Some RENHENG Enterprise Holdings Shareholders Have Copped A Big 70% Share Price Drop

Want to participate in a short research study? Help shape the future of investing tools and receive a $20 prize!

If you love investing in stocks you're bound to buy some losers. But long term RENHENG Enterprise Holdings Limited (HKG:3628) shareholders have had a particularly rough ride in the last three year. Regrettably, they have had to cope with a 70% drop in the share price over that period. And more recent buyers are having a tough time too, with a drop of 69% in the last year. The falls have accelerated recently, with the share price down 48% in the last three months.

View our latest analysis for RENHENG Enterprise Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During three years of share price growth, RENHENG Enterprise Holdings moved from a loss to profitability. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

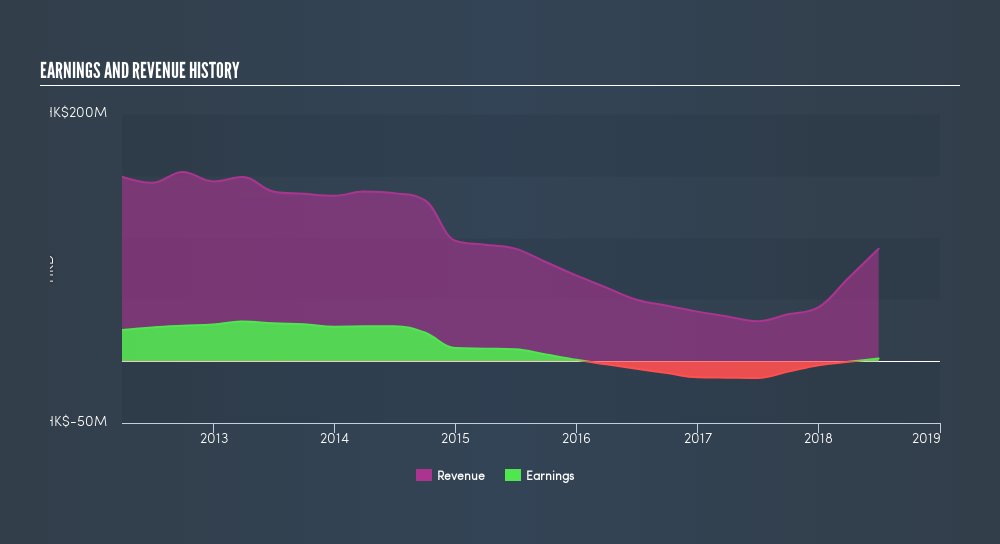

Arguably the revenue decline of -11% per year has people thinking RENHENG Enterprise Holdings is shrinking. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of RENHENG Enterprise Holdings's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between RENHENG Enterprise Holdings's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings. RENHENG Enterprise Holdings hasn't been paying dividends, but its TSR of -70% exceeds its share price return of -70%, implying it has raised capital at a discount.

A Different Perspective

While the broader market lost about 7.4% in the twelve months, RENHENG Enterprise Holdings shareholders did even worse, losing 69%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2.6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before forming an opinion on RENHENG Enterprise Holdings you might want to consider these 3 valuation metrics.

We will like RENHENG Enterprise Holdings better if we see some big insider buys. While we wait, check out this freelist of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:3628

RENHENG Enterprise Holdings

An investment holding company, engages in the manufacture and sale of tobacco machinery products in the People’s Republic of China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives