Will Weichai Power’s (SEHK:2338) Fuel Cell Push Reshape Its Competitive Edge in Power Generation?

Reviewed by Sasha Jovanovic

- On November 5, 2025, Ceres Power Holdings plc announced it has signed a manufacturing licence agreement with Weichai Power for the production of its solid oxide fuel cell technology, enabling Weichai to produce cells and stacks for stationary power systems in China targeting AI data centres, commercial buildings, and industrial sectors.

- This agreement not only expands Ceres' roster of manufacturing partners to four but also marks a shift for Weichai Power into advanced energy solutions that complement its existing gas engine and powertrain offerings.

- We'll examine how Weichai Power's expansion into solid oxide fuel cell technology could reshape its broader investment case in power generation.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Weichai Power's Investment Narrative?

For those interested in Weichai Power, the big-picture investment case has often focused on the group's steady growth in sales and earnings, paired with solid value metrics and a willingness to return cash to shareholders via dividends and buybacks. The new manufacturing licence agreement with Ceres Power marks a meaningful step into clean energy technologies, potentially diversifying revenue sources beyond traditional engines. While this move may not materially change the near-term financial picture, licence revenues are intended for recognition in fiscal 2026, it does begin to influence key catalysts and risks. Most immediate trading drivers remain earnings momentum, dividend sustainability, and management stability. However, risk now broadens to include execution around new energy initiatives and dependence on successful integration of solid oxide fuel cell production. If sentiment shifts on Weichai's ability to capitalise on these new markets, the assessment of risks and upside could adjust quickly.

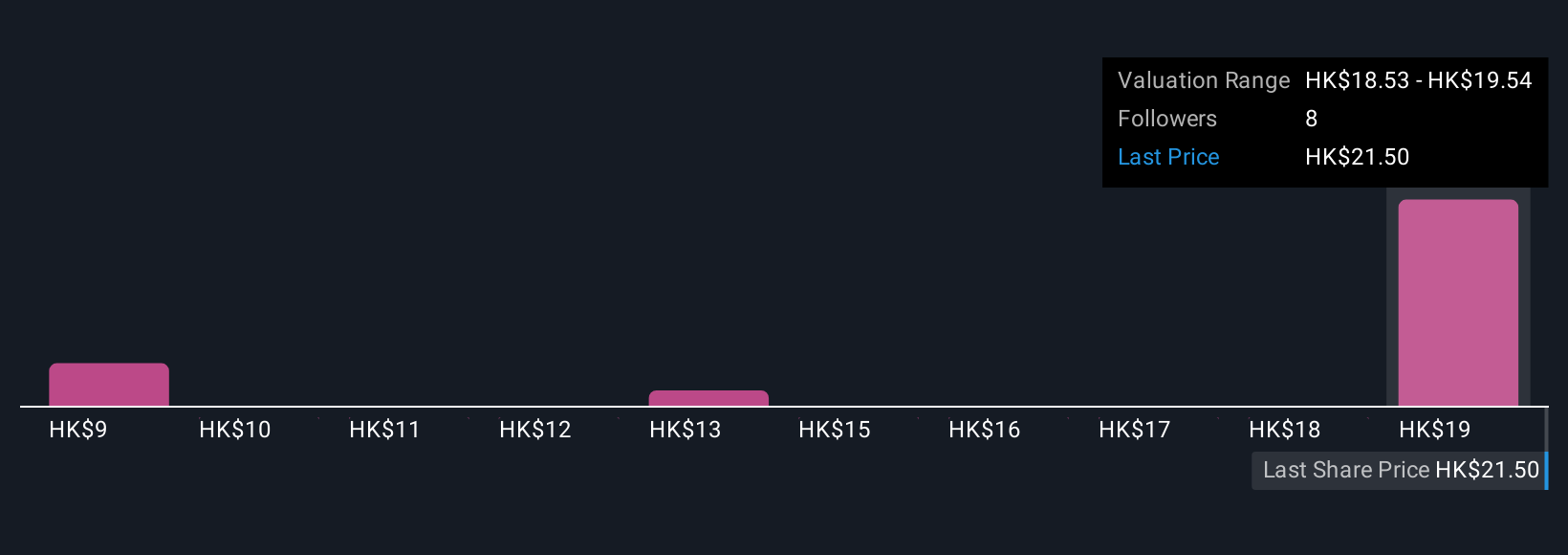

But consider: rapid board changes and new ventures add new challenges to oversight. Despite retreating, Weichai Power's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 5 other fair value estimates on Weichai Power - why the stock might be worth as much as 10% more than the current price!

Build Your Own Weichai Power Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Weichai Power research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Weichai Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Weichai Power's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weichai Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2338

Weichai Power

Engages in the automobile and equipment manufacturing industry in China and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives