Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Build King Holdings Limited (HKG:240) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Build King Holdings

What Is Build King Holdings's Debt?

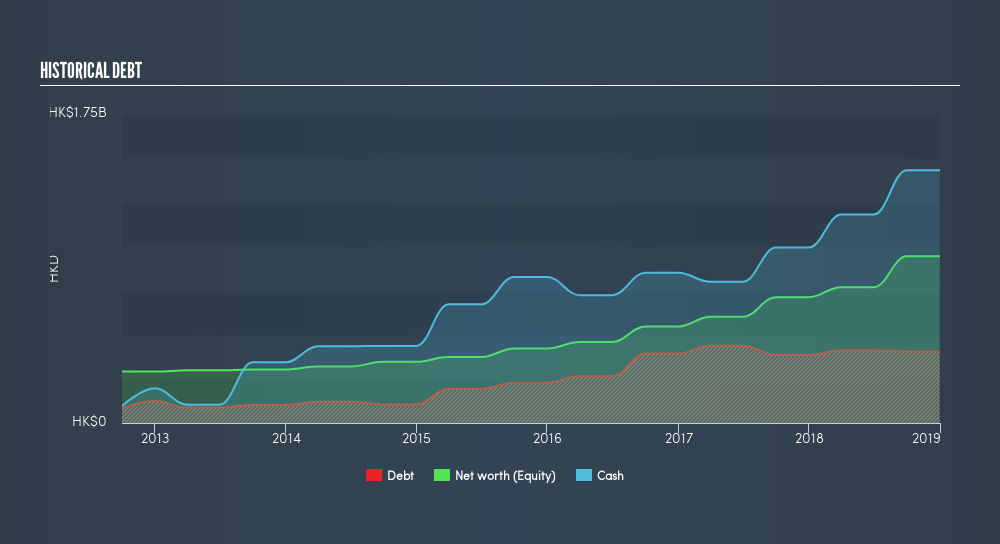

You can click the graphic below for the historical numbers, but it shows that as of December 2018 Build King Holdings had HK$404.7m of debt, an increase on HK$384.7m, over one year. But on the other hand it also has HK$1.43b in cash, leading to a HK$1.03b net cash position.

How Strong Is Build King Holdings's Balance Sheet?

The latest balance sheet data shows that Build King Holdings had liabilities of HK$3.19b due within a year, and liabilities of HK$156.8m falling due after that. Offsetting this, it had HK$1.43b in cash and HK$2.30b in receivables that were due within 12 months. So it actually has HK$375.8m more liquid assets than total liabilities.

This luscious liquidity implies that Build King Holdings's balance sheet is sturdy like a giant sequoia tree. On this basis we think its balance sheet is strong like a sleek panther or even a proud lion. Succinctly put, Build King Holdings boasts net cash, so it's fair to say it does not have a heavy debt load!

Better yet, Build King Holdings grew its EBIT by 120% last year, which is an impressive improvement. That boost will make it even easier to pay down debt going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Build King Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Build King Holdings has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Build King Holdings generated free cash flow amounting to a very robust 94% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Summing up

While it is always sensible to investigate a company's debt, in this case Build King Holdings has HK$1.0b in net cash and a decent-looking balance sheet. And it impressed us with free cash flow of HK$630m, being 94% of its EBIT. The bottom line is that we do not find Build King Holdings's debt levels at all concerning. Another factor that would give us confidence in Build King Holdings would be if insiders have been buying shares: if you're conscious of that signal too, you can find out instantly by clicking this link.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:240

Build King Holdings

An investment holding company, engages in the building construction and civil engineering works in Hong Kong and the People's Republic of China.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives