- Hong Kong

- /

- Aerospace & Defense

- /

- SEHK:232

Revenues Working Against Continental Aerospace Technologies Holding Limited's (HKG:232) Share Price

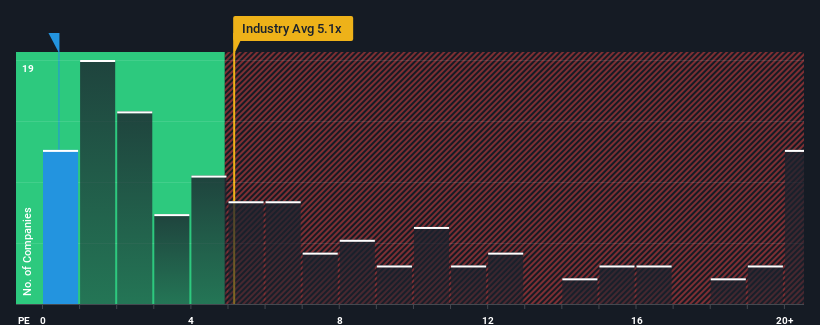

With a price-to-sales (or "P/S") ratio of 0.4x Continental Aerospace Technologies Holding Limited (HKG:232) may be sending very bullish signals at the moment, given that almost half of all the Aerospace & Defense companies in Hong Kong have P/S ratios greater than 5.1x and even P/S higher than 11x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Continental Aerospace Technologies Holding

How Continental Aerospace Technologies Holding Has Been Performing

Revenue has risen firmly for Continental Aerospace Technologies Holding recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on Continental Aerospace Technologies Holding will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Continental Aerospace Technologies Holding will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Continental Aerospace Technologies Holding's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. The solid recent performance means it was also able to grow revenue by 29% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 36% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's understandable that Continental Aerospace Technologies Holding's P/S sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Continental Aerospace Technologies Holding revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - Continental Aerospace Technologies Holding has 2 warning signs we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:232

Continental Aerospace Technologies Holding

An investment holding company, designs, develops, produces, and sells general aviation aircraft piston engines and spare parts in the United States, Europe, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives