A Look At TK Group (Holdings)'s (HKG:2283) CEO Remuneration

The CEO of TK Group (Holdings) Limited (HKG:2283) is Michael Yung, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for TK Group (Holdings)

Comparing TK Group (Holdings) Limited's CEO Compensation With the industry

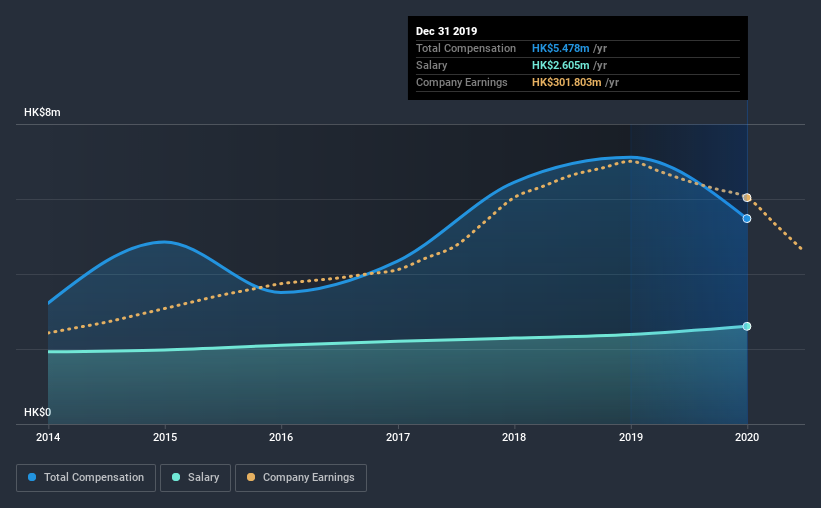

According to our data, TK Group (Holdings) Limited has a market capitalization of HK$2.1b, and paid its CEO total annual compensation worth HK$5.5m over the year to December 2019. Notably, that's a decrease of 23% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at HK$2.6m.

On examining similar-sized companies in the industry with market capitalizations between HK$775m and HK$3.1b, we discovered that the median CEO total compensation of that group was HK$2.6m. Accordingly, our analysis reveals that TK Group (Holdings) Limited pays Michael Yung north of the industry median. Moreover, Michael Yung also holds HK$142m worth of TK Group (Holdings) stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | HK$2.6m | HK$2.4m | 48% |

| Other | HK$2.9m | HK$4.7m | 52% |

| Total Compensation | HK$5.5m | HK$7.1m | 100% |

On an industry level, around 86% of total compensation represents salary and 14% is other remuneration. It's interesting to note that TK Group (Holdings) allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

TK Group (Holdings) Limited's Growth

Over the last three years, TK Group (Holdings) Limited has shrunk its earnings per share by 1.4% per year. In the last year, its revenue is down 11%.

The lack of EPS growth is certainly unimpressive. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has TK Group (Holdings) Limited Been A Good Investment?

With a three year total loss of 39% for the shareholders, TK Group (Holdings) Limited would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be lessto generous with CEO compensation.

To Conclude...

As we touched on above, TK Group (Holdings) Limited is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. This doesn't look good against shareholder returns, which have been negative for the past three years. Arguably worse, we've been waiting for positive EPS growth for the last three years. Considering such poor performance, we think shareholders might be concerned if the CEO's compensation were to grow.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 1 warning sign for TK Group (Holdings) that investors should look into moving forward.

Switching gears from TK Group (Holdings), if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade TK Group (Holdings), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TK Group (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:2283

TK Group (Holdings)

An investment holding company, engages in the manufacture, sale, subcontracting, fabrication, and modification of molds and plastic components.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.