- Hong Kong

- /

- Electrical

- /

- SEHK:1979

Upgrade: Analysts Just Made A Captivating Increase To Their Ten Pao Group Holdings Limited (HKG:1979) Forecasts

Ten Pao Group Holdings Limited (HKG:1979) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals.

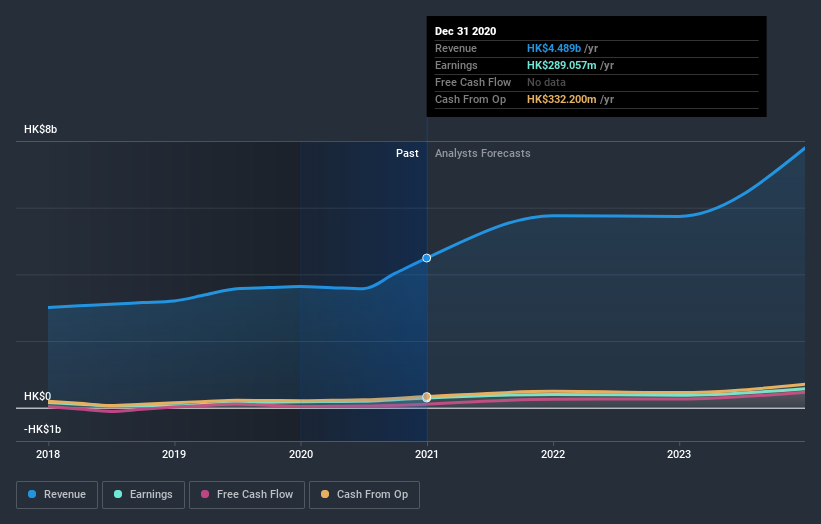

Following the upgrade, the latest consensus from Ten Pao Group Holdings' twin analysts is for revenues of HK$5.8b in 2021, which would reflect a sizeable 28% improvement in sales compared to the last 12 months. Per-share earnings are expected to jump 36% to HK$0.39. Before this latest update, the analysts had been forecasting revenues of HK$4.5b and earnings per share (EPS) of HK$0.28 in 2021. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

See our latest analysis for Ten Pao Group Holdings

It will come as no surprise to learn that the analysts have increased their price target for Ten Pao Group Holdings 33% to HK$2.54 on the back of these upgrades. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Ten Pao Group Holdings, with the most bullish analyst valuing it at HK$3.86 and the most bearish at HK$1.21 per share. With such a wide range in price targets, the analysts are almost certainly betting on widely diverse outcomes for the underlying business. As a result it might not be possible to derive much meaning from the consensus price target, which is after all just an average of this wide range of estimates.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's clear from the latest estimates that Ten Pao Group Holdings' rate of growth is expected to accelerate meaningfully, with the forecast 28% annualised revenue growth to the end of 2021 noticeably faster than its historical growth of 12% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 7.1% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Ten Pao Group Holdings is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, Ten Pao Group Holdings could be worth investigating further.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for Ten Pao Group Holdings going out as far as 2023, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you decide to trade Ten Pao Group Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Ten Pao Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1979

Ten Pao Group Holdings

An investment holding company, engages in the development, manufacture, and sale of electric charging products in the People’s Republic of China, the rest of Asia, the United States, Europe, Africa, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives