David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Shuang Yun Holdings Limited (HKG:1706) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Shuang Yun Holdings

How Much Debt Does Shuang Yun Holdings Carry?

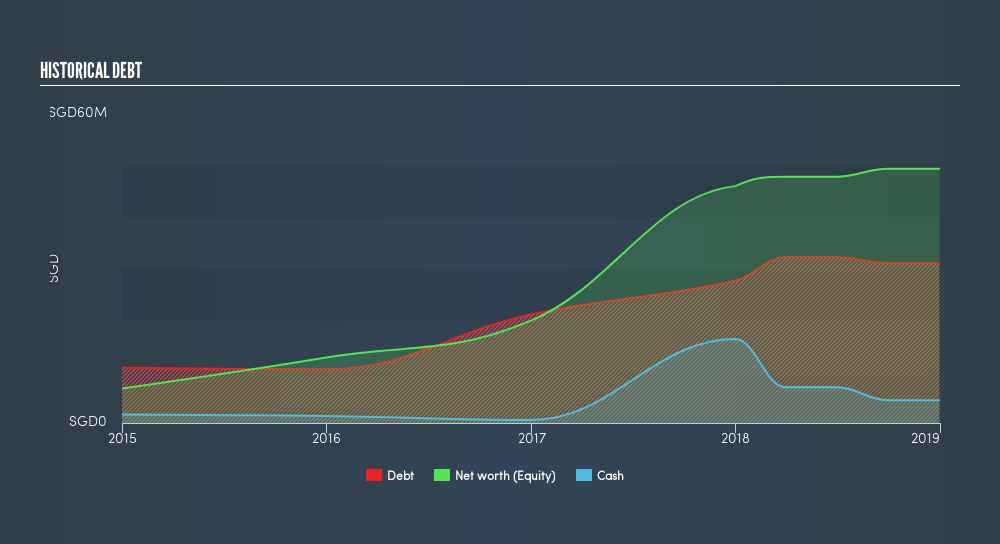

As you can see below, at the end of December 2018, Shuang Yun Holdings had S$44.1m of debt, up from S$35.8m a year ago. Click the image for more detail. However, it also had S$4.44m in cash, and so its net debt is S$39.7m.

A Look At Shuang Yun Holdings's Liabilities

According to the last reported balance sheet, Shuang Yun Holdings had liabilities of S$46.7m due within 12 months, and liabilities of S$15.9m due beyond 12 months. Offsetting these obligations, it had cash of S$4.44m as well as receivables valued at S$71.8m due within 12 months. So it can boast S$13.7m more liquid assets than total liabilities.

This surplus strongly suggests that Shuang Yun Holdings has a rock-solid balance sheet (and the debt is of no concern whatsoever). On this view, it seems its balance sheet is as strong as a black-belt karate master. Because it carries more debt than cash, we think it's worth watching Shuang Yun Holdings's balance sheet over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Shuang Yun Holdings has a debt to EBITDA ratio of 3.76 and its EBIT covered its interest expense 2.79 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Worse, Shuang Yun Holdings's EBIT was down 30% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Shuang Yun Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Shuang Yun Holdings saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

Both Shuang Yun Holdings's EBIT growth rate and its conversion of EBIT to free cash flow were discouraging. But at least its level of total liabilities is a gleaming silver lining to those clouds. Taking the abovementioned factors together we do think Shuang Yun Holdings's debt poses some risks to the business. While that debt can boost returns, we think the company has enough leverage now. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Shuang Yun Holdings's earnings per share history for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:1706

Shuang Yun Holdings

Shuang Yun Holdings Limited, an investment holding company, provides road construction and construction ancillary services in Singapore.

Imperfect balance sheet with weak fundamentals.

Market Insights

Community Narratives