- Hong Kong

- /

- Trade Distributors

- /

- SEHK:2112

Getting In Cheap On Grace Life-tech Holdings Limited (HKG:2112) Is Unlikely

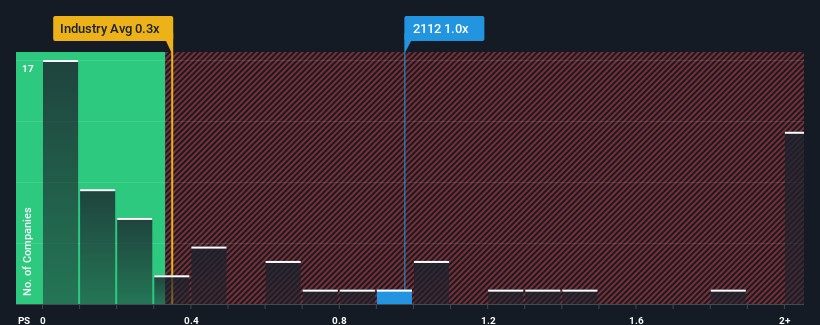

Grace Life-tech Holdings Limited's (HKG:2112) price-to-sales (or "P/S") ratio of 1x may not look like an appealing investment opportunity when you consider close to half the companies in the Trade Distributors industry in Hong Kong have P/S ratios below 0.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Grace Life-tech Holdings

What Does Grace Life-tech Holdings' Recent Performance Look Like?

For instance, Grace Life-tech Holdings' receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Grace Life-tech Holdings will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Grace Life-tech Holdings?

The only time you'd be truly comfortable seeing a P/S as high as Grace Life-tech Holdings' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 2.2% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 34% shows it's an unpleasant look.

With this information, we find it concerning that Grace Life-tech Holdings is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Grace Life-tech Holdings' P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Grace Life-tech Holdings revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Plus, you should also learn about these 5 warning signs we've spotted with Grace Life-tech Holdings (including 3 which make us uncomfortable).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2112

Grace Life-tech Holdings

An investment holding company, engages in the research, development, and application of plant stem cell technology.

Low with imperfect balance sheet.

Market Insights

Community Narratives