- Hong Kong

- /

- Construction

- /

- SEHK:1690

We Believe Lap Kei Engineering (Holdings)'s (HKG:1690) Earnings Are A Poor Guide For Its Profitability

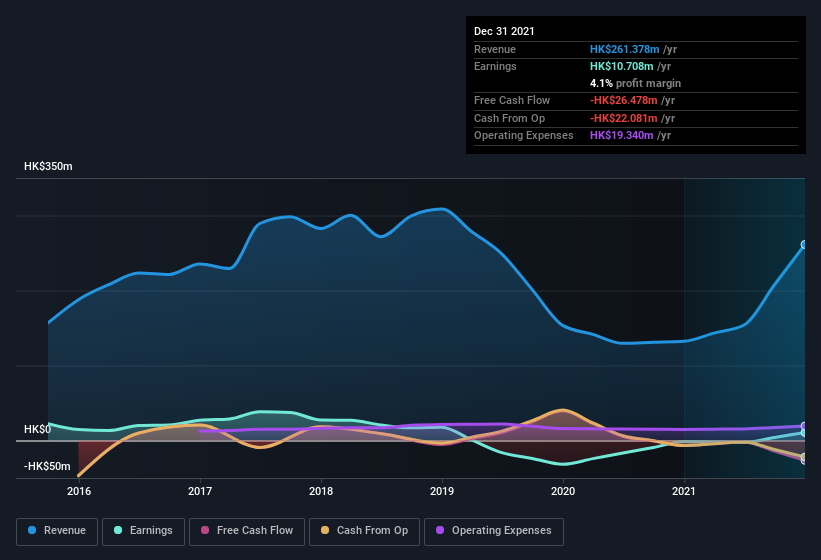

Even though Lap Kei Engineering (Holdings) Limited (HKG:1690) posted strong earnings recently, the stock hasn't reacted in a large way. We think that investors might be worried about the foundations the earnings are built on.

View our latest analysis for Lap Kei Engineering (Holdings)

A Closer Look At Lap Kei Engineering (Holdings)'s Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Lap Kei Engineering (Holdings) has an accrual ratio of 0.53 for the year to December 2021. Statistically speaking, that's a real negative for future earnings. And indeed, during the period the company didn't produce any free cash flow whatsoever. Over the last year it actually had negative free cash flow of HK$26m, in contrast to the aforementioned profit of HK$10.7m. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of HK$26m, this year, indicates high risk. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Lap Kei Engineering (Holdings).

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, Lap Kei Engineering (Holdings) issued 15% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Lap Kei Engineering (Holdings)'s EPS by clicking here.

A Look At The Impact Of Lap Kei Engineering (Holdings)'s Dilution on Its Earnings Per Share (EPS).

We don't have any data on the company's profits from three years ago. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). So you can see that the dilution has had a bit of an impact on shareholders.

In the long term, if Lap Kei Engineering (Holdings)'s earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Lap Kei Engineering (Holdings)'s Profit Performance

As it turns out, Lap Kei Engineering (Holdings) couldn't match its profit with cashflow and its dilution means that shareholders own less of the company than the did before (unless they bought more shares). Considering all this we'd argue Lap Kei Engineering (Holdings)'s profits probably give an overly generous impression of its sustainable level of profitability. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Case in point: We've spotted 4 warning signs for Lap Kei Engineering (Holdings) you should be mindful of and 2 of these bad boys are a bit unpleasant.

Our examination of Lap Kei Engineering (Holdings) has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1690

Lap Kei Engineering (Holdings)

An investment holding company, provides engineering services for building services systems in Hong Kong.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives