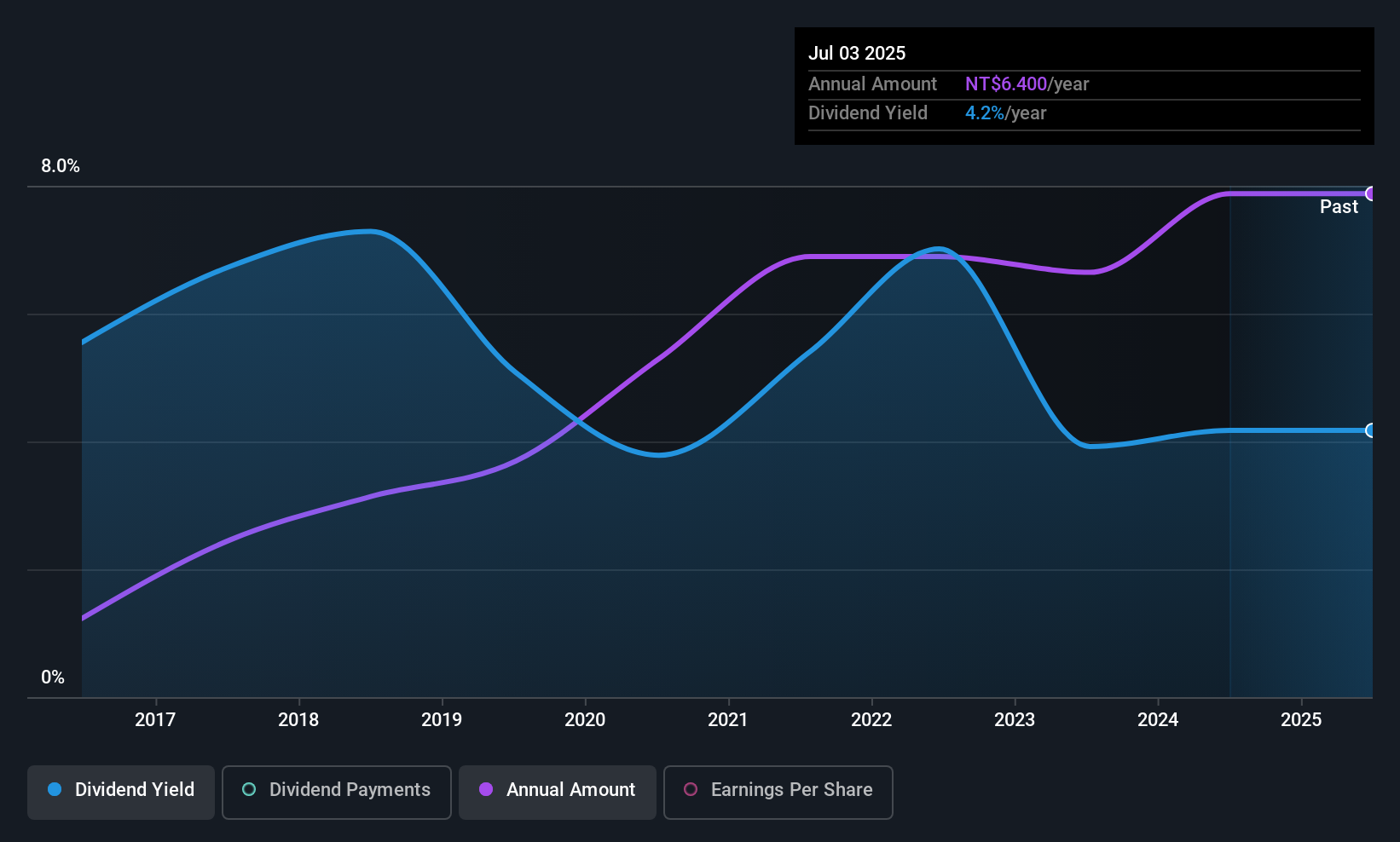

Dividend Yield: 5%

Argosy Research trades at a 42.5% discount to its estimated fair value and offers a dividend yield of 4.97%, slightly below the top quartile in Taiwan. Despite an 18.6% earnings growth last year, dividends have been volatile over the past decade, yet remain covered by earnings (74.5%) and cash flow (84.3%). Recent reports show mixed results with Q2 sales increasing to TWD 1.05 billion, while net income decreased slightly to TWD 207.34 million from the previous year.

- Get an in-depth perspective on Argosy Research's performance by reading our dividend report here.

- Our valuation report here indicates Argosy Research may be undervalued.

Seize The Opportunity

- Get an in-depth perspective on all 1072 Top Asian Dividend Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuchan Zhongda GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600704

Wuchan Zhongda GroupLtd

Provides bulk commodity supply chain integration services in China and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives