Precision Tsugami (China) Corporation Limited's (HKG:1651) CEO Looks Due For A Compensation Raise

Shareholders will be pleased by the impressive results for Precision Tsugami (China) Corporation Limited (HKG:1651) recently and CEO Donglei Tang has played a key role. At the upcoming AGM on 16 August 2021, they would be interested to hear about the company strategy going forward and get a chance to cast their votes on resolutions such as executive remuneration and other company matters. We think the CEO has done a pretty decent job and probably deserves a well-earned pay rise.

See our latest analysis for Precision Tsugami (China)

Comparing Precision Tsugami (China) Corporation Limited's CEO Compensation With the industry

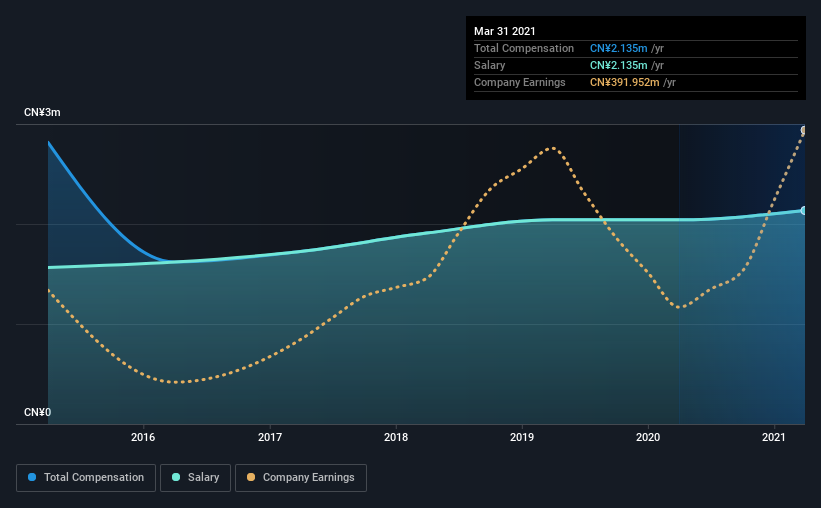

According to our data, Precision Tsugami (China) Corporation Limited has a market capitalization of HK$4.2b, and paid its CEO total annual compensation worth CN¥2.1m over the year to March 2021. That's just a smallish increase of 4.6% on last year. It is worth noting that the CEO compensation consists entirely of the salary, worth CN¥2.1m.

In comparison with other companies in the industry with market capitalizations ranging from HK$1.6b to HK$6.2b, the reported median CEO total compensation was CN¥3.5m. Accordingly, Precision Tsugami (China) pays its CEO under the industry median. What's more, Donglei Tang holds HK$1.6m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | CN¥2.1m | CN¥2.0m | 100% |

| Other | - | - | - |

| Total Compensation | CN¥2.1m | CN¥2.0m | 100% |

Speaking on an industry level, nearly 85% of total compensation represents salary, while the remainder of 15% is other remuneration. At the company level, Precision Tsugami (China) pays Donglei Tang solely through a salary, preferring to go down a conventional route. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Precision Tsugami (China) Corporation Limited's Growth Numbers

Precision Tsugami (China) Corporation Limited has seen its earnings per share (EPS) increase by 22% a year over the past three years. In the last year, its revenue is up 60%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Precision Tsugami (China) Corporation Limited Been A Good Investment?

Boasting a total shareholder return of 84% over three years, Precision Tsugami (China) Corporation Limited has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Precision Tsugami (China) rewards its CEO solely through a salary, ignoring non-salary benefits completely. Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Precision Tsugami (China) that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1651

Precision Tsugami (China)

An investment holding company, manufactures and sells computer numerical control machine tools primarily in Mainland China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives