Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, CAA Resources Limited (HKG:2112) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for CAA Resources

What Is CAA Resources's Net Debt?

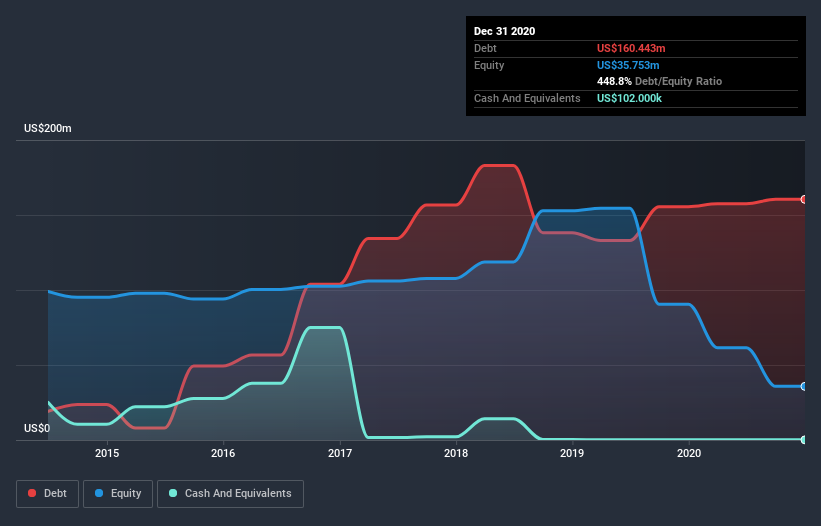

As you can see below, CAA Resources had US$160.4m of debt, at December 2020, which is about the same as the year before. You can click the chart for greater detail. Net debt is about the same, since the it doesn't have much cash.

How Healthy Is CAA Resources' Balance Sheet?

The latest balance sheet data shows that CAA Resources had liabilities of US$197.5m due within a year, and liabilities of US$3.47m falling due after that. Offsetting these obligations, it had cash of US$102.0k as well as receivables valued at US$205.6m due within 12 months. So it can boast US$4.79m more liquid assets than total liabilities.

This excess liquidity suggests that CAA Resources is taking a careful approach to debt. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders. The balance sheet is clearly the area to focus on when you are analysing debt. But it is CAA Resources's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, CAA Resources made a loss at the EBIT level, and saw its revenue drop to US$28m, which is a fall of 97%. That makes us nervous, to say the least.

Caveat Emptor

While CAA Resources's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost a very considerable US$6.9m at the EBIT level. Looking on the brighter side, the business has adequate liquid assets, which give it time to grow and develop before its debt becomes a near-term issue. But we'd be more likely to spend time trying to understand the stock if the company made a profit. So it seems too risky for our taste. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 3 warning signs with CAA Resources (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade CAA Resources, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2112

Grace Life-tech Holdings

An investment holding company, engages in the research, development, and application of plant stem cell technology.

Low with imperfect balance sheet.

Market Insights

Community Narratives