- Hong Kong

- /

- Trade Distributors

- /

- SEHK:2866

Is COSCO SHIPPING Development (SEHK:2866) Still Undervalued? A Fresh Look at Its Quiet Uptrend

Reviewed by Simply Wall St

Price-to-Earnings of 8.2x: Is it justified?

COSCO SHIPPING Development is currently valued at a price-to-earnings (P/E) ratio of 8.2x, which is below both its industry peers and the broader Hong Kong market. This suggests the stock could be attractively priced compared to similar companies and the overall market context.

The price-to-earnings multiple measures what investors are willing to pay today for a company’s historical or projected earnings. In the capital goods and trade distribution sector, this ratio is a useful benchmark because it highlights whether the market is optimistic or cautious about future profitability and growth potential compared to peers.

Peers in the Hong Kong Trade Distributors industry currently trade at an average P/E of 10.4x. The Hong Kong market average is 12.2x. With COSCO SHIPPING Development’s multiple well below both, investors may be pricing in slower growth or higher perceived risk, or potentially overlooking positive earnings momentum. Overall, its lower P/E could indicate underappreciated value if current earnings trends persist.

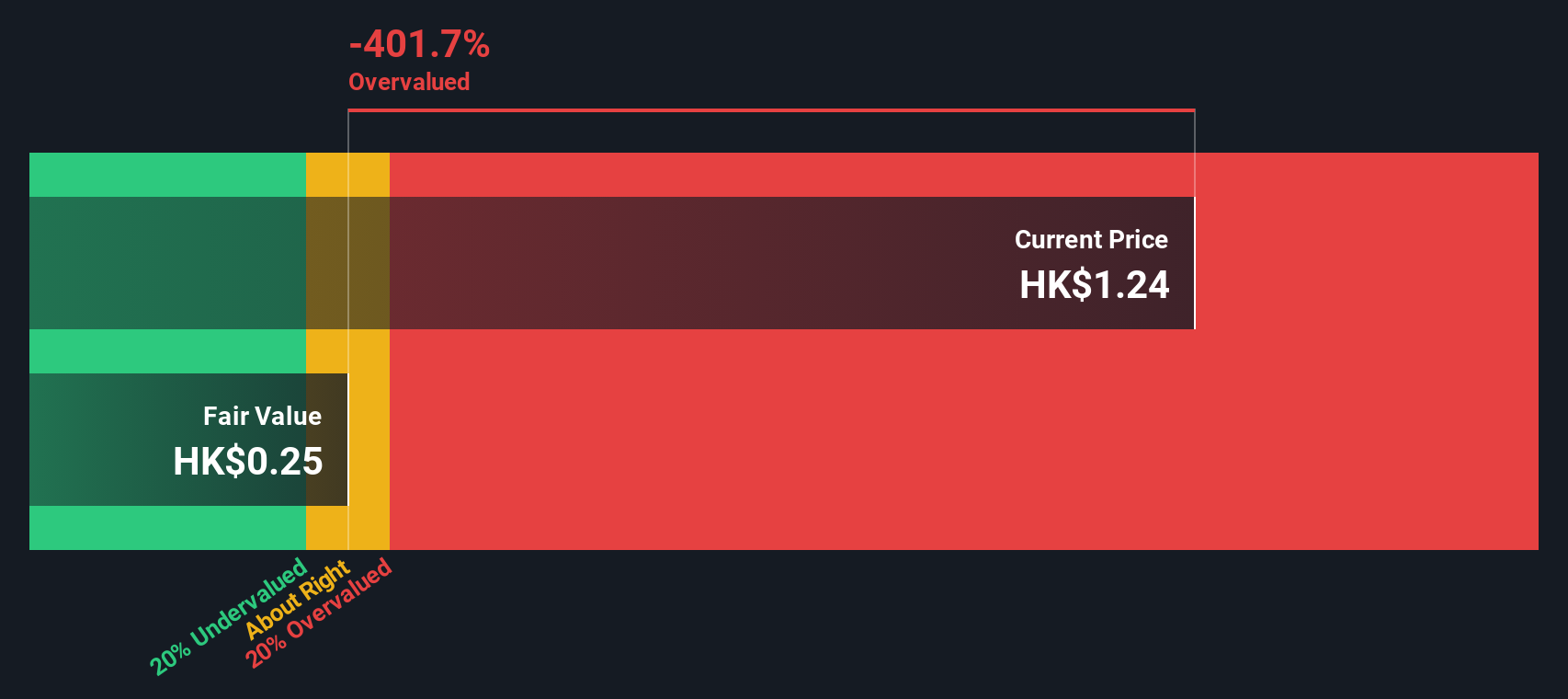

Result: Fair Value of $0.21 (OVERVALUED)

See our latest analysis for COSCO SHIPPING Development.However, shifting outlooks on global trade or unexpected changes in earnings could quickly challenge this positive momentum for COSCO SHIPPING Development.

Find out about the key risks to this COSCO SHIPPING Development narrative.Another View: Discounted Cash Flow Analysis

While valuation based on earnings appears favorable, our SWS DCF model tells a very different story. This method suggests the stock may actually be overvalued, which calls into question how reliable these traditional benchmarks really are. Could fundamentals or optimism be winning out?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own COSCO SHIPPING Development Narrative

If you see things differently, or want to dig deeper for yourself, you can easily build your own narrative and reach a conclusion in just a few minutes. Do it your way

A great starting point for your COSCO SHIPPING Development research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock even more investing opportunities with Simply Wall Street’s screeners. If you hesitate, you could miss trending stocks and untapped growth the market rarely hands out twice.

- Secure your portfolio with income potential by targeting companies offering dividend stocks with yields > 3% and yields that outshine savings accounts.

- Tap into emerging trends by spotting innovative companies at the forefront of technology and growth through undervalued stocks based on cash flows.

- Get ahead of the next tech breakthrough by backing pioneers in supercomputing. Start with quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:2866

COSCO SHIPPING Development

Researches, develops, manufactures, and sells containers in the United States, Asia, Hong Kong, Mainland China, Europe, and internationally.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives