- Hong Kong

- /

- Electrical

- /

- SEHK:1608

VPower Group International Holdings (HKG:1608) Share Prices Have Dropped 43% In The Last Three Years

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But if you try your hand at stock picking, your risk returning less than the market. We regret to report that long term VPower Group International Holdings Limited (HKG:1608) shareholders have had that experience, with the share price dropping 43% in three years, versus a market decline of about 0.1%. The falls have accelerated recently, with the share price down 12% in the last three months.

Check out our latest analysis for VPower Group International Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate three years of share price decline, VPower Group International Holdings actually saw its earnings per share (EPS) improve by 5.3% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

With a rather small yield of just 1.0% we doubt that the stock's share price is based on its dividend. We note that, in three years, revenue has actually grown at a 25% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching VPower Group International Holdings more closely, as sometimes stocks fall unfairly. This could present an opportunity.

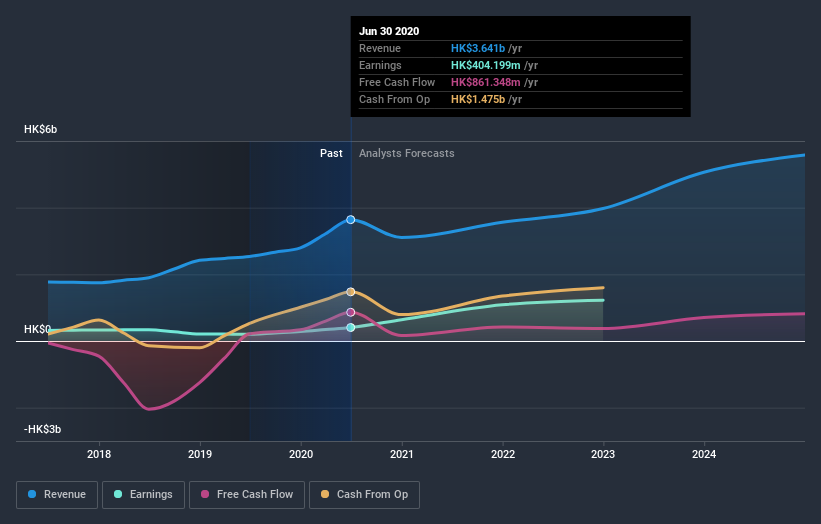

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think VPower Group International Holdings will earn in the future (free profit forecasts).

A Different Perspective

It's nice to see that VPower Group International Holdings shareholders have gained 19% (in total) over the last year. And yes, that does include the dividend. This recent result is much better than the 12% drop suffered by shareholders each year (on average) over the last three. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. It's always interesting to track share price performance over the longer term. But to understand VPower Group International Holdings better, we need to consider many other factors. For instance, we've identified 2 warning signs for VPower Group International Holdings (1 shouldn't be ignored) that you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade VPower Group International Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1608

VPower Group International Holdings

An investment holding company, designs, integrates, sells, and installs engine-based electricity generation units in Hong Kong, Macau, Mainland China, other Asian countries, and internationally.

Adequate balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives