- Hong Kong

- /

- Construction

- /

- SEHK:1615

Here's Why We're Watching AB Builders Group's (HKG:1615) Cash Burn Situation

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So, the natural question for AB Builders Group (HKG:1615) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for AB Builders Group

How Long Is AB Builders Group's Cash Runway?

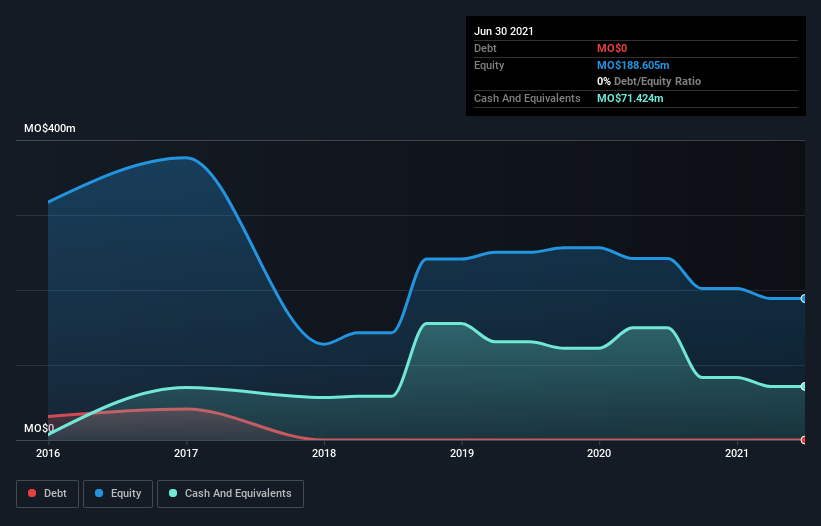

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In June 2021, AB Builders Group had MO$71m in cash, and was debt-free. In the last year, its cash burn was MO$79m. So it had a cash runway of approximately 11 months from June 2021. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. Depicted below, you can see how its cash holdings have changed over time.

Is AB Builders Group's Revenue Growing?

We're hesitant to extrapolate on the recent trend to assess its cash burn, because AB Builders Group actually had positive free cash flow last year, so operating revenue growth is probably our best bet to measure, right now. Regrettably, the company's operating revenue moved in the wrong direction over the last twelve months, declining by 23%. In reality, this article only makes a short study of the company's growth data. This graph of historic earnings and revenue shows how AB Builders Group is building its business over time.

Can AB Builders Group Raise More Cash Easily?

Given its problematic fall in revenue, AB Builders Group shareholders should consider how the company could fund its growth, if it turns out it needs more cash. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Since it has a market capitalisation of MO$176m, AB Builders Group's MO$79m in cash burn equates to about 45% of its market value. That's high expenditure relative to the value of the entire company, so if it does have to issue shares to fund more growth, that could end up really hurting shareholders returns (through significant dilution).

Is AB Builders Group's Cash Burn A Worry?

We must admit that we don't think AB Builders Group is in a very strong position, when it comes to its cash burn. While its cash runway wasn't too bad, its cash burn relative to its market cap does leave us rather nervous. After looking at that range of measures, we think shareholders should be extremely attentive to how the company is using its cash, as the cash burn makes us uncomfortable. On another note, we conducted an in-depth investigation of the company, and identified 2 warning signs for AB Builders Group (1 is potentially serious!) that you should be aware of before investing here.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1615

AB Builders Group

An investment holding company, engages in the provision of construction services in Macau, the People’s Republic of China, and Hong Kong.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives