- Hong Kong

- /

- Trade Distributors

- /

- SEHK:380

China Pipe Group Limited's (HKG:380) P/S Is Still On The Mark Following 26% Share Price Bounce

China Pipe Group Limited (HKG:380) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Looking further back, the 23% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

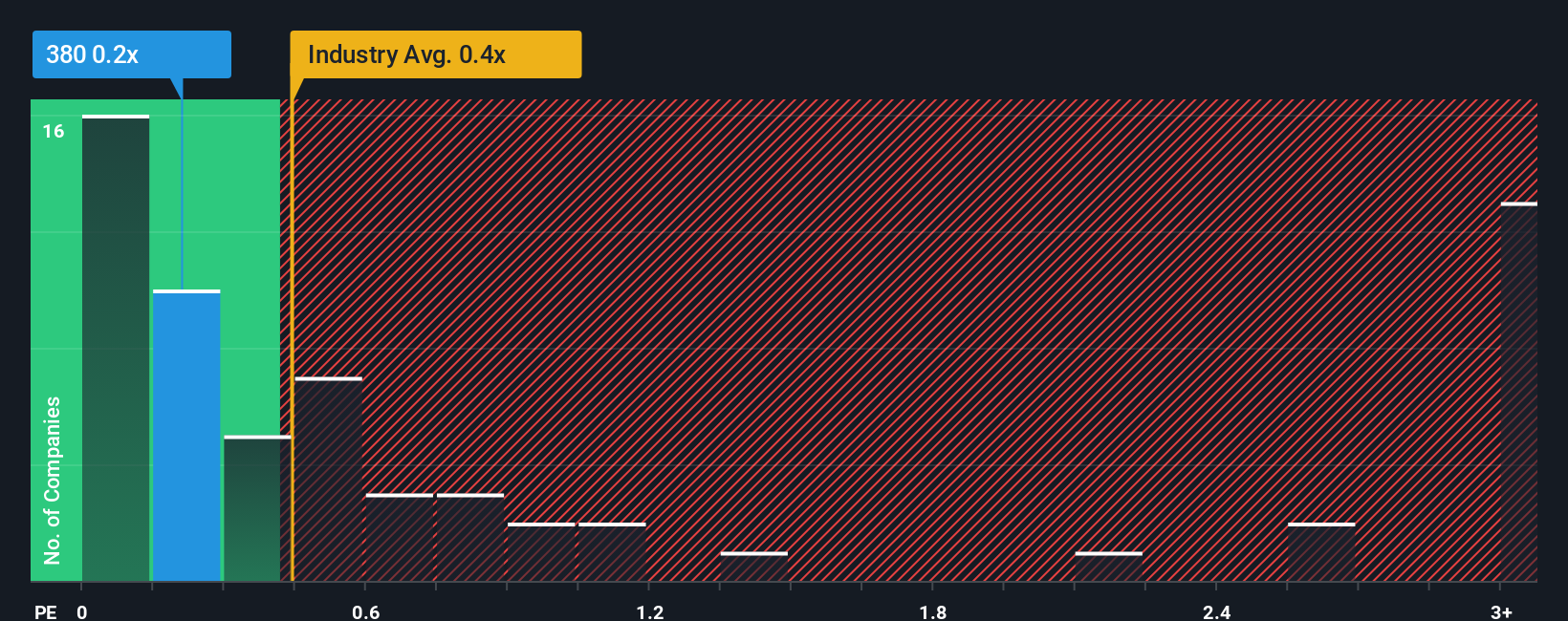

Although its price has surged higher, you could still be forgiven for feeling indifferent about China Pipe Group's P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Trade Distributors industry in Hong Kong is also close to 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for China Pipe Group

How Has China Pipe Group Performed Recently?

The revenue growth achieved at China Pipe Group over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China Pipe Group will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, China Pipe Group would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 9.7% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 15% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 4.2% shows it's about the same on an annualised basis.

In light of this, it's understandable that China Pipe Group's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

What We Can Learn From China Pipe Group's P/S?

Its shares have lifted substantially and now China Pipe Group's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we've seen, China Pipe Group's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. With previous revenue trends that keep up with the current industry outlook, it's hard to justify the company's P/S ratio deviating much from it's current point. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for China Pipe Group that you should be aware of.

If these risks are making you reconsider your opinion on China Pipe Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:380

China Pipe Group

An investment holding company, engages in the trading of construction materials in Hong Kong, Macau, and Mainland China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives