- Hong Kong

- /

- Hospitality

- /

- SEHK:2282

SEHK Growth Companies With High Insider Ownership In August 2024

Reviewed by Simply Wall St

As global markets experience mixed performances and economic data presents a varied picture, the Hong Kong market has seen its share of fluctuations. Despite these challenges, certain growth companies with high insider ownership stand out as potentially resilient investments. In this environment, stocks with substantial insider ownership often signal strong confidence from those who know the company best. This article will explore three such companies listed on the SEHK that are noteworthy for their growth potential and significant insider stakes.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| iDreamSky Technology Holdings (SEHK:1119) | 18.7% | 104.1% |

| Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

| Fenbi (SEHK:2469) | 31.1% | 42.8% |

| Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 73% |

| DPC Dash (SEHK:1405) | 38.2% | 91.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

| Ocumension Therapeutics (SEHK:1477) | 23.3% | 93.7% |

| Beijing Airdoc Technology (SEHK:2251) | 28.6% | 83.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

J&T Global Express (SEHK:1519)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: J&T Global Express Limited (SEHK:1519) is an investment holding company that provides express delivery services and has a market cap of HK$54.19 billion.

Operations: The company's revenue segments include Transportation - Air Freight, which generated $8.85 billion.

Insider Ownership: 20.2%

J&T Global Express, recently added to the FTSE All-World Index, shows promising growth with revenue forecasted to increase by 15.9% per year, outpacing the Hong Kong market. Despite a low projected Return on Equity of 17.9%, its earnings are expected to grow by 102.99% annually and become profitable within three years, surpassing average market growth. Insider ownership remains strong with no substantial insider trading in recent months.

- Click here to discover the nuances of J&T Global Express with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of J&T Global Express shares in the market.

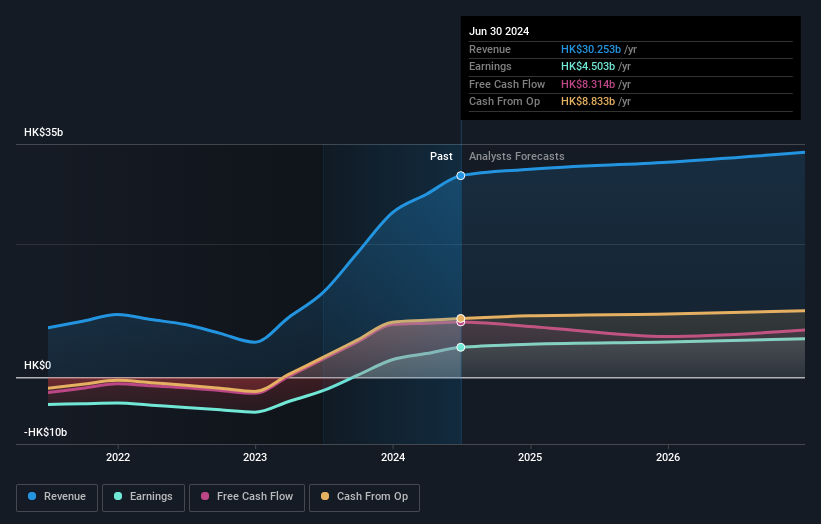

MGM China Holdings (SEHK:2282)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MGM China Holdings Limited is an investment holding company involved in the development, ownership, and operation of gaming and lodging resorts in the Greater China region, with a market cap of HK$43.32 billion.

Operations: The company's revenue primarily comes from its casinos and resorts, generating HK$24.68 billion.

Insider Ownership: 10%

MGM China Holdings, with substantial insider ownership, is poised for growth as its earnings are projected to increase by 17.05% annually, outpacing the Hong Kong market's average. Recent debt financing of US$500 million aims to strengthen its financial position by repaying outstanding credit. Additionally, a significant share buyback program could enhance net asset value and earnings per share. However, interest payments on new debt may strain earnings coverage in the short term.

- Dive into the specifics of MGM China Holdings here with our thorough growth forecast report.

- Our valuation report unveils the possibility MGM China Holdings' shares may be trading at a discount.

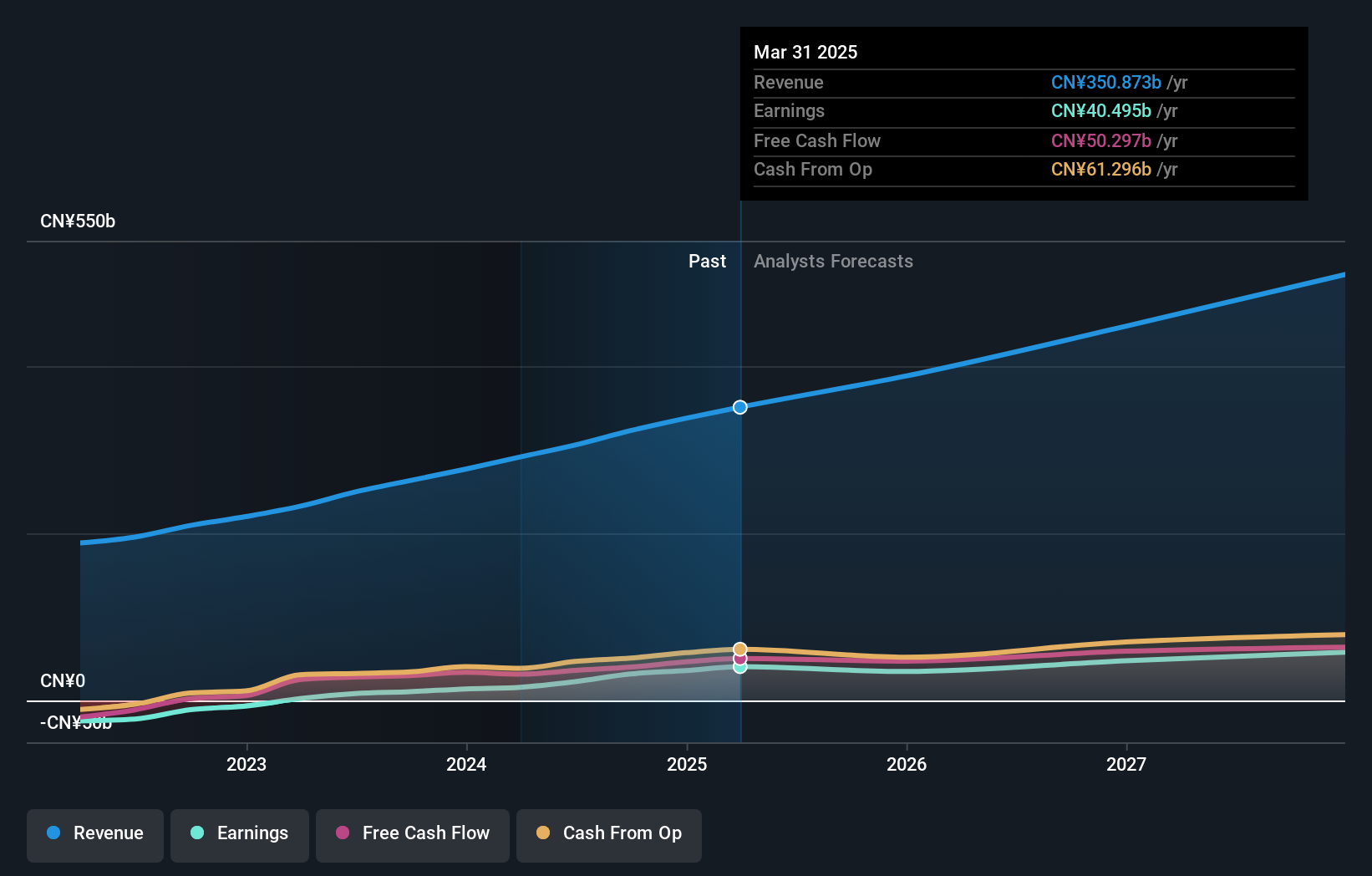

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Meituan, with a market cap of HK$664.72 billion, operates as a technology retail company in the People’s Republic of China.

Operations: The company's revenue segments are as follows: Food delivery (CN¥96.28 billion), In-store, hotel, and travel (CN¥32.48 billion), and New initiatives and others (CN¥57.18 billion).

Insider Ownership: 11.6%

Meituan, with significant insider ownership, is expected to see annual earnings growth of 30.81%, outpacing the Hong Kong market's 11.4%. Recent events include a share repurchase program worth $2 billion and amendments to company bylaws. Q1 2024 results showed strong financial performance with sales at CNY 73.28 billion and net income at CNY 5.37 billion, reflecting substantial year-over-year growth despite no substantial insider buying in the past three months.

- Navigate through the intricacies of Meituan with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Meituan shares in the market.

Make It Happen

- Unlock more gems! Our Fast Growing SEHK Companies With High Insider Ownership screener has unearthed 51 more companies for you to explore.Click here to unveil our expertly curated list of 54 Fast Growing SEHK Companies With High Insider Ownership.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2282

MGM China Holdings

An investment holding company, engages in the development, ownership, and operation of gaming and lodging resorts in the Greater China region.

Good value with reasonable growth potential.