- Hong Kong

- /

- Construction

- /

- SEHK:1903

JBB Builders International (SEHK:1903) Margin Decline Reinforces Market Concerns Over Earnings Quality

Reviewed by Simply Wall St

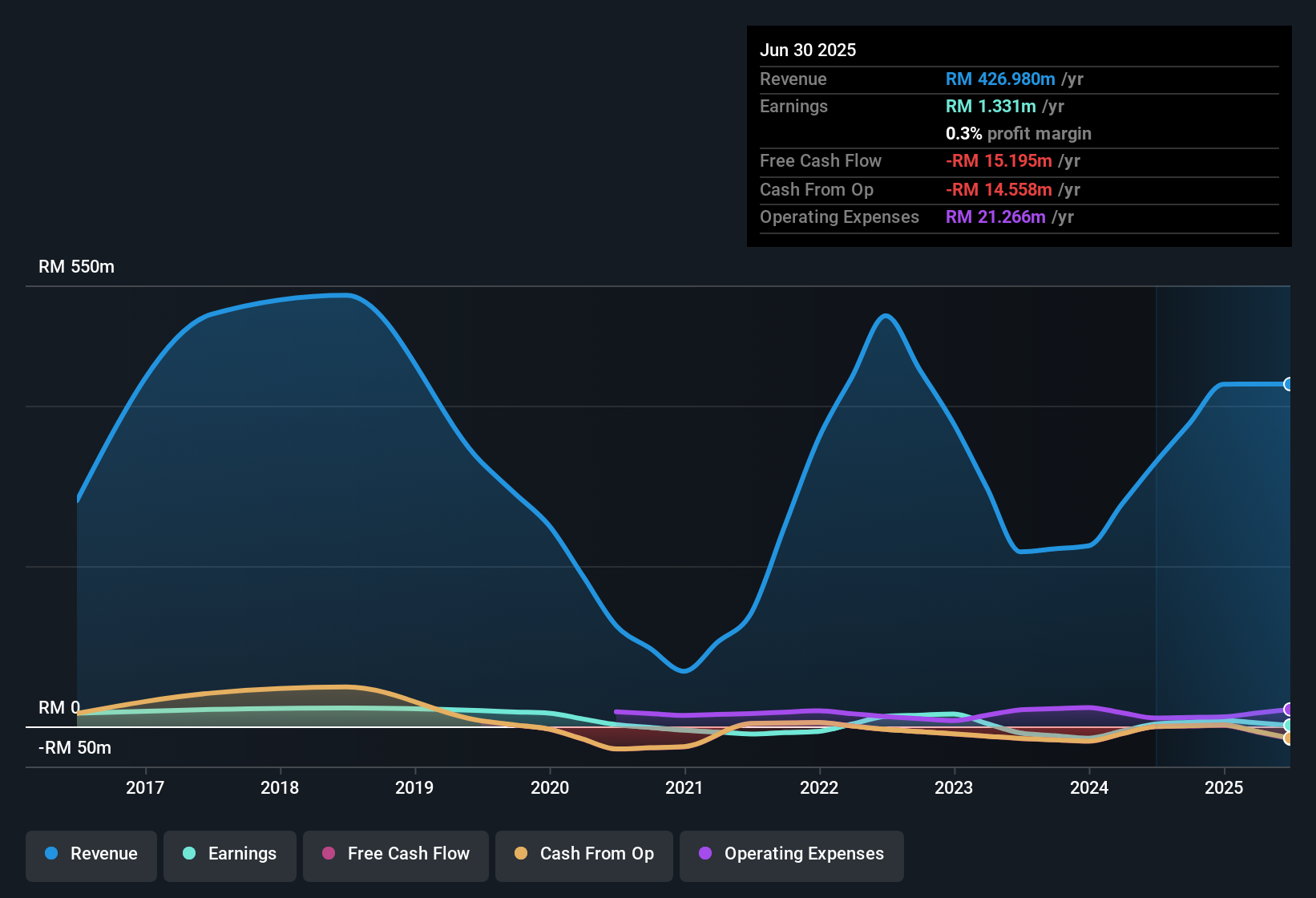

JBB Builders International (SEHK:1903) reported a net profit margin of 0.3%, a drop from last year’s 0.9%. Annual earnings have grown by 13.4% on average over the past five years but declined in the most recent period. Its Price-to-Sales ratio stands at 1.2x, making the stock appear expensive compared to the Hong Kong Construction industry average of 0.4x, though more attractively valued relative to direct peers, which average 2.5x. Margins have compressed and weak recent earnings overshadow the company’s longer-term growth track record, which puts the focus squarely on where profits go from here.

See our full analysis for JBB Builders International.Next, we will put these results up against the most discussed narratives to see which market stories are supported by the numbers and which ones face new challenges.

Curious how numbers become stories that shape markets? Explore Community Narratives

Non-Cash Earnings Raise Quality Questions

- The company is noted to have a high level of non-cash earnings, which introduces uncertainty around the sustainability of reported profits.

- Prevailing market view sees this as a meaningful headwind for the investment case, since:

- Even with 13.4% annual earnings growth over five years, the recent period saw negative earnings growth and rising non-cash contributions. This challenges belief in continued momentum.

- Critics highlight that headline profit figures can mask underlying profitability weakness if cash flow generation does not track earnings, inhibiting confidence in the true health of the business.

Net Profit Margin Slides From 0.9% to 0.3%

- Net profit margin contracted to 0.3% from 0.9% last year, spotlighting a sharp drop in underlying profitability for JBB Builders International.

- Prevailing market view argues this erosion adds pressure to management’s ability to defend profit levels, since:

- Weak recent margins and the negative shift against a solid multi-year average undermine bullish hopes for a quick turnaround.

- The declining margin may also raise questions about competitive positioning within the Hong Kong Construction industry, where peer margins could influence investor expectations for recovery.

Valuation: Peer Discount Yet Sector Premium

- Price-to-Sales stands at 1.2x, significantly above the broader Hong Kong Construction industry’s average of 0.4x, suggesting an expensive sector stance, but below the peer average of 2.5x, which makes it relatively attractive in its direct peer group.

- Prevailing market view debates whether this blend of premium and discount is justified, considering:

- The company’s mixed margin and earnings quality trends force investors to weigh short-term headwinds against long-run growth rates when interpreting the current multiple.

- Because sector averages and peer comparisons diverge so sharply, the right valuation lens, whether industry or peer set, could be pivotal in shaping the outlook for the share price, currently at 1.89.

Curious how numbers become stories that shape markets? Explore Community Narratives Curious how numbers become stories that shape markets? Explore Community Narratives

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on JBB Builders International's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Margins have shrunk, recent profits are down, and reliance on non-cash earnings raises doubts about JBB Builders International’s earnings quality and sustainability.

If you want stocks that show steadier results and reliable profit growth, check out our list of stable growth stocks screener (2097 results) built for consistency through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1903

JBB Builders International

An investment holding company, provides marine construction, and building and infrastructure services in Malaysia and Singapore.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives