- Hong Kong

- /

- Construction

- /

- SEHK:1746

Man Shun Group (Holdings)'s (HKG:1746) Shareholders Are Down 13% On Their Shares

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. Investors in Man Shun Group (Holdings) Limited (HKG:1746) have tasted that bitter downside in the last year, as the share price dropped 13%. That's well below the market return of 22%. Man Shun Group (Holdings) may have better days ahead, of course; we've only looked at a one year period. But it's up 6.7% in the last week. The buoyant market could have helped drive the share price pop, since stocks are up 5.1% in the same period.

See our latest analysis for Man Shun Group (Holdings)

While Man Shun Group (Holdings) made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last twelve months, Man Shun Group (Holdings) increased its revenue by 31%. That's definitely a respectable growth rate. Meanwhile, the share price is down 13% over twelve months, which is disappointing given the progress made. This implies the market was expecting better growth. But if revenue keeps growing, then at a certain point the share price would likely follow.

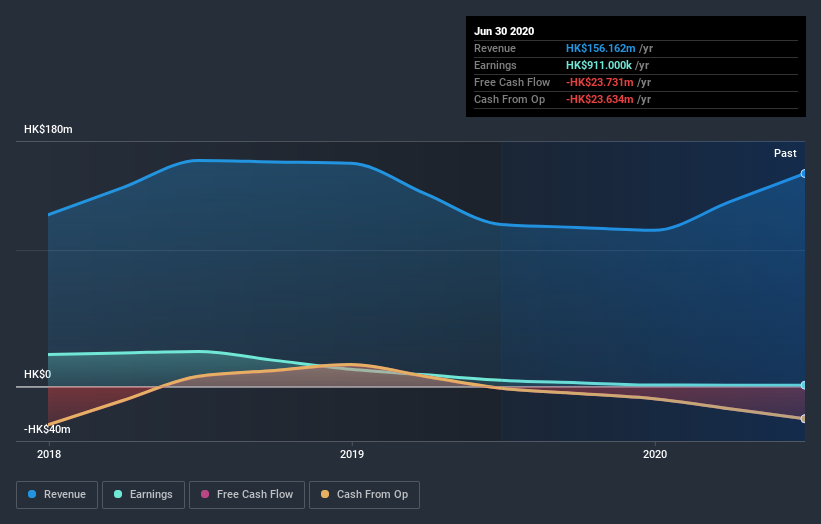

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While Man Shun Group (Holdings) shareholders are down 13% for the year, the market itself is up 22%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock flat over the last three months, the market now seems fairly ambivalent about the business. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 4 warning signs for Man Shun Group (Holdings) (2 shouldn't be ignored!) that you should be aware of before investing here.

But note: Man Shun Group (Holdings) may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade Man Shun Group (Holdings), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Man Shun Group (Holdings), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1746

Man Shun Group (Holdings)

An investment holding company, engages in the installation of heat, ventilation, and air-conditioning (HVAC) systems in Hong Kong.

Flawless balance sheet very low.

Market Insights

Community Narratives