- Hong Kong

- /

- Trade Distributors

- /

- SEHK:1733

3 Penny Stocks With Market Caps Under US$400M To Consider

Reviewed by Simply Wall St

As global markets react to recent political developments and economic indicators, major indexes like the S&P 500 have reached new highs, driven by optimism surrounding trade policies and advancements in artificial intelligence. In such a climate, investors often look for opportunities that offer both growth potential and value. Penny stocks, though sometimes seen as a relic of past trading days, remain relevant due to their ability to provide access to smaller or newer companies with promising financials. These stocks can present significant opportunities when they are grounded in strong fundamentals and balance sheets.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.59B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £178.85M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.09B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.905 | £470.9M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR423.03M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.09 | £776.24M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$143.12M | ★★★★☆☆ |

Click here to see the full list of 5,717 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

National Corporation for Tourism and Hotels (ADX:NCTH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: National Corporation for Tourism and Hotels operates by investing in, owning, and managing hotels and leisure complexes in the United Arab Emirates with a market cap of AED2.28 billion.

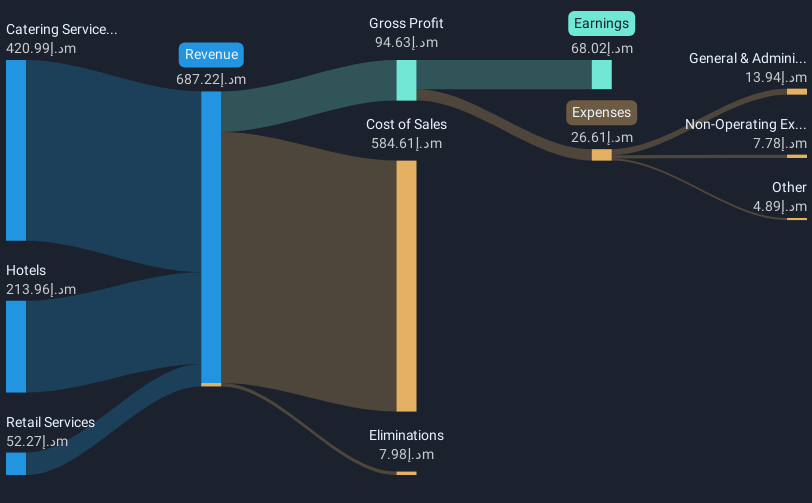

Operations: The company's revenue is derived from three main segments: Hotels (AED213.96 million), Retail Services (AED52.27 million), and Catering Services (AED420.99 million).

Market Cap: AED2.28B

National Corporation for Tourism and Hotels, with a market cap of AED2.28 billion, operates primarily in the UAE's hospitality sector. The company generates revenue from hotels (AED213.96 million), retail services (AED52.27 million), and catering services (AED420.99 million). Financially, it maintains strong liquidity with short-term assets exceeding both short- and long-term liabilities, while its debt is well-covered by cash flow and interest payments are easily managed by EBIT. Although earnings have grown recently by 5.9%, they have declined over five years at 13.2% annually, highlighting volatility in profit growth trends amidst stable weekly stock volatility at 3%.

- Unlock comprehensive insights into our analysis of National Corporation for Tourism and Hotels stock in this financial health report.

- Evaluate National Corporation for Tourism and Hotels' historical performance by accessing our past performance report.

E-Commodities Holdings (SEHK:1733)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E-Commodities Holdings Limited, along with its subsidiaries, is involved in the processing and trading of coal and other products, with a market cap of HK$3.02 billion.

Operations: The company generates revenue from two primary segments: HK$6.34 billion from rendering integrated supply chain services and HK$36.57 billion from the processing and trading of coal and other products.

Market Cap: HK$3.02B

E-Commodities Holdings, with a market cap of HK$3.02 billion, has shown robust financial health, as evidenced by its substantial revenue streams from integrated supply chain services (HK$6.34 billion) and coal trading (HK$36.57 billion). The company's short-term assets significantly surpass both short- and long-term liabilities, indicating strong liquidity. Its debt is well-covered by operating cash flow and interest payments are comfortably managed by EBIT coverage of 34.8 times. Recent developments include new credit facilities worth RMB 150 million to enhance cash flows for subsidiaries and a board change with Ms. Feng Tong's appointment as a non-executive director in December 2024.

- Jump into the full analysis health report here for a deeper understanding of E-Commodities Holdings.

- Assess E-Commodities Holdings' previous results with our detailed historical performance reports.

China Dongxiang (Group) (SEHK:3818)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Dongxiang (Group) Co., Ltd. and its subsidiaries focus on designing, developing, marketing, and selling sport-related apparel, footwear, and accessories in China and internationally, with a market cap of HK$1.94 billion.

Operations: The company generates revenue from its apparel segment in China, amounting to CN¥1.72 billion.

Market Cap: HK$1.94B

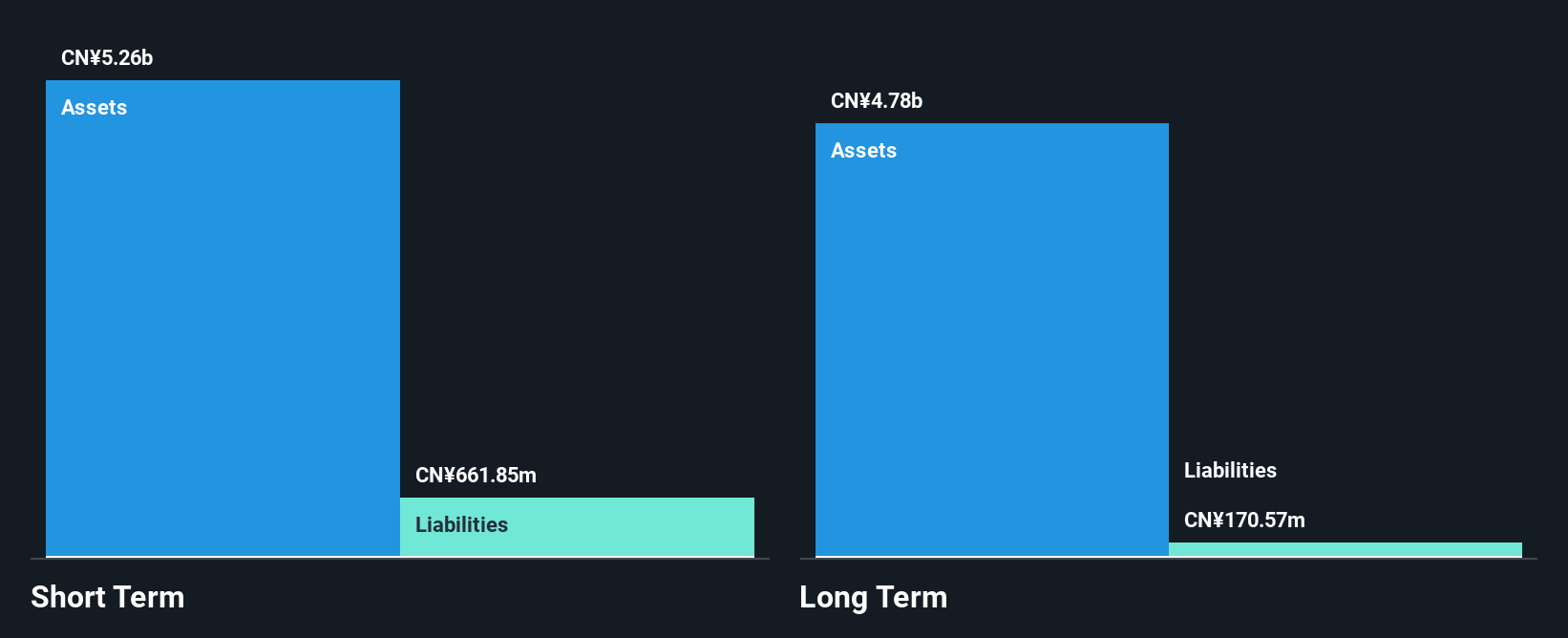

China Dongxiang (Group) Co., Ltd. has a market cap of HK$1.94 billion and generates CN¥1.72 billion from its apparel segment in China, although it remains unprofitable with a negative return on equity of -1.01%. Despite this, the company’s short-term assets significantly exceed its liabilities, indicating good liquidity and no debt concerns. Recent earnings showed improvement with net income reaching CN¥136.97 million for the half-year ended September 2024, reversing a prior loss. The board's recent appointment of Ms. Tang Songlian as an independent director may bring valuable financial oversight to support strategic goals amidst ongoing challenges in profitability and dividend sustainability.

- Get an in-depth perspective on China Dongxiang (Group)'s performance by reading our balance sheet health report here.

- Gain insights into China Dongxiang (Group)'s past trends and performance with our report on the company's historical track record.

Next Steps

- Click here to access our complete index of 5,717 Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if E-Commodities Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1733

E-Commodities Holdings

Engages in the processing and trading of coal and other products.

Flawless balance sheet and good value.

Market Insights

Community Narratives