- Hong Kong

- /

- Construction

- /

- SEHK:240

Spotlight On 3 Penny Stocks With Market Caps Up To US$200M

Reviewed by Simply Wall St

Global markets have experienced a week of mixed performance, with U.S. stocks giving back some gains amid uncertainty over incoming policy changes and interest rate expectations. In such fluctuating conditions, investors often look to diversify their portfolios by exploring various asset classes, including penny stocks. Although the term "penny stocks" may seem outdated, these smaller or newer companies can offer unique opportunities for growth and value when they exhibit strong financial fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.475 | MYR2.36B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.155 | £810.04M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.56 | £69.99M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.05 | £387.38M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$148.62M | ★★★★☆☆ |

| SHAPE Australia (ASX:SHA) | A$2.89 | A$239.61M | ★★★★★★ |

Click here to see the full list of 5,805 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Fortress Minerals (Catalist:OAJ)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fortress Minerals Limited is an investment holding company involved in the exploration, mining, production, and sale of iron ore concentrates with a market cap of SGD128.21 million.

Operations: The company generates revenue exclusively from its iron ore segment, amounting to $50.46 million.

Market Cap: SGD128.21M

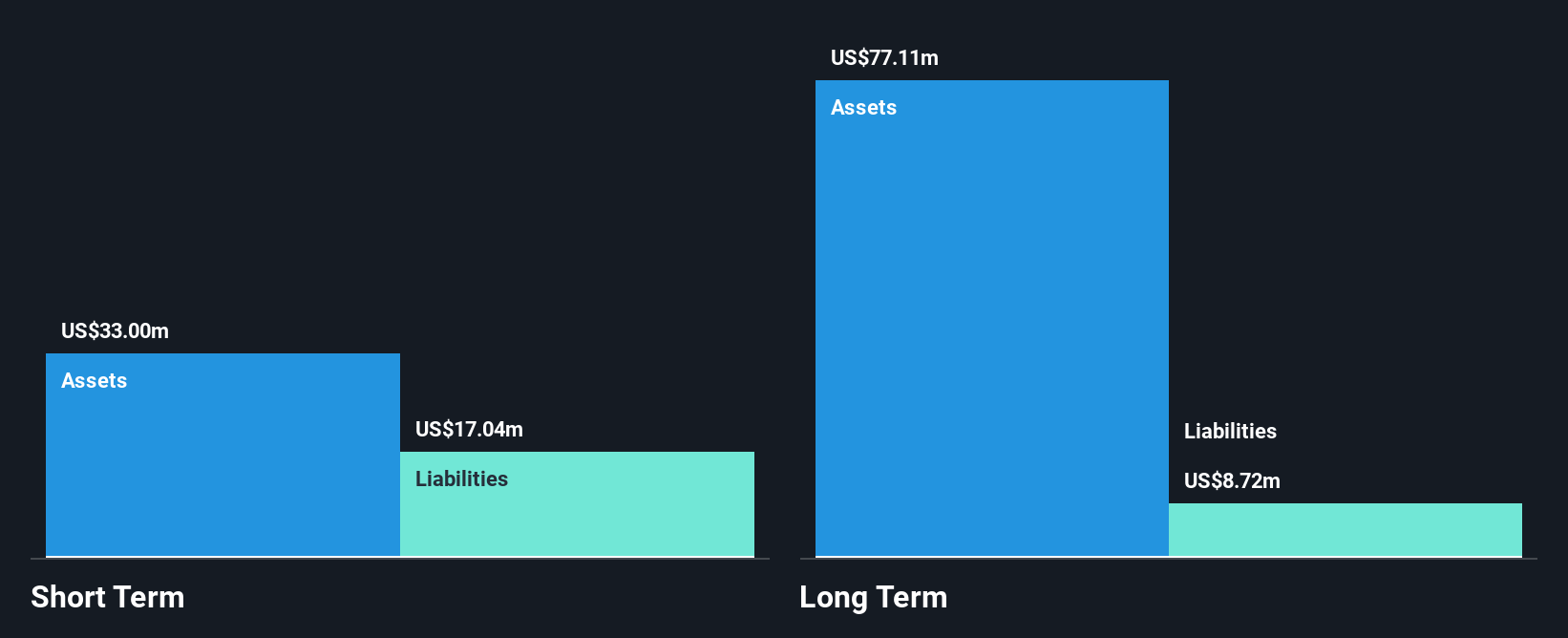

Fortress Minerals Limited, with a market cap of SGD128.21 million, is generating revenue exclusively from iron ore, totaling $50.46 million. The company trades at a good value relative to peers and industry standards and has high-quality past earnings. Its debt is well covered by operating cash flow, and short-term assets exceed both short- and long-term liabilities. However, the company's earnings growth has been negative over the past year, contrasting with its 5-year growth trend of 4.7% annually. Additionally, its share price has shown high volatility recently despite strong interest coverage by EBIT (21.5x).

- Dive into the specifics of Fortress Minerals here with our thorough balance sheet health report.

- Gain insights into Fortress Minerals' outlook and expected performance with our report on the company's earnings estimates.

GomSpace Group (OM:GOMX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GomSpace Group AB (publ) specializes in designing, developing, integrating, and manufacturing nanosatellites for academic, government, and commercial markets with a market cap of SEK617.54 million.

Operations: The company's revenue is primarily generated from Europe (excluding Sweden and Denmark) at SEK146.66 million, followed by Denmark with SEK33.8 million, the United States at SEK16.88 million, Asia contributing SEK19.19 million, the Rest of The World with SEK9.21 million, and Sweden at SEK0.26 million.

Market Cap: SEK617.54M

GomSpace Group AB, with a market cap of SEK617.54 million, has shown resilience despite being unprofitable by maintaining a positive cash runway for over three years due to growing free cash flow. The company's short-term assets exceed both its short- and long-term liabilities, providing financial stability. Recent contracts with the European Space Agency and other clients have bolstered its revenue stream, including a SEK8.9 million extension for the GOMX-5 project and additional agreements supporting the HERA mission. Despite increasing debt levels over five years, GomSpace's net debt to equity remains satisfactory at 35.5%.

- Click here and access our complete financial health analysis report to understand the dynamics of GomSpace Group.

- Understand GomSpace Group's track record by examining our performance history report.

Build King Holdings (SEHK:240)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Build King Holdings Limited is an investment holding company involved in building construction and civil engineering works in Hong Kong and the People's Republic of China, with a market cap of HK$1.20 billion.

Operations: The company's revenue is primarily derived from construction work, amounting to HK$13.01 billion.

Market Cap: HK$1.2B

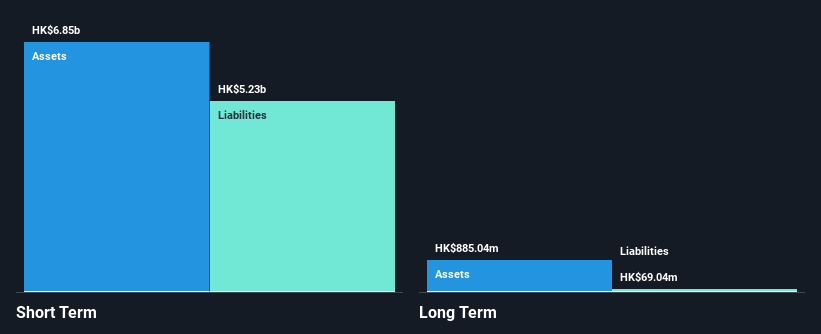

Build King Holdings Limited, with a market cap of HK$1.20 billion, has seen a reduction in net income to HK$148.2 million for the half year ended June 2024, down from HK$250.25 million the previous year. Despite this decline and negative earnings growth over the past year, its valuation appears attractive as it trades significantly below estimated fair value. The company maintains strong financial health with more cash than total debt and short-term assets exceeding liabilities. While dividends have decreased recently, Build King's interest coverage is solid and its debt-to-equity ratio has improved substantially over five years.

- Click here to discover the nuances of Build King Holdings with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Build King Holdings' track record.

Key Takeaways

- Gain an insight into the universe of 5,805 Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Build King Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:240

Build King Holdings

An investment holding company, engages in the building construction and civil engineering works in Hong Kong and the People's Republic of China.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives