- Hong Kong

- /

- Professional Services

- /

- SEHK:2225

VPower Group International Holdings And 2 More Prominent Asian Penny Stocks

Reviewed by Simply Wall St

As global markets navigate the complexities of economic shifts, Asia's financial landscape continues to capture attention with its unique dynamics and potential opportunities. Penny stocks, often considered a relic from past market eras, remain relevant as they offer an intriguing mix of affordability and growth potential. For investors looking beyond mainstream options, these smaller or newer companies can present compelling opportunities when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.71 | HK$2.21B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.48 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.56 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect Medical Health Management (SEHK:1830) | HK$1.41 | HK$1.77B | ✅ 2 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.00 | SGD405.29M | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.103 | SGD53.92M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.37 | SGD13.26B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.20 | ₱841.12M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$3.02 | NZ$258.17M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 959 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

VPower Group International Holdings (SEHK:1608)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: VPower Group International Holdings Limited is an investment holding company that designs, integrates, sells, and installs engine-based electricity generation units across Hong Kong, Mainland China, other Asian countries, Latin America, and internationally with a market cap of approximately HK$1.22 billion.

Operations: The company generates revenue through its System Integration segment, contributing HK$470.96 million, and its Investment, Building and Operating segment, which accounts for HK$907.96 million.

Market Cap: HK$1.22B

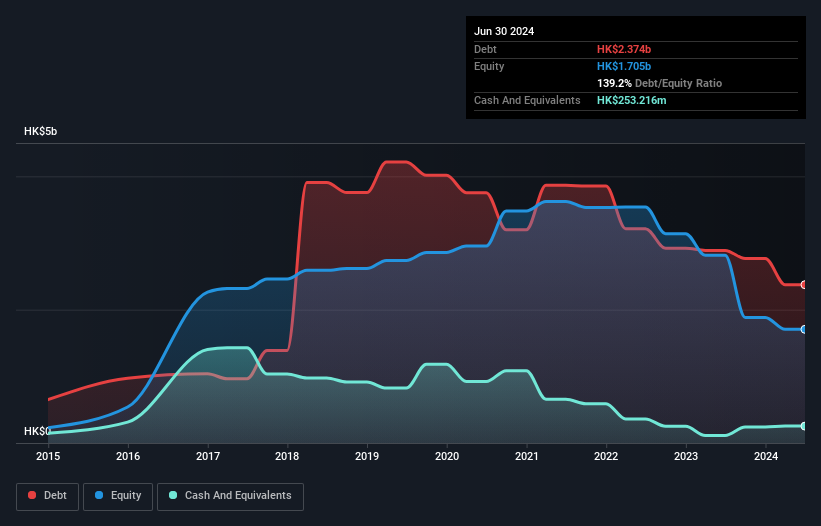

VPower Group International Holdings, with a market cap of HK$1.22 billion, operates in the engine-based electricity generation sector and is currently unprofitable. Despite generating revenue through its System Integration (HK$470.96 million) and Investment segments (HK$907.96 million), the company faces challenges such as high net debt to equity ratio at 97.6% and increasing losses over the past five years by 54.4% annually. However, it has a strong cash position with short-term assets exceeding liabilities and a cash runway extending beyond three years if current free cash flow levels are maintained, providing some financial stability amidst volatility.

- Click here to discover the nuances of VPower Group International Holdings with our detailed analytical financial health report.

- Examine VPower Group International Holdings' past performance report to understand how it has performed in prior years.

Jinhai Medical Technology (SEHK:2225)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Jinhai Medical Technology Limited is an investment holding company that offers minimally invasive surgery solutions, medical products, and related services in the People's Republic of China and Singapore, with a market cap of HK$6.56 billion.

Operations: The company's revenue is derived from two primary regions, with SGD 14.82 million generated in Singapore and SGD 19.83 million from the People's Republic of China.

Market Cap: HK$6.56B

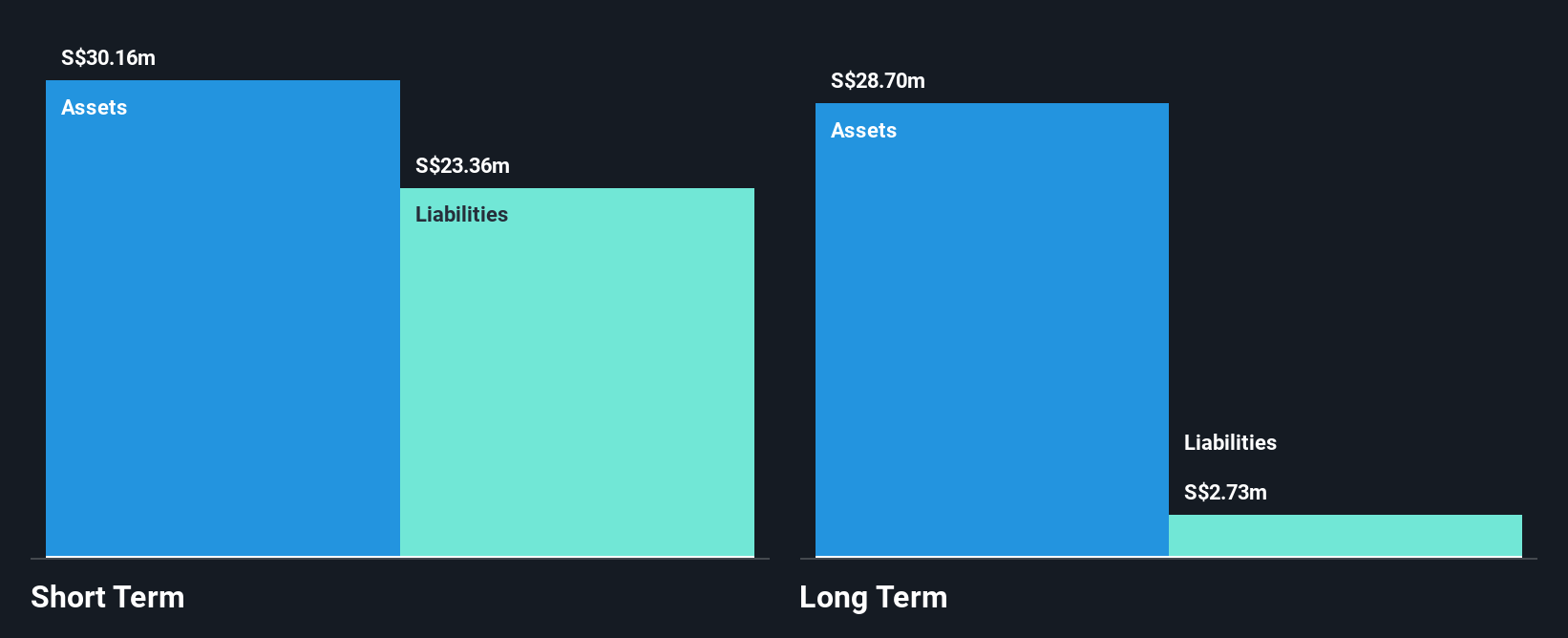

Jinhai Medical Technology, with a market cap of HK$6.56 billion, operates in the medical sector across China and Singapore. Despite generating revenue of SGD 34.65 million from these regions, the company remains unprofitable with increasing losses over five years at a rate of 83.8% annually. Short-term assets (SGD 23.7 million) exceed both short-term and long-term liabilities, providing some liquidity cushion despite a volatile share price and high weekly volatility compared to most Hong Kong stocks. Recent capital raising extends its cash runway beyond six months, while experienced management offers potential stability amid financial challenges and strategic changes within the company.

- Get an in-depth perspective on Jinhai Medical Technology's performance by reading our balance sheet health report here.

- Evaluate Jinhai Medical Technology's historical performance by accessing our past performance report.

AIRA Capital (SET:AIRA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AIRA Capital Public Company Limited, with a market cap of THB6.82 billion, operates in Thailand through its subsidiaries by providing investment and financial advisory services.

Operations: AIRA Capital's revenue is primarily derived from its Property Development segment at THB290 million, followed by Securities and Investment Business at THB288 million, Factoring at THB134 million, Rental and Service Business (Excluding Property Development) at THB76 million, and Advisory and Investment Banking contributing THB9 million.

Market Cap: THB6.82B

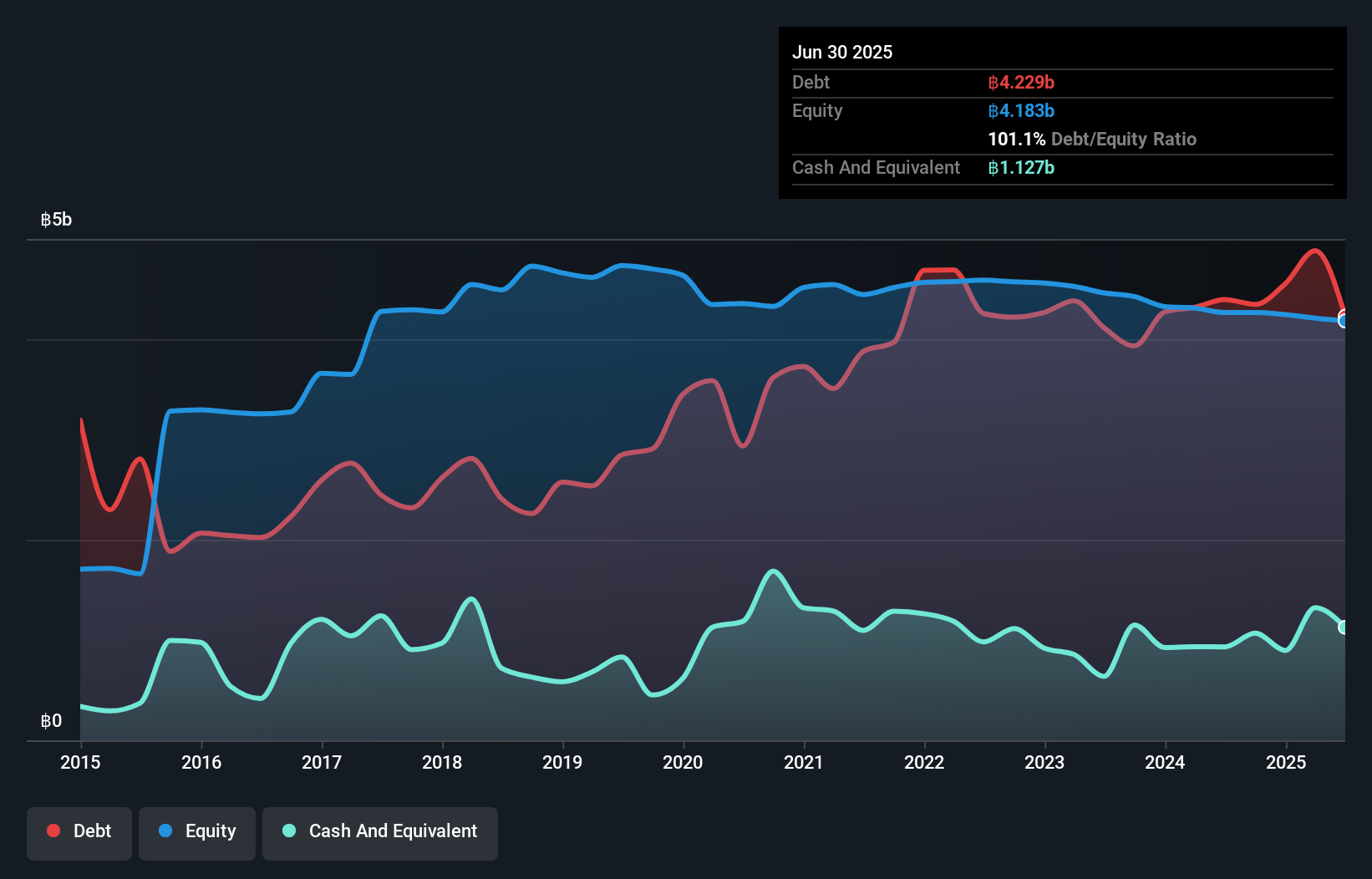

AIRA Capital, with a market cap of THB6.82 billion, derives significant revenue from its Property Development and Securities segments but remains unprofitable. Despite this, the company has a positive cash flow and sufficient runway for over three years if current conditions persist. A seasoned board and management team contribute to strategic stability, although high net debt to equity (86.1%) presents financial challenges. Recent earnings reports indicate declining revenues and marginally reduced net losses compared to the previous year. Share price volatility remains high relative to other Thai stocks, reflecting market uncertainty amid ongoing financial restructuring efforts.

- Navigate through the intricacies of AIRA Capital with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into AIRA Capital's track record.

Next Steps

- Gain an insight into the universe of 959 Asian Penny Stocks by clicking here.

- Interested In Other Possibilities? Uncover 13 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2225

Jinhai Medical Technology

An investment holding company, provides minimally invasive surgery solutions, medical products, and related services in the People's Republic of China and Singapore.

Excellent balance sheet with very low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026