- Hong Kong

- /

- Trade Distributors

- /

- SEHK:2866

Subdued Growth No Barrier To COSCO SHIPPING Development Co., Ltd. (HKG:2866) With Shares Advancing 27%

COSCO SHIPPING Development Co., Ltd. (HKG:2866) shareholders have had their patience rewarded with a 27% share price jump in the last month. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.8% over the last year.

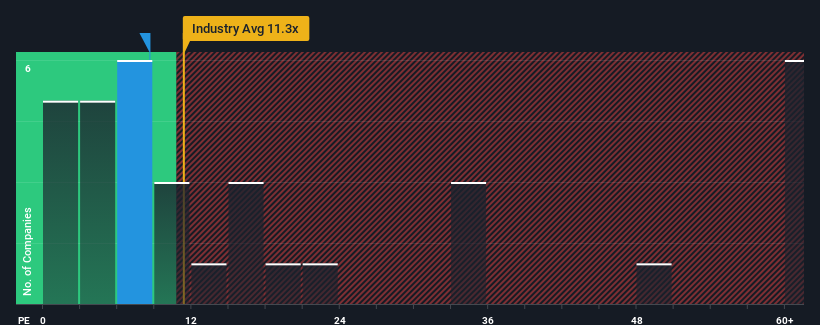

Although its price has surged higher, you could still be forgiven for feeling indifferent about COSCO SHIPPING Development's P/E ratio of 8.6x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 10x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For instance, COSCO SHIPPING Development's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for COSCO SHIPPING Development

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like COSCO SHIPPING Development's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 50% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 45% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 21% shows it's an unpleasant look.

With this information, we find it concerning that COSCO SHIPPING Development is trading at a fairly similar P/E to the market. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

What We Can Learn From COSCO SHIPPING Development's P/E?

COSCO SHIPPING Development's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of COSCO SHIPPING Development revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 3 warning signs for COSCO SHIPPING Development (of which 1 is concerning!) you should know about.

If you're unsure about the strength of COSCO SHIPPING Development's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2866

COSCO SHIPPING Development

Researches, develops, manufactures, and sells containers in the United States, Asia, Hong Kong, Mainland China, Europe, and internationally.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives