- Hong Kong

- /

- Trade Distributors

- /

- SEHK:2322

Hong Kong ChaoShang Group Limited's (HKG:2322) 32% Share Price Surge Not Quite Adding Up

The Hong Kong ChaoShang Group Limited (HKG:2322) share price has done very well over the last month, posting an excellent gain of 32%. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 4.7% over the last year.

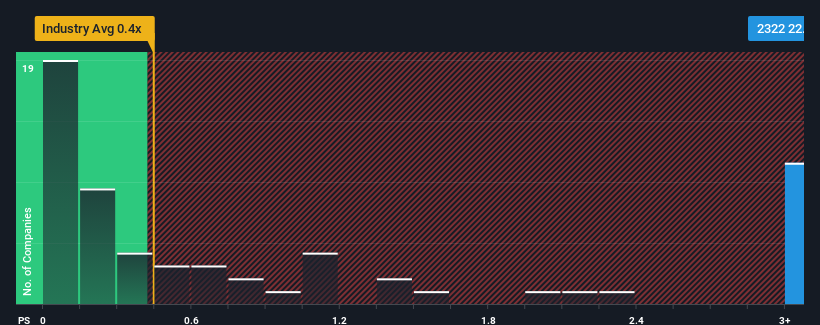

Since its price has surged higher, you could be forgiven for thinking Hong Kong ChaoShang Group is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 22.7x, considering almost half the companies in Hong Kong's Trade Distributors industry have P/S ratios below 0.4x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Hong Kong ChaoShang Group

What Does Hong Kong ChaoShang Group's Recent Performance Look Like?

For instance, Hong Kong ChaoShang Group's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Hong Kong ChaoShang Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Hong Kong ChaoShang Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 32% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 54% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 34% shows it's an unpleasant look.

With this in mind, we find it worrying that Hong Kong ChaoShang Group's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Hong Kong ChaoShang Group's P/S

Shares in Hong Kong ChaoShang Group have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Hong Kong ChaoShang Group revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Hong Kong ChaoShang Group you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2322

Modern Innovative Digital Technology

An investment holding company, engages in the trading, money lending and factoring, and finance leasing and financial services businesses in the People’s Republic of China and Hong Kong.

Adequate balance sheet minimal.

Similar Companies

Market Insights

Community Narratives