Did CRRC Group Deal Negotiations Just Shift Zhuzhou CRRC Times Electric’s (SEHK:3898) Investment Narrative?

Reviewed by Sasha Jovanovic

- Zhuzhou CRRC Times Electric Co., Ltd. has scheduled its first extraordinary general meeting for 2025 on December 15 in Zhuzhou, China, where shareholders will vote on the 2026-2028 CRRC Group Mutual Supply Agreement and related transaction estimates.

- This agreement sets the framework for the company's ongoing business dealings with its parent group, potentially shaping operational direction and future opportunities.

- We'll explore how setting the terms for future transactions with CRRC Group influences Zhuzhou CRRC Times Electric's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Zhuzhou CRRC Times Electric's Investment Narrative?

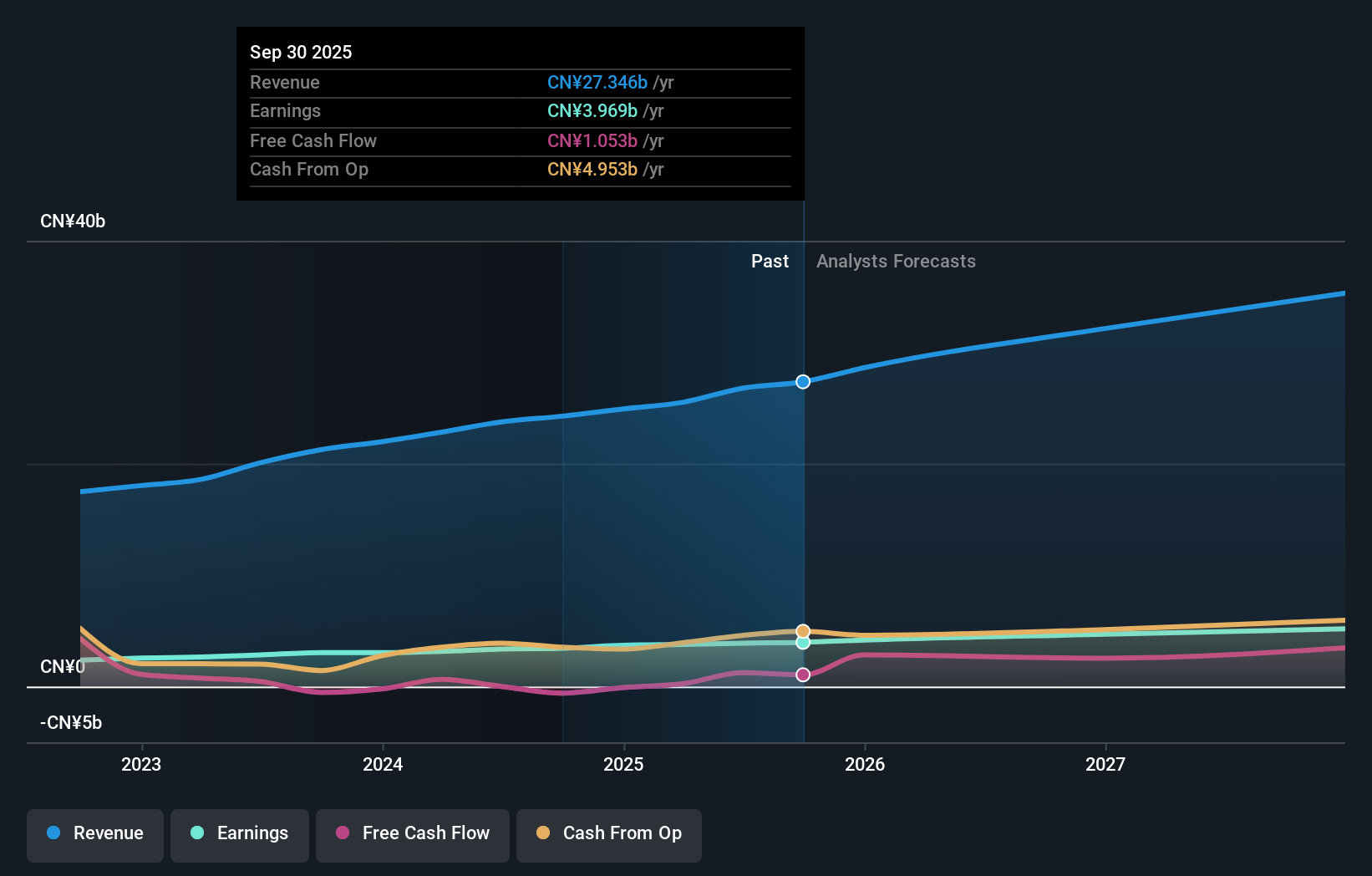

To get behind Zhuzhou CRRC Times Electric as a shareholder, an investor needs to have faith in the company’s ongoing relationship with CRRC Group and its capacity to keep growing earnings and revenue faster than both its sector and the wider Hong Kong market. The recent announcement that shareholders are set to vote on a three-year mutual supply agreement with its parent could impact some key short-term catalysts. With average annual profit and sales growth outpacing industry norms and a valuation still at a substantial discount both to analyst targets and estimated fair value, the business fundamentals look strong, but the final terms of the agreement are now center stage. This development could either reinforce supply and revenue stability or, if estimates or terms disappoint, dampen sentiment. The risk landscape could shift if shareholder approval reveals unexpected limits or dependencies.

However, the board's relatively short average tenure is one risk investors should not ignore.

Exploring Other Perspectives

Explore 2 other fair value estimates on Zhuzhou CRRC Times Electric - why the stock might be worth just HK$44.68!

Build Your Own Zhuzhou CRRC Times Electric Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zhuzhou CRRC Times Electric research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Zhuzhou CRRC Times Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zhuzhou CRRC Times Electric's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhuzhou CRRC Times Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3898

Zhuzhou CRRC Times Electric

Engages in the research and development, design, manufacture and sale of propulsion and control systems to rolling stock industry in Mainland China and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.