- Hong Kong

- /

- Construction

- /

- SEHK:1591

The Shun Wo Group Holdings (HKG:1591) Share Price Is Down 74% So Some Shareholders Are Rather Upset

It's not possible to invest over long periods without making some bad investments. But really bad investments should be rare. So take a moment to sympathize with the long term shareholders of Shun Wo Group Holdings Limited (HKG:1591), who have seen the share price tank a massive 74% over a three year period. That would certainly shake our confidence in the decision to own the stock. The more recent news is of little comfort, with the share price down 61% in a year. The falls have accelerated recently, with the share price down 33% in the last three months.

View our latest analysis for Shun Wo Group Holdings

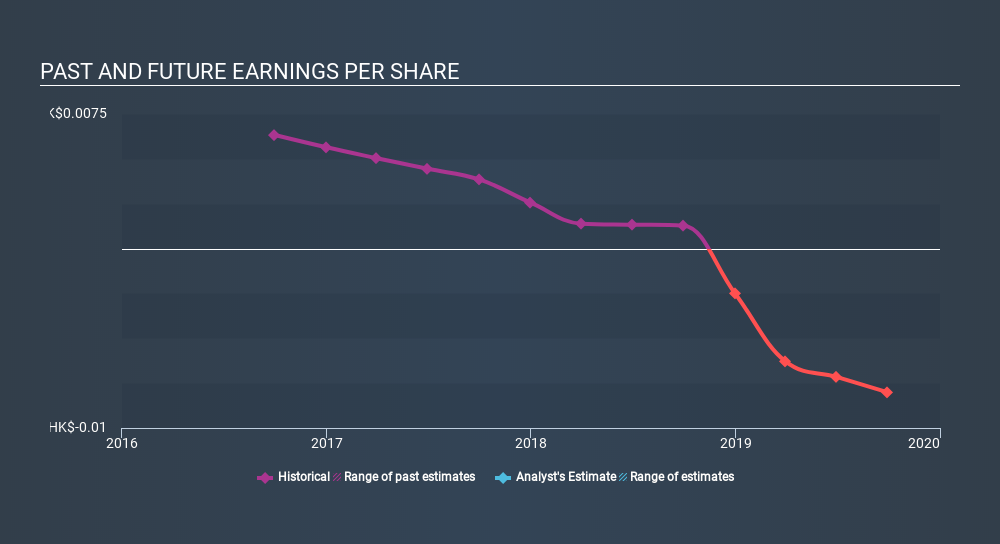

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the three years that the share price declined, Shun Wo Group Holdings's earnings per share (EPS) dropped significantly, falling to a loss. Due to the loss, it's not easy to use EPS as a reliable guide to the business. However, we can say we'd expect to see a falling share price in this scenario.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Shun Wo Group Holdings's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Shun Wo Group Holdings shareholders are down 61% for the year, falling short of the market return. Meanwhile, the broader market slid about 8.5%, likely weighing on the stock. Shareholders have lost 36% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. It's always interesting to track share price performance over the longer term. But to understand Shun Wo Group Holdings better, we need to consider many other factors. For instance, we've identified 3 warning signs for Shun Wo Group Holdings (1 is concerning) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1591

Shun Wo Group Holdings

An investment holding company, undertakes foundation works in Hong Kong.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives