- Hong Kong

- /

- Construction

- /

- SEHK:2442

Shareholders 12% loss in Easy Smart Group Holdings (HKG:2442) partly attributable to the company's decline in earnings over past year

Easy Smart Group Holdings Limited (HKG:2442) shareholders should be happy to see the share price up 12% in the last week. But that doesn't change the fact that the returns over the last year have been less than pleasing. The cold reality is that the stock has dropped 23% in one year, under-performing the market.

While the last year has been tough for Easy Smart Group Holdings shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for Easy Smart Group Holdings

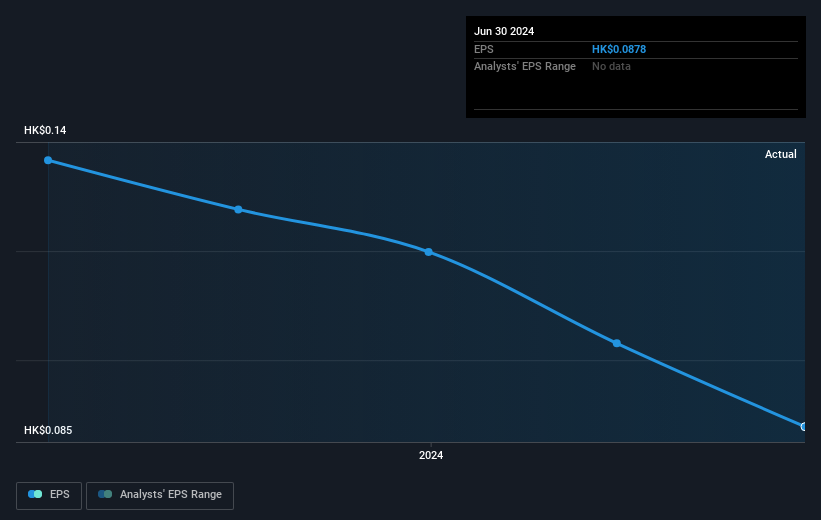

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unfortunately Easy Smart Group Holdings reported an EPS drop of 36% for the last year. The share price fall of 23% isn't as bad as the reduction in earnings per share. It may have been that the weak EPS was not as bad as some had feared.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Easy Smart Group Holdings' earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Easy Smart Group Holdings the TSR over the last 1 year was -12%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While Easy Smart Group Holdings shareholders are down 12% for the year (even including dividends), the market itself is up 27%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 7.8%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand Easy Smart Group Holdings better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Easy Smart Group Holdings (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Easy Smart Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2442

Easy Smart Group Holdings

Operates as a subcontractor in passive fire protection works for public infrastructure and facilities, commercial and industrial buildings, and residential buildings in Hong Kong.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives