- Hong Kong

- /

- Construction

- /

- SEHK:2295

Investors in Maxicity Holdings (HKG:2295) have seen massive returns of 668% over the past five years

We think all investors should try to buy and hold high quality multi-year winners. While not every stock performs well, when investors win, they can win big. Don't believe it? Then look at the Maxicity Holdings Limited (HKG:2295) share price. It's 575% higher than it was five years ago. If that doesn't get you thinking about long term investing, we don't know what will. On the other hand, the stock price has retraced 10.0% in the last week. However, this might be related to the overall market decline of 4.3% in a week. Anyone who held for that rewarding ride would probably be keen to talk about it.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for Maxicity Holdings

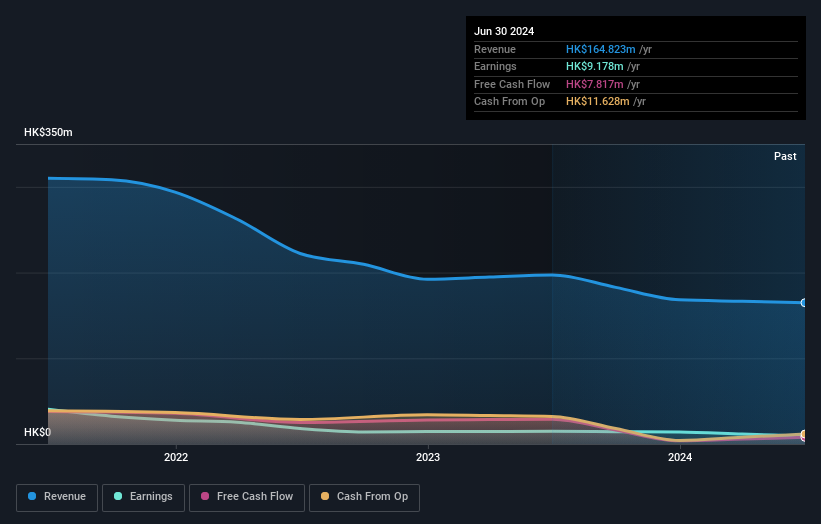

We don't think that Maxicity Holdings' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Maxicity Holdings' financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Maxicity Holdings' total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Maxicity Holdings' TSR of 668% over the last 5 years is better than the share price return.

A Different Perspective

Maxicity Holdings shareholders gained a total return of 16% during the year. But that was short of the market average. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 50% over five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Maxicity Holdings you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2295

Maxicity Holdings

An investment holding company, operates as a slope works contractor in Hong Kong.

Flawless balance sheet with poor track record.