- Hong Kong

- /

- Industrials

- /

- SEHK:267

CITIC (SEHK:267): Evaluating Valuation as Steady Gains Draw New Investor Attention

Reviewed by Simply Wall St

Most Popular Narrative: 3.6% Undervalued

According to the most widely followed narrative, CITIC is considered undervalued, with shares trading at a small discount to analysts’ calculated fair value. The narrative underscores how the company’s future prospects, growth strategies, and profitability enhancements support a higher price target.

Significant investment in technology and R&D, including AI and smart manufacturing, is set to enhance operational efficiencies and innovation, which may improve profitability and net margins over the long term.

Curious how technology investments today could boost future profits? One forecast powerfully shapes the current value estimate, and it’s not just about this year’s numbers. If you want to discover the surprising roadmap analysts are following to arrive at CITIC’s “undervalued” status, keep reading. You might be surprised by the bold assumptions powering this call.

Result: Fair Value of $12.4 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent geopolitical tensions or renewed real estate pressures could quickly shift analyst forecasts and challenge the current optimism around CITIC’s valuation.

Find out about the key risks to this CITIC narrative.Another View: Discounted Cash Flow Perspective

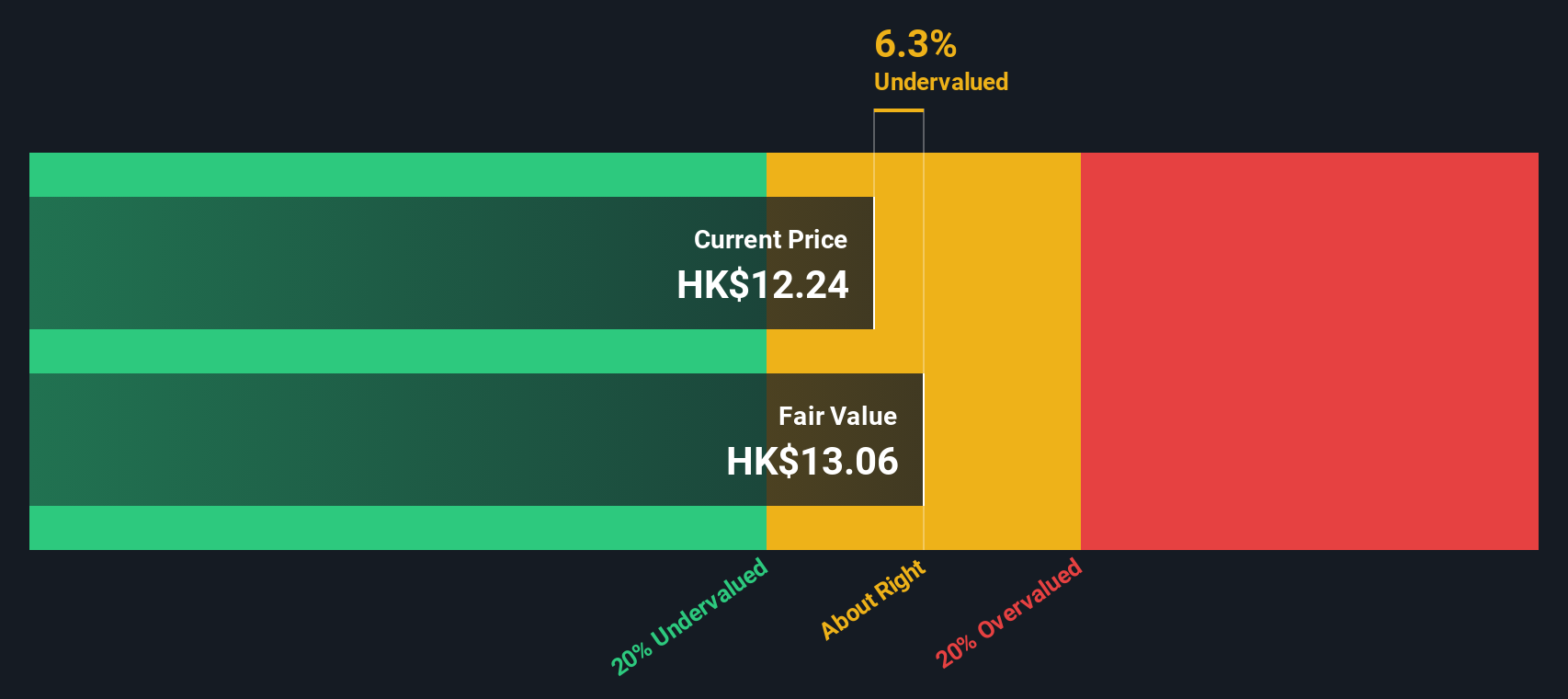

While the most popular approach suggests undervaluation, our DCF model also points toward CITIC trading below its estimated fair value. However, does this reinforce the case for optimism, or does it overlook something deeper beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CITIC Narrative

If you see things differently or simply want to dig into the numbers on your own terms, you can pull together your own outlook in just a few minutes. Do it your way

A great starting point for your CITIC research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that the next big opportunity could be just around the corner. Don’t let your search stop with CITIC. Expand your horizons and set yourself up for even more potential wins using the featured screens below.

- Snap up value before the crowd by targeting shares that look unloved but have strong fundamentals, starting with our undervalued stocks based on cash flows.

- Unlock the potential of medical breakthroughs driven by intelligent systems when you shortlist companies from our healthcare AI stocks.

- Boost your income stream by choosing companies regularly rewarding shareholders with reliable cash payouts through our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:267

CITIC

Operates in the financial services, advanced intelligent manufacturing, advanced materials, consumption, and urbanization businesses in the Mainland of China, Hong Kong, Macau, Taiwan, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives