- Hong Kong

- /

- Construction

- /

- SEHK:2448

If You Had Bought Space Group Holdings (HKG:2448) Stock A Year Ago, You Could Pocket A 27% Gain Today

It hasn't been the best quarter for Space Group Holdings Limited (HKG:2448) shareholders, since the share price has fallen 12% in that time. But looking back over the last year, the returns have actually been rather pleasing! In that time we've seen the stock easily surpass the market return, with a gain of 27%.

Check out our latest analysis for Space Group Holdings

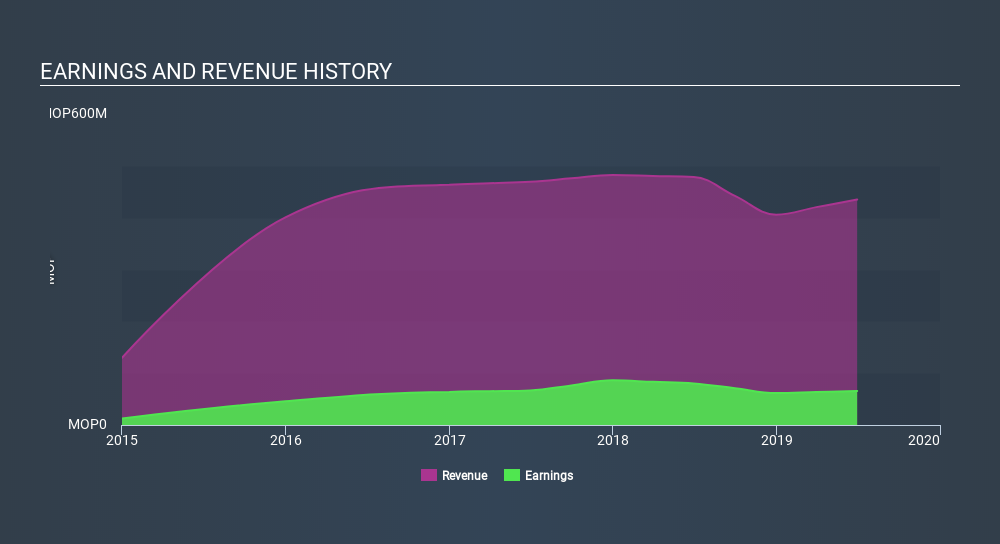

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last twelve months, Space Group Holdings actually shrank its EPS by 28%.

This means it's unlikely the market is judging the company based on earnings growth. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

Space Group Holdings's revenue actually dropped 9.1% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Space Group Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Space Group Holdings shareholders have gained 27% over the last year. Unfortunately the share price is down 12% over the last quarter. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Space Group Holdings (at least 2 which are potentially serious) , and understanding them should be part of your investment process.

But note: Space Group Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:2448

Space Group Holdings

An investment holding company, undertakes fitting-out and building construction works in Macau and Hong Kong.

Moderate and slightly overvalued.

Market Insights

Community Narratives