- Hong Kong

- /

- Electrical

- /

- SEHK:1608

3 Promising Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

Global markets have been navigating a complex landscape, with U.S. stocks ending the week lower amid tariff uncertainties and mixed economic signals, such as weaker-than-expected job growth but robust corporate earnings reports. Amidst these fluctuations, investors often look towards smaller or newer companies that may offer growth opportunities at lower price points. Penny stocks, though an outdated term, still represent a relevant area of investment; when these companies are supported by strong financials and solid fundamentals, they can present underappreciated chances for significant returns.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.83 | HK$43.97B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.545 | MYR2.71B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £483.91M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.705 | MYR417.12M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.13 | HK$717.31M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.13B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.922 | £148.21M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

| Warpaint London (AIM:W7L) | £4.08 | £322.74M | ★★★★★★ |

Click here to see the full list of 5,705 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

SSI Group (PSE:SSI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SSI Group, Inc., along with its subsidiaries, operates as a specialty retailer mainly in the Philippines and has a market capitalization of approximately ₱10.24 billion.

Operations: The company's revenue primarily comes from store operations, amounting to ₱29.02 billion.

Market Cap: ₱10.24B

SSI Group, Inc. demonstrates financial stability with its short-term assets of ₱17.2 billion exceeding both short-term and long-term liabilities, indicating strong liquidity. The company's debt management is robust, with operating cash flow well covering its debt and a reduction in the debt-to-equity ratio from 45% to 9.7% over five years. Despite stable earnings quality and interest coverage by EBIT at 16.3 times, SSI faces challenges with declining net profit margins and negative earnings growth over the past year. However, it trades at a favorable price-to-earnings ratio of 4.4x compared to the Philippine market average of 9.4x.

- Dive into the specifics of SSI Group here with our thorough balance sheet health report.

- Explore SSI Group's analyst forecasts in our growth report.

VPower Group International Holdings (SEHK:1608)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: VPower Group International Holdings Limited is an investment holding company that designs, integrates, sells, and installs engine-based electricity generation units across Hong Kong, Macau, Mainland China, other Asian countries, and internationally with a market cap of approximately HK$1.09 billion.

Operations: The company's revenue is primarily derived from two segments: System Integration (SI), contributing HK$435.27 million, and Investment, Building and Operating (IBO), generating HK$885.83 million.

Market Cap: HK$1.09B

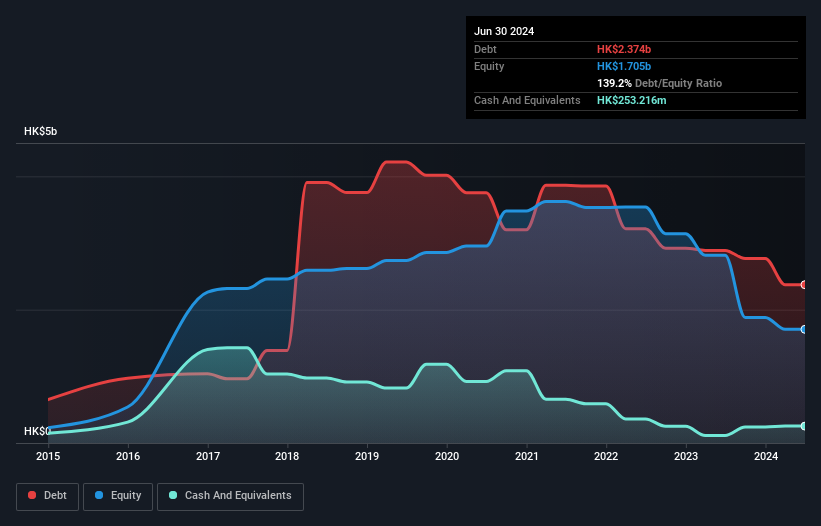

VPower Group International Holdings faces significant financial challenges, with a high net debt to equity ratio of 124.4% and unprofitability marked by a negative return on equity of -156.28%. Despite these hurdles, the company maintains a positive free cash flow, providing it with a cash runway exceeding three years. However, its short-term assets (HK$3 billion) fall short of covering its short-term liabilities (HK$4.2 billion). Recent board changes introduce Mr. Wang Jiachang as an executive director from January 2025, bringing expertise in overseas market development and large-scale project management to potentially steer future growth initiatives.

- Navigate through the intricacies of VPower Group International Holdings with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into VPower Group International Holdings' track record.

AGTech Holdings (SEHK:8279)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AGTech Holdings Limited is an integrated technology and services company operating in the People's Republic of China and Macau, with a market cap of approximately HK$2.35 billion.

Operations: The company's revenue is primarily derived from its Lottery Operation, which generated HK$261.14 million, and its Electronic Payment and Related Services, contributing HK$338.92 million.

Market Cap: HK$2.35B

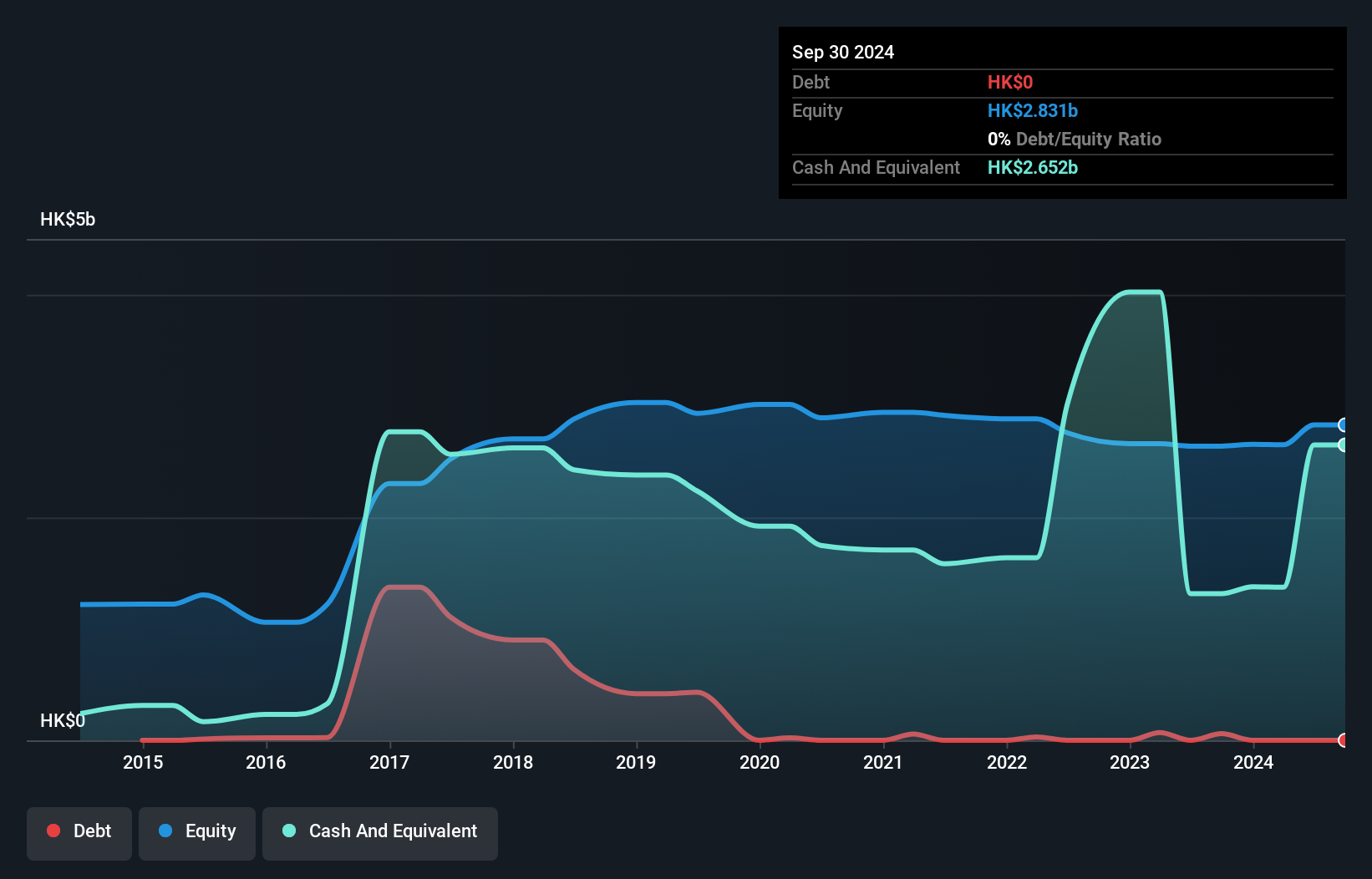

AGTech Holdings Limited demonstrates financial stability with no debt and short-term assets of HK$3.1 billion exceeding both short and long-term liabilities. The company has shown impressive earnings growth, with a 69.9% increase over the past year, surpassing its five-year average growth rate of 37.8%. Despite a low return on equity of 1.2%, AGTech's net profit margins have improved from last year, rising to 6%. Recent earnings reports indicate a positive shift from a net loss to a modest net income for the half-year ended September 2024, reflecting operational improvements amidst stable management tenure and board experience.

- Click to explore a detailed breakdown of our findings in AGTech Holdings' financial health report.

- Learn about AGTech Holdings' historical performance here.

Key Takeaways

- Take a closer look at our Penny Stocks list of 5,705 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1608

VPower Group International Holdings

An investment holding company, designs, integrates, sells, and installs engine-based electricity generation units in Hong Kong, Macau, Mainland China, other Asian countries, and internationally.

Adequate balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives