- Hong Kong

- /

- Construction

- /

- SEHK:1559

Kwan On Holdings Limited's (HKG:1559) Popularity With Investors Under Threat As Stock Sinks 32%

Kwan On Holdings Limited (HKG:1559) shareholders that were waiting for something to happen have been dealt a blow with a 32% share price drop in the last month. Indeed, the recent drop has reduced its annual gain to a relatively sedate 5.3% over the last twelve months.

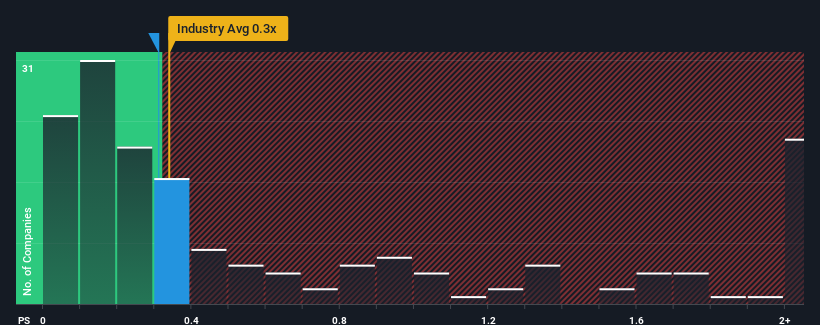

Even after such a large drop in price, there still wouldn't be many who think Kwan On Holdings' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when it essentially matches the median P/S in Hong Kong's Construction industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Kwan On Holdings

How Has Kwan On Holdings Performed Recently?

With revenue growth that's exceedingly strong of late, Kwan On Holdings has been doing very well. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Kwan On Holdings' earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Kwan On Holdings' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 37%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 3.2% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 12% shows it's an unpleasant look.

With this information, we find it concerning that Kwan On Holdings is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

What We Can Learn From Kwan On Holdings' P/S?

With its share price dropping off a cliff, the P/S for Kwan On Holdings looks to be in line with the rest of the Construction industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We find it unexpected that Kwan On Holdings trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

Having said that, be aware Kwan On Holdings is showing 3 warning signs in our investment analysis, and 2 of those are concerning.

If you're unsure about the strength of Kwan On Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kwan On Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1559

Kwan On Holdings

An investment holding company, engages in the construction and maintenance works on civil engineering contracts and building works contracts in Hong Kong, the People’s Republic of China, Philippines, and Malaysia.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives