- Hong Kong

- /

- Construction

- /

- SEHK:1799

Market is not liking Xinte Energy's (HKG:1799) earnings decline as stock retreats 3.1% this week

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. That downside risk was realized by Xinte Energy Co., Ltd. (HKG:1799) shareholders over the last year, as the share price declined 49%. That's well below the market return of 6.9%. We note that it has not been easy for shareholders over three years, either; the share price is down 49% in that time. The falls have accelerated recently, with the share price down 11% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Since Xinte Energy has shed HK$400m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Xinte Energy

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

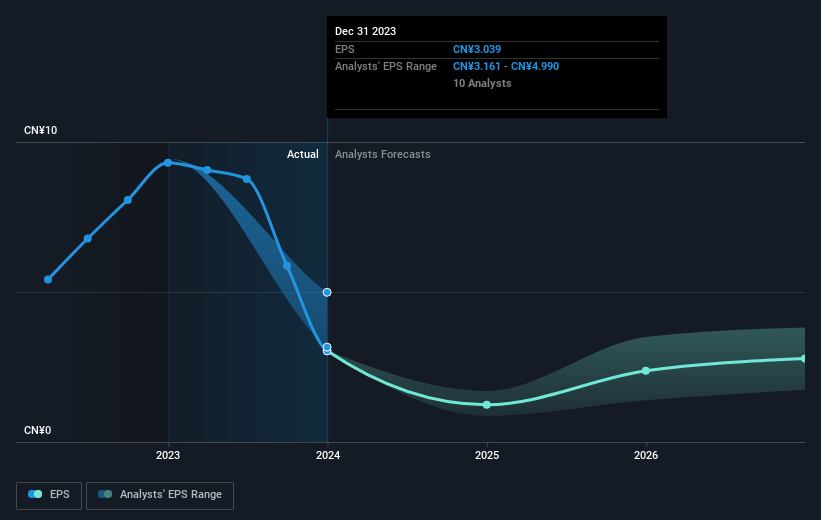

Unhappily, Xinte Energy had to report a 67% decline in EPS over the last year. The share price fall of 49% isn't as bad as the reduction in earnings per share. It may have been that the weak EPS was not as bad as some had feared.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Xinte Energy has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Xinte Energy stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Xinte Energy shareholders are down 49% for the year, but the market itself is up 6.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 9% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Xinte Energy you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1799

Xinte Energy

Engages in the research and development, production, and sale of high-purity polysilicon in the People’s Republic of China.

Flawless balance sheet and undervalued.