As global markets react to the recent Federal Reserve rate cut, Hong Kong's Hang Seng Index has seen a notable uptick, gaining 5.12% despite mixed economic data from China. This backdrop of shifting monetary policies and market optimism highlights the importance of stable income-generating investments. In such an environment, dividend stocks can offer a reliable source of returns through regular payouts. Here are three SEHK dividend stocks to consider, boasting yields up to 9.3%.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| Consun Pharmaceutical Group (SEHK:1681) | 9.25% | ★★★★★☆ |

| Luk Fook Holdings (International) (SEHK:590) | 9.24% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.06% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 5.25% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.22% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 7.12% | ★★★★★☆ |

| Zhejiang Expressway (SEHK:576) | 7.30% | ★★★★★☆ |

| Tianjin Development Holdings (SEHK:882) | 7.85% | ★★★★★☆ |

| China Resources Land (SEHK:1109) | 7.31% | ★★★★★☆ |

| Tian An China Investments (SEHK:28) | 5.08% | ★★★★★☆ |

Click here to see the full list of 79 stocks from our Top SEHK Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

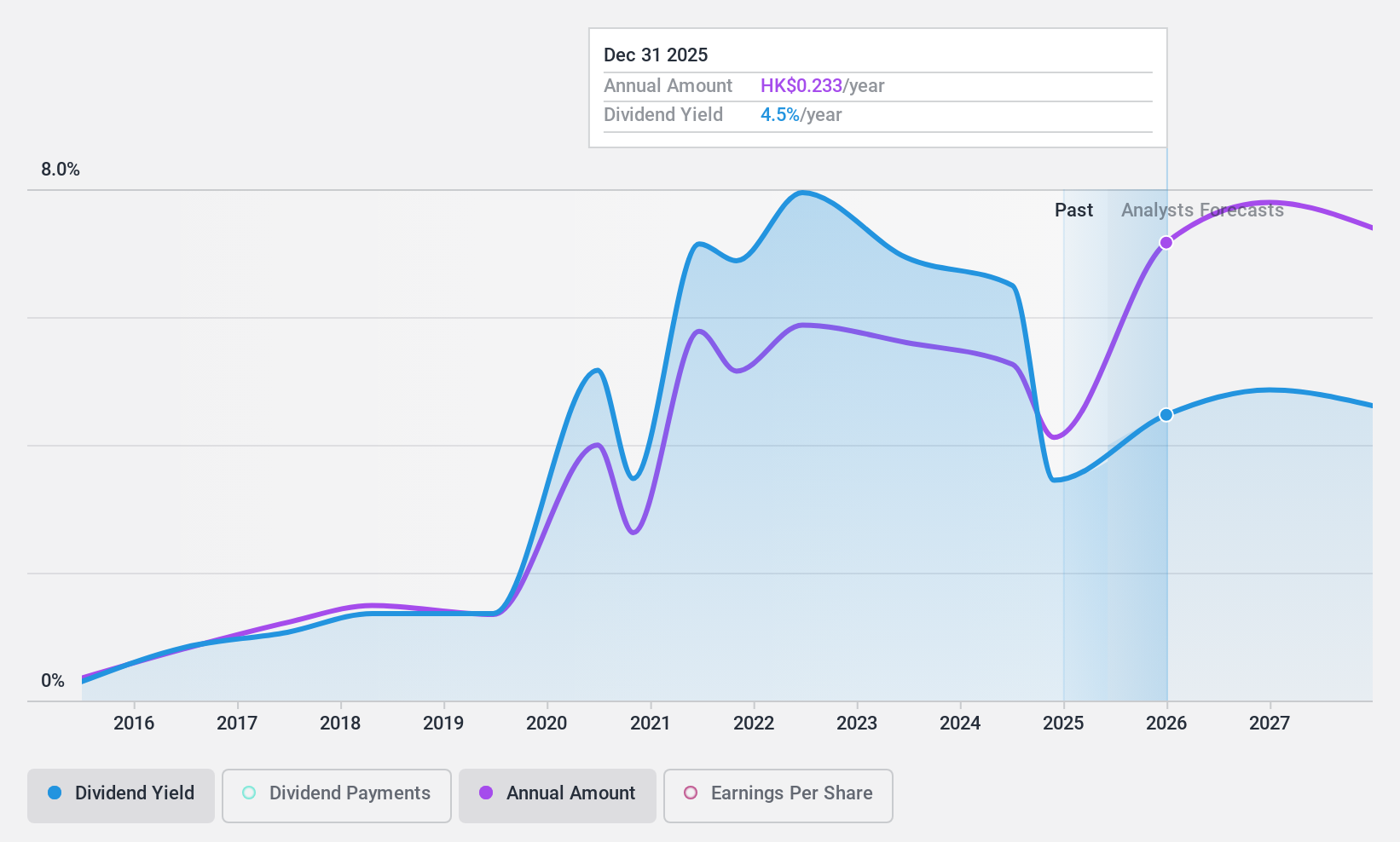

People's Insurance Company (Group) of China (SEHK:1339)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The People's Insurance Company (Group) of China Limited, an investment holding company with a market cap of HK$281.47 billion, provides insurance products and services in the People’s Republic of China and Hong Kong.

Operations: The People's Insurance Company (Group) of China Limited generates revenue from several segments, including Non-Life Insurance (CN¥486.03 billion), Health Insurance (CN¥26.88 billion), Life Insurance (CN¥21.47 billion), and Asset Management (CN¥2.87 billion).

Dividend Yield: 4.1%

People's Insurance Company (Group) of China shows a mixed profile for dividend investors. The company recently declared an interim dividend of RMB 0.063 per share and reported half-year earnings with revenue at CNY 292.34 billion and net income at CNY 23.40 billion, indicating strong financials. However, its dividend yield is relatively low compared to top payers in Hong Kong, and its historical dividend payments have been volatile and unreliable despite being well-covered by earnings and cash flows.

- Dive into the specifics of People's Insurance Company (Group) of China here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of People's Insurance Company (Group) of China shares in the market.

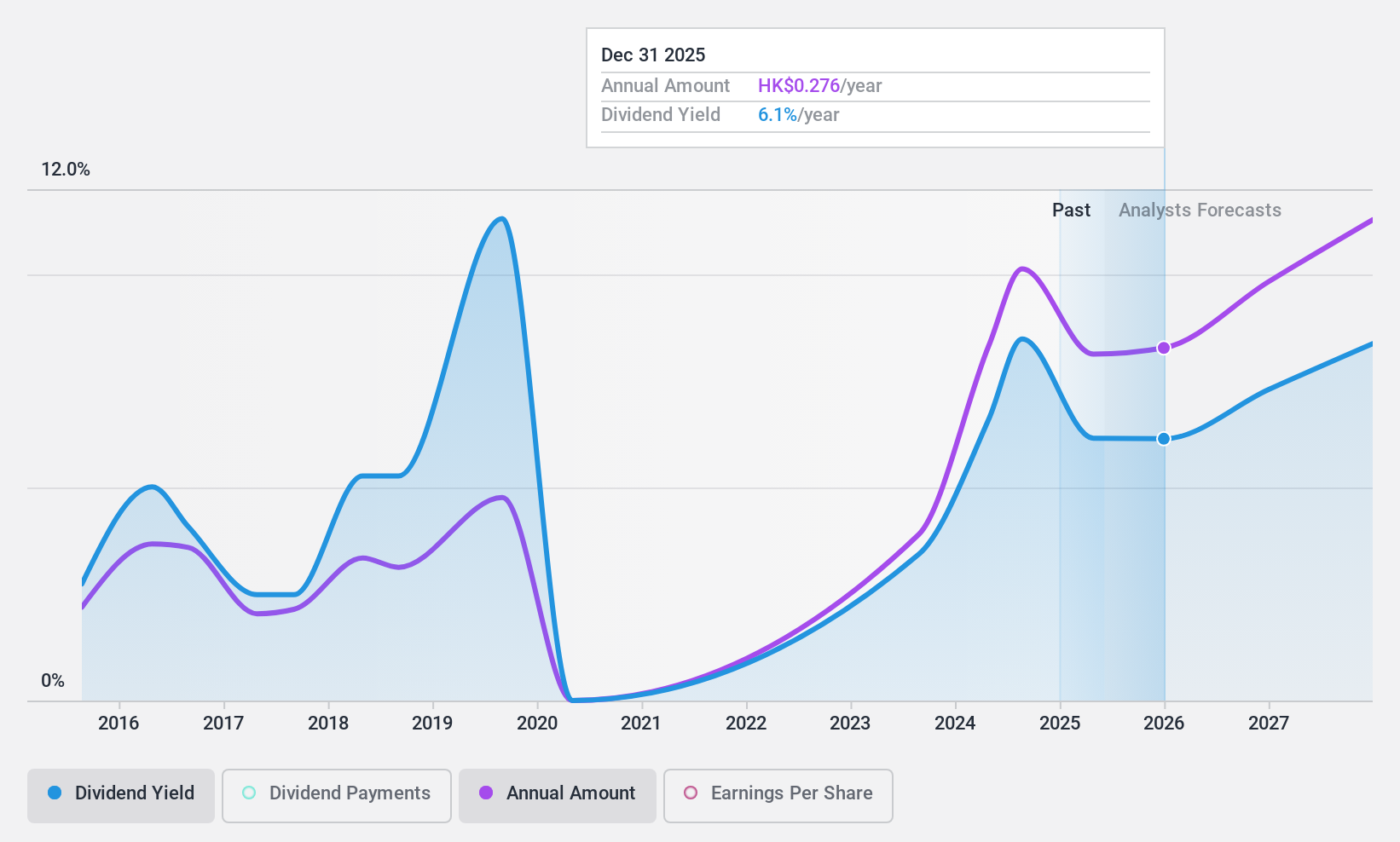

361 Degrees International (SEHK:1361)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: 361 Degrees International Limited is an investment holding company that manufactures and trades sporting goods in the People’s Republic of China, with a market cap of HK$7.53 billion.

Operations: 361 Degrees International Limited generates revenue from two main segments: Kids (CN¥2.18 billion) and Adults (CN¥7.13 billion).

Dividend Yield: 9.4%

361 Degrees International's dividend yield of 9.38% is among the top 25% in Hong Kong, but its sustainability is questionable due to a high cash payout ratio of 162%. Despite earnings growing by 16.4% last year and forecasted to grow annually by 12.88%, dividends have been volatile over the past decade. Recent financials show net income at CNY 789.7 million for H1-2024, with an interim dividend declared at HKD 0.165 per share payable on September 9, 2024.

- Click here to discover the nuances of 361 Degrees International with our detailed analytical dividend report.

- Our expertly prepared valuation report 361 Degrees International implies its share price may be lower than expected.

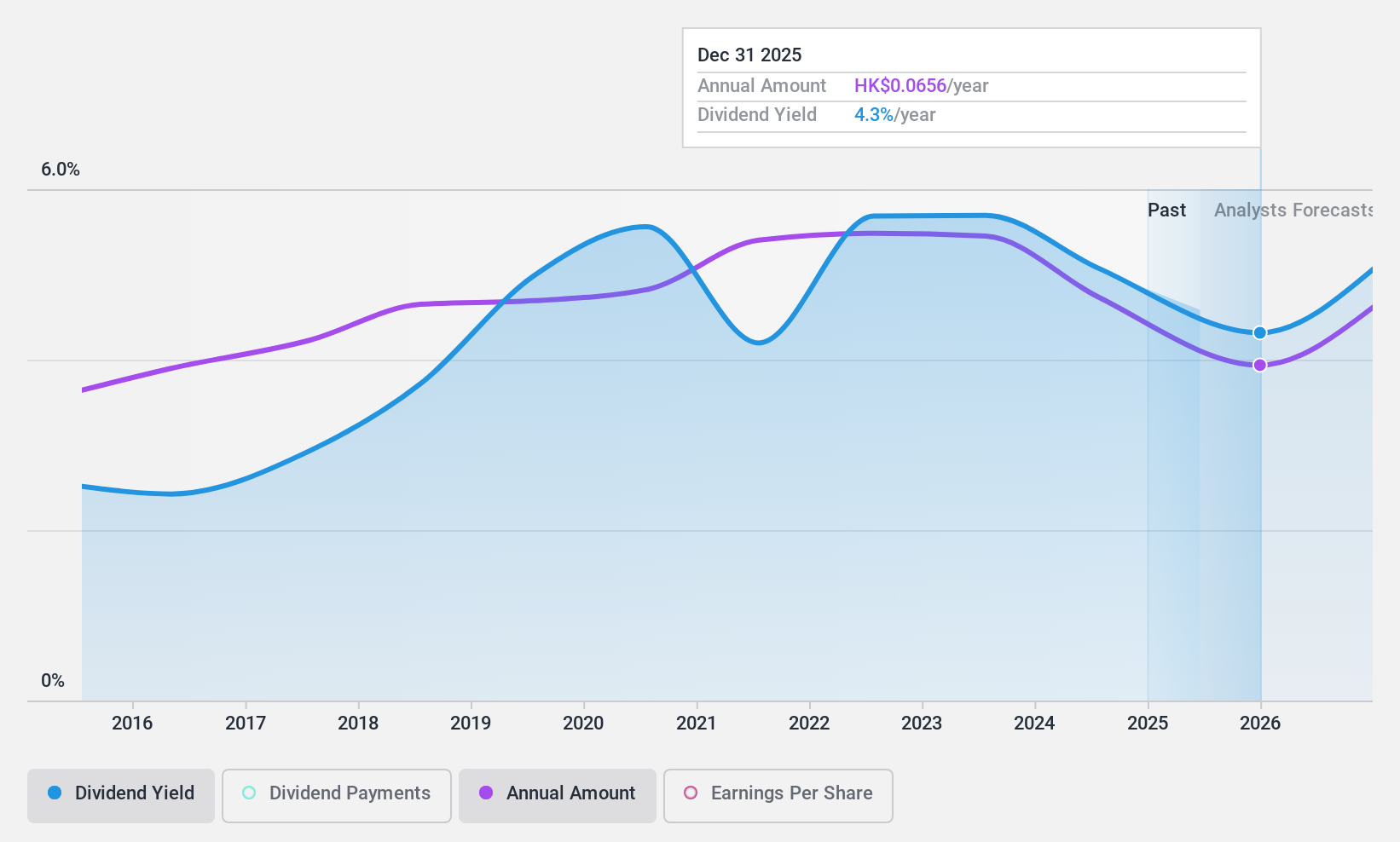

Metallurgical Corporation of China (SEHK:1618)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Metallurgical Corporation of China Ltd. (SEHK:1618) operates in engineering contracting, property development, equipment manufacture, and resource development both domestically and internationally with a market cap of approximately HK$58.54 billion.

Operations: Metallurgical Corporation of China Ltd.'s revenue segments include Engineering Contracting (CN¥553.39 billion), Featured Business (CN¥31.46 billion), and Resource Development (CN¥6.54 billion).

Dividend Yield: 5.9%

Metallurgical Corporation of China's dividend yield is 5.91%, lower than the top 25% in Hong Kong. Despite stable and growing dividends over the past decade, recent earnings reports show a net income decline to CNY 462.55 million for H1-2024 from CNY 504.5 million last year, with profit margins dropping to 0.6%. The company’s dividends are not covered by free cash flows, raising sustainability concerns despite a low payout ratio of 39.9%.

- Delve into the full analysis dividend report here for a deeper understanding of Metallurgical Corporation of China.

- Upon reviewing our latest valuation report, Metallurgical Corporation of China's share price might be too pessimistic.

Key Takeaways

- Click here to access our complete index of 79 Top SEHK Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 361 Degrees International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1361

361 Degrees International

An investment holding company, manufactures and trades in sporting goods in the People’s Republic of China.

Very undervalued with flawless balance sheet.