Haitian International Holdings Limited's (HKG:1882) 29% Price Boost Is Out Of Tune With Earnings

Haitian International Holdings Limited (HKG:1882) shareholders have had their patience rewarded with a 29% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 68% in the last year.

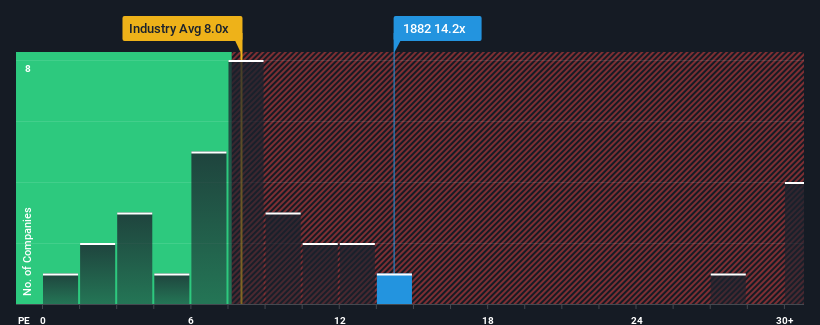

Following the firm bounce in price, given around half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may consider Haitian International Holdings as a stock to potentially avoid with its 14.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times have been advantageous for Haitian International Holdings as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Haitian International Holdings

Does Growth Match The High P/E?

Haitian International Holdings' P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered an exceptional 20% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 5.5% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 9.5% per year during the coming three years according to the twelve analysts following the company. Meanwhile, the rest of the market is forecast to expand by 12% per year, which is noticeably more attractive.

With this information, we find it concerning that Haitian International Holdings is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Haitian International Holdings' P/E

The large bounce in Haitian International Holdings' shares has lifted the company's P/E to a fairly high level. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Haitian International Holdings' analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Haitian International Holdings with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Haitian International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1882

Haitian International Holdings

An investment holding company, engages in the manufacture, distribution, and sale of plastic injection molding machines and related products in Mainland China, Hong Kong, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives