- Hong Kong

- /

- Construction

- /

- SEHK:2195

Unity Enterprise Holdings Limited's (HKG:2195) Shares May Have Run Too Fast Too Soon

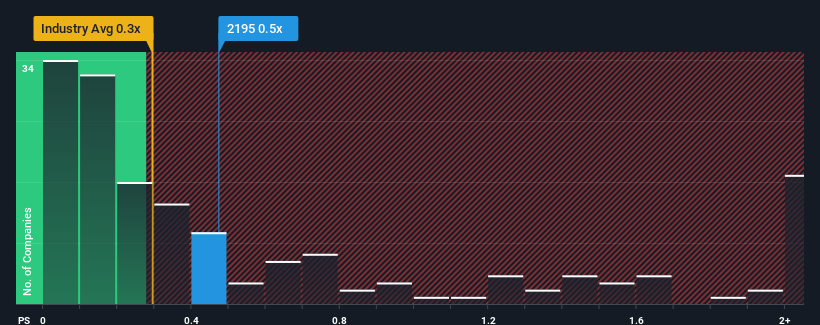

There wouldn't be many who think Unity Enterprise Holdings Limited's (HKG:2195) price-to-sales (or "P/S") ratio of 0.5x is worth a mention when the median P/S for the Construction industry in Hong Kong is similar at about 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Unity Enterprise Holdings

How Unity Enterprise Holdings Has Been Performing

Unity Enterprise Holdings certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Unity Enterprise Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Unity Enterprise Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Unity Enterprise Holdings' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 76% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 58% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 8.8% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Unity Enterprise Holdings is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Unity Enterprise Holdings currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Unity Enterprise Holdings (2 don't sit too well with us!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Unity Enterprise Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2195

Unity Enterprise Holdings

Unity Enterprise Holdings Limited, and investment holding company, operates as a contractor of repair, maintenance, alteration, and addition (RMAA) works in Hong Kong.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives