- Hong Kong

- /

- Construction

- /

- SEHK:1662

Update: Yee Hop Holdings (HKG:1662) Stock Gained 60% In The Last Three Years

One simple way to benefit from the stock market is to buy an index fund. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, Yee Hop Holdings Limited (HKG:1662) shareholders have seen the share price rise 60% over three years, well in excess of the market return (5.4%, not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 14% in the last year.

Check out our latest analysis for Yee Hop Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the three years of share price growth, Yee Hop Holdings actually saw its earnings per share (EPS) drop 17% per year.

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Given this situation, it makes sense to look at other metrics too.

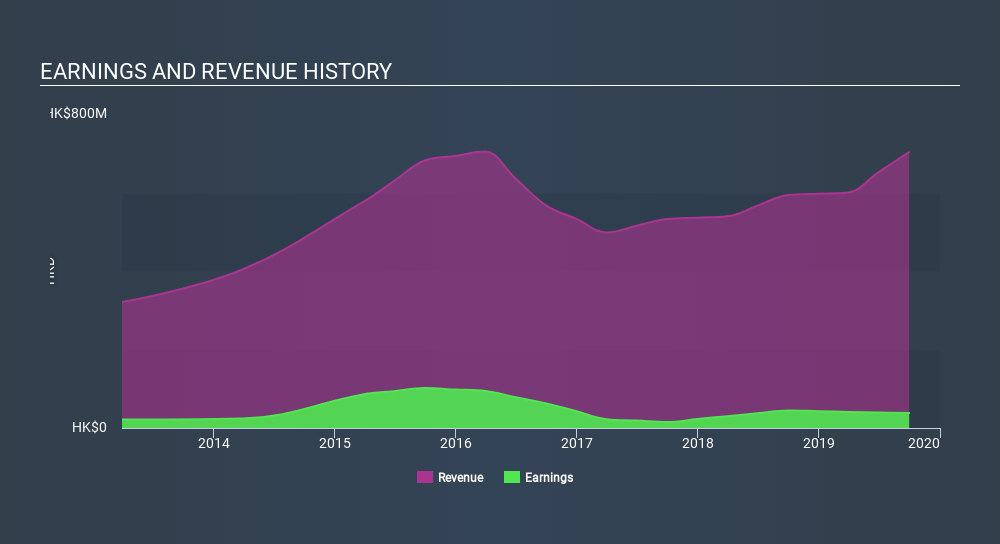

It may well be that Yee Hop Holdings revenue growth rate of 8.5% over three years has convinced shareholders to believe in a brighter future. If the company is being managed for the long term good, today's shareholders might be right to hold on.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. It might be well worthwhile taking a look at our free report on Yee Hop Holdings's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Yee Hop Holdings shareholders have gained 14% (in total) over the last year. That falls short of the 17% it has made, for shareholders, each year, over three years. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Yee Hop Holdings is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1662

Yee Hop Holdings

An investment holding company, provides engineering and construction services in Hong Kong, the People’s Republic of China, and the Philippines.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives