- China

- /

- Electronic Equipment and Components

- /

- SZSE:002056

Asian Dividend Stocks: First Tractor And 2 More To Boost Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating inflation rates and geopolitical tensions, Asian economies are showing resilience with notable stock market gains, particularly in China and Japan. In this context, dividend stocks can offer a compelling option for investors seeking steady income; companies like First Tractor exemplify the potential benefits of incorporating such stocks into a diversified portfolio.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.27% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.01% | ★★★★★★ |

| NCD (TSE:4783) | 4.28% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.03% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| Daicel (TSE:4202) | 4.29% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.48% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.70% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.60% | ★★★★★★ |

Click here to see the full list of 1042 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

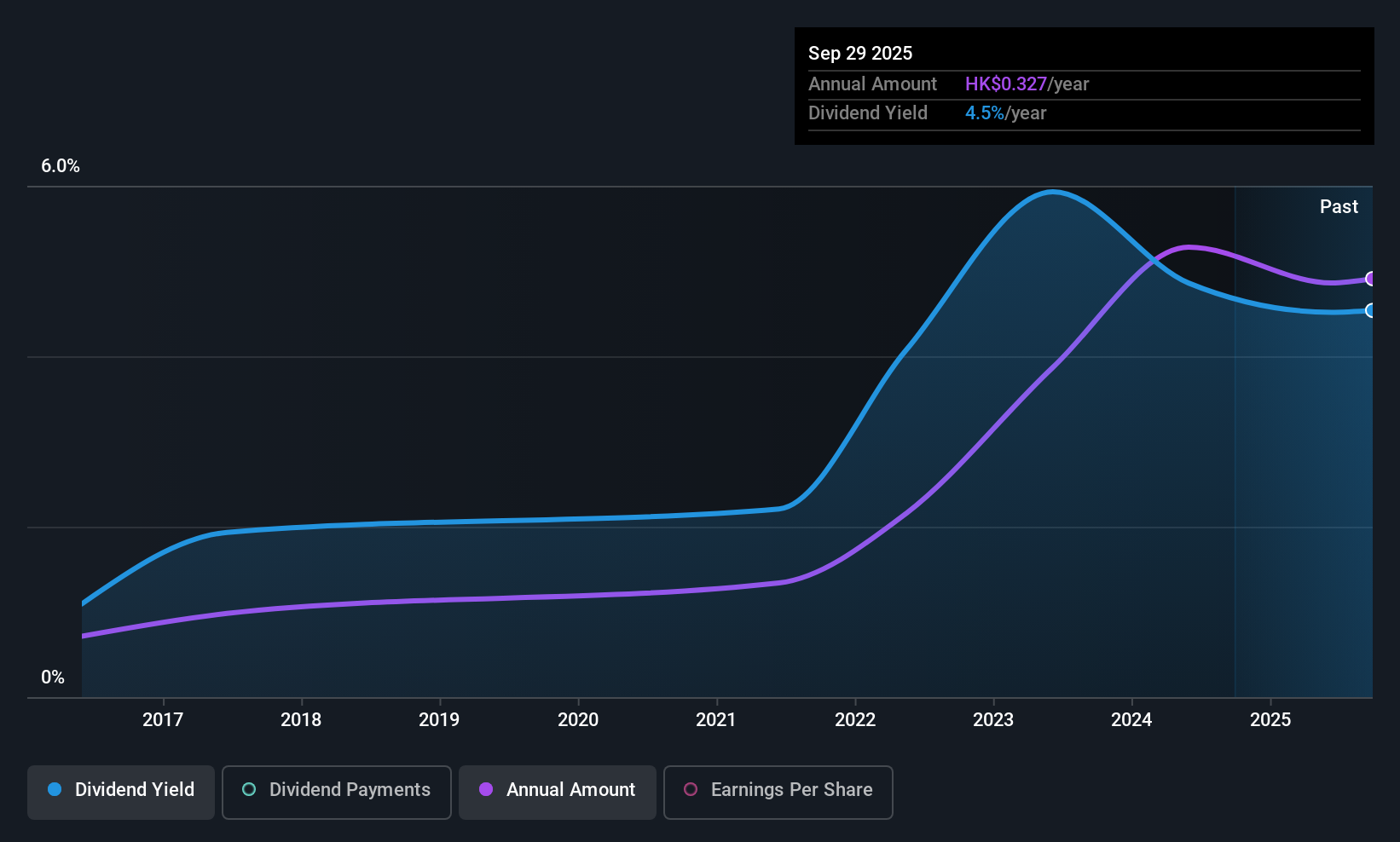

First Tractor (SEHK:38)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Tractor Company Limited is involved in the manufacturing and sale of agricultural and power machinery, with a market cap of HK$13.52 billion.

Operations: First Tractor Company Limited generates its revenue primarily from the manufacturing and sale of agricultural machinery and power machinery.

Dividend Yield: 4.2%

First Tractor's dividend payments are covered by earnings with a payout ratio of 52.6% and cash flows at 55.4%, indicating sustainability despite a volatile history over the past decade. Its dividend yield of 4.2% is lower than the top tier in Hong Kong, but it trades at a favorable price-to-earnings ratio of 10.2x compared to the market's 12.7x, suggesting good relative value. Recent amendments to company bylaws may impact future governance and strategic decisions.

- Click here to discover the nuances of First Tractor with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that First Tractor is priced lower than what may be justified by its financials.

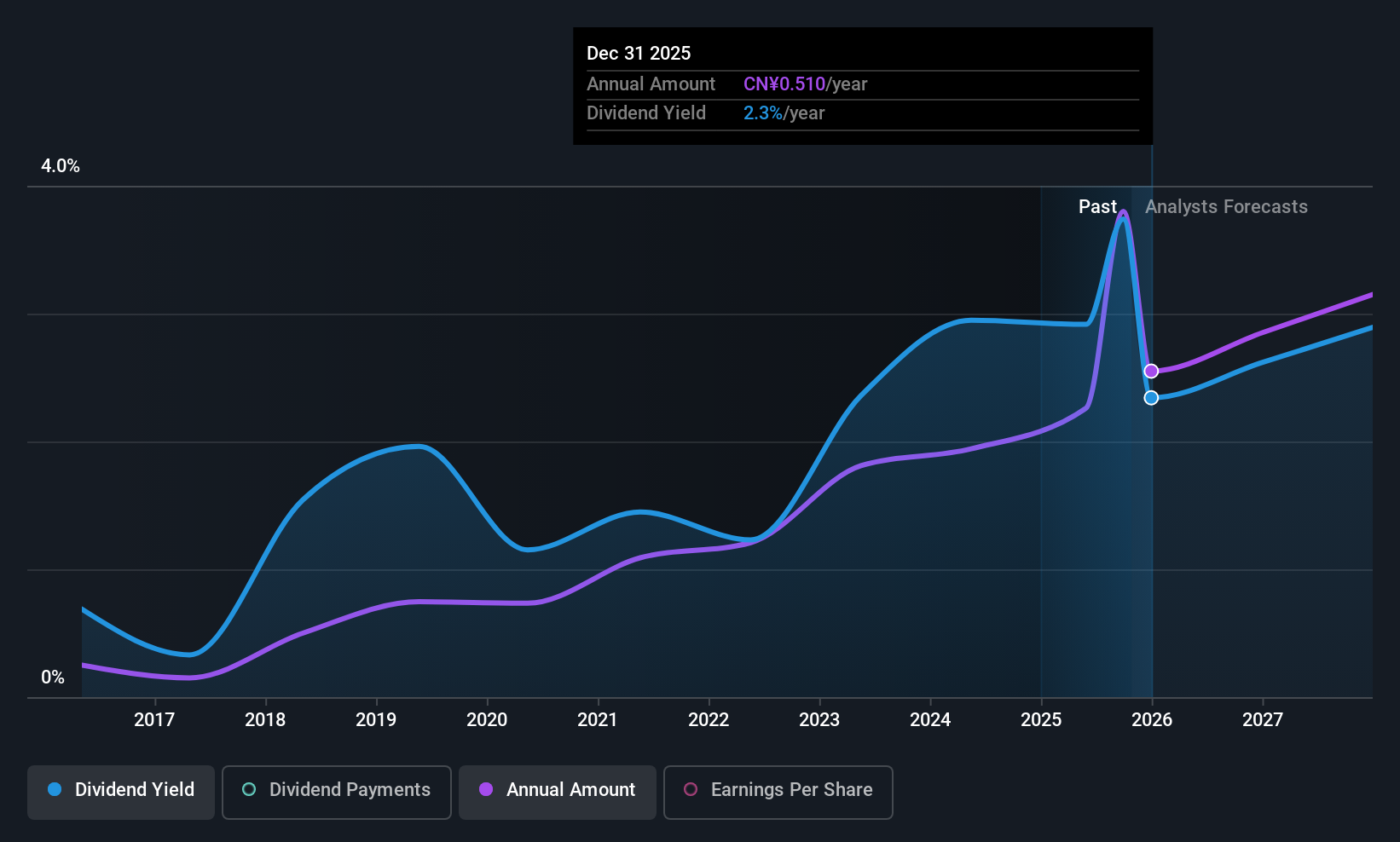

Hengdian Group DMEGC Magnetics Ltd (SZSE:002056)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hengdian Group DMEGC Magnetics Co., Ltd is involved in the research, development, manufacturing, and sales of magnetic materials and devices as well as photovoltaics and lithium batteries both in China and internationally, with a market cap of CN¥35.34 billion.

Operations: Hengdian Group DMEGC Magnetics Ltd generates revenue through its operations in magnetic materials and devices, photovoltaics, and lithium batteries across domestic and international markets.

Dividend Yield: 3.4%

Hengdian Group DMEGC Magnetics Ltd. offers a dividend yield of 3.44%, ranking in the top 25% of CN market payers, with dividends well-covered by earnings and cash flows due to payout ratios around 30%. Despite past volatility in payments, recent earnings growth—sales reaching CNY 17.56 billion—supports its dividend sustainability. The company's interim profit distribution plan affirms a cash dividend of CNY 3.80 per 10 shares for A shares, reflecting ongoing shareholder returns amidst strategic amendments to governance structures.

- Unlock comprehensive insights into our analysis of Hengdian Group DMEGC Magnetics Ltd stock in this dividend report.

- Our expertly prepared valuation report Hengdian Group DMEGC Magnetics Ltd implies its share price may be lower than expected.

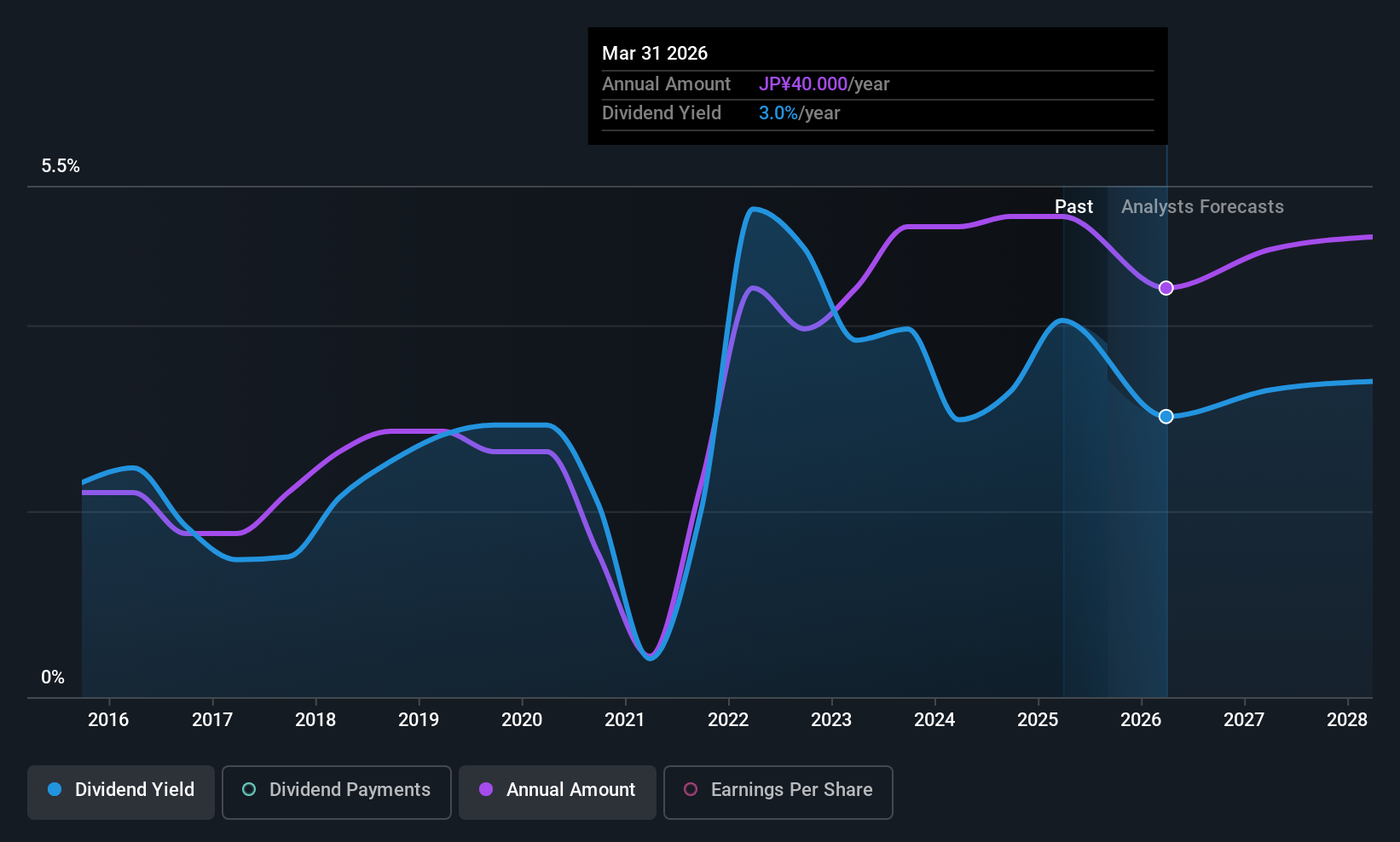

Daido Steel (TSE:5471)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Daido Steel Co., Ltd. manufactures and sells steel products both in Japan and internationally, with a market cap of approximately ¥287 billion.

Operations: Daido Steel Co., Ltd.'s revenue segments include Special Steel Material at ¥207.95 billion, High Performance Materials and Magnetic Materials at ¥199.47 billion, Parts for Automobile and Industrial Equipment at ¥115.13 billion, Engineering at ¥26.27 million, and Trading and Service at ¥26.38 million.

Dividend Yield: 3.3%

Daido Steel's dividend yield of 3.27% falls short of the top tier in Japan, and its dividend track record has been unstable with past volatility. However, dividends are well-covered by earnings and cash flows, with a payout ratio at 35.1% and a cash payout ratio at 79.1%. The recent buyback program, involving ¥6.60 billion for 2.83% of shares, aims to enhance capital efficiency and shareholder returns amidst evolving business conditions.

- Dive into the specifics of Daido Steel here with our thorough dividend report.

- Our valuation report here indicates Daido Steel may be undervalued.

Seize The Opportunity

- Dive into all 1042 of the Top Asian Dividend Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hengdian Group DMEGC Magnetics Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002056

Hengdian Group DMEGC Magnetics Ltd

Researches, develops, manufactures, and sells magnetic materials + devices and photovoltaics + lithium batteries in China and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives