Rocky Poon has been the CEO of FSE Services Group Limited (HKG:331) since 2015, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for FSE Services Group

Comparing FSE Services Group Limited's CEO Compensation With the industry

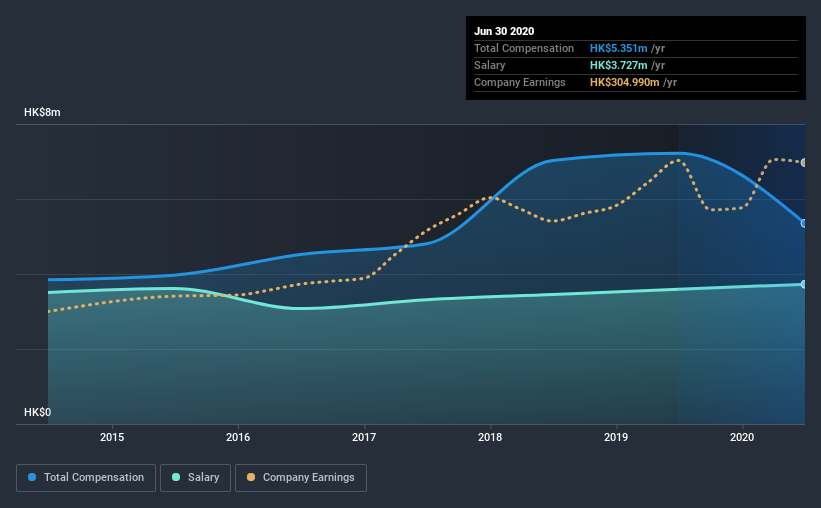

Our data indicates that FSE Services Group Limited has a market capitalization of HK$1.6b, and total annual CEO compensation was reported as HK$5.4m for the year to June 2020. We note that's a decrease of 26% compared to last year. We note that the salary portion, which stands at HK$3.73m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between HK$775m and HK$3.1b had a median total CEO compensation of HK$2.3m. Accordingly, our analysis reveals that FSE Services Group Limited pays Rocky Poon north of the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$3.7m | HK$3.6m | 70% |

| Other | HK$1.6m | HK$3.6m | 30% |

| Total Compensation | HK$5.4m | HK$7.2m | 100% |

Speaking on an industry level, nearly 91% of total compensation represents salary, while the remainder of 8.8% is other remuneration. In FSE Services Group's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at FSE Services Group Limited's Growth Numbers

Over the past three years, FSE Services Group Limited has seen its earnings per share (EPS) grow by 11% per year. In the last year, its revenue is down 9.9%.

This demonstrates that the company has been improving recently and is good news for the shareholders. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has FSE Services Group Limited Been A Good Investment?

We think that the total shareholder return of 81%, over three years, would leave most FSE Services Group Limited shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

As previously discussed, Rocky is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. But EPS growth and shareholder returns have been top-notch for the past three years. As a result of the excellent all-round performance of the company, we believe CEO compensation is fair. The pleasing shareholder returns are the cherry on top. We wouldn't be wrong in saying that shareholders feel that Rocky's performance creates value for the company.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for FSE Services Group that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade FSE Services Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:331

FSE Lifestyle Services

An investment holding company, provides city essential services in Hong Kong, Mainland China, and Macau.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026