- Hong Kong

- /

- Construction

- /

- SEHK:1637

Should You Be Adding SH Group (Holdings) (HKG:1637) To Your Watchlist Today?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in SH Group (Holdings) (HKG:1637). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for SH Group (Holdings)

SH Group (Holdings)'s Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. As a tree reaches steadily for the sky, SH Group (Holdings)'s EPS has grown 23% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

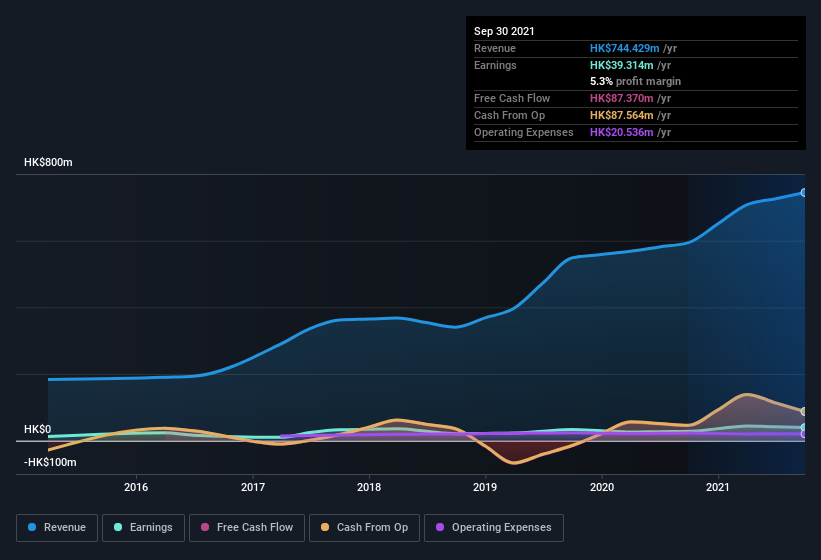

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). SH Group (Holdings) maintained stable EBIT margins over the last year, all while growing revenue 25% to HK$744m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since SH Group (Holdings) is no giant, with a market capitalization of HK$216m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are SH Group (Holdings) Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that SH Group (Holdings) insiders own a significant number of shares certainly appeals to me. Indeed, with a collective holding of 75%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. With that sort of holding, insiders have about HK$162m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Should You Add SH Group (Holdings) To Your Watchlist?

You can't deny that SH Group (Holdings) has grown its earnings per share at a very impressive rate. That's attractive. I think that EPS growth is something to boast of, and it doesn't surprise me that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with SH Group (Holdings) , and understanding them should be part of your investment process.

Although SH Group (Holdings) certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1637

SH Group (Holdings)

An investment holding company, provides electrical and mechanical (E&M) engineering services for public and private sectors in Hong Kong.

Flawless balance sheet slight.

Market Insights

Community Narratives