- Hong Kong

- /

- Construction

- /

- SEHK:1499

We Think Shareholders Are Less Likely To Approve A Large Pay Rise For OKG Technology Holdings Limited's (HKG:1499) CEO For Now

Key Insights

- OKG Technology Holdings' Annual General Meeting to take place on 6th of September

- Salary of HK$3.42m is part of CEO Jeff Ren's total remuneration

- The total compensation is 55% higher than the average for the industry

- OKG Technology Holdings' three-year loss to shareholders was 62% while its EPS grew by 81% over the past three years

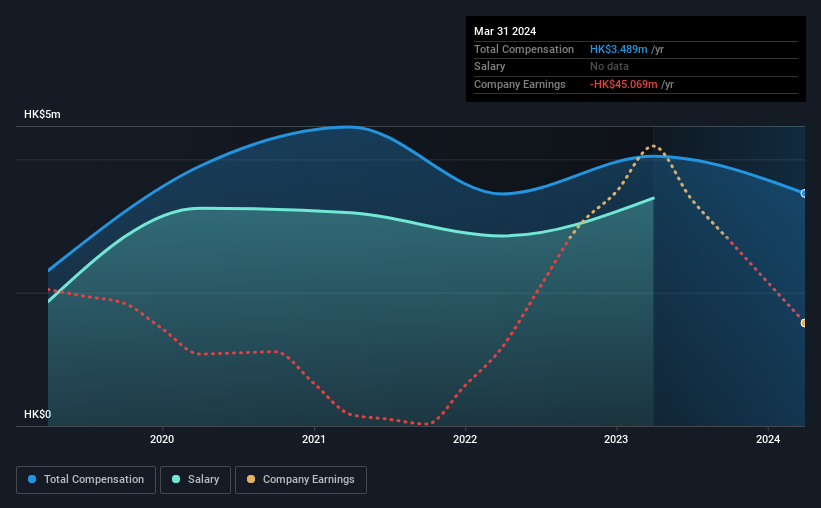

The underwhelming share price performance of OKG Technology Holdings Limited (HKG:1499) in the past three years would have disappointed many shareholders. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. The AGM coming up on the 6th of September could be an opportunity for shareholders to bring these concerns to the board's attention. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

See our latest analysis for OKG Technology Holdings

Comparing OKG Technology Holdings Limited's CEO Compensation With The Industry

According to our data, OKG Technology Holdings Limited has a market capitalization of HK$736m, and paid its CEO total annual compensation worth HK$3.5m over the year to March 2024. That's a notable decrease of 14% on last year. In particular, the salary of HK$3.42m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Hong Kong Construction industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$2.3m. This suggests that Jeff Ren is paid more than the median for the industry.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$3.4m | HK$2.9m | 98% |

| Other | HK$71k | HK$1.2m | 2% |

| Total Compensation | HK$3.5m | HK$4.0m | 100% |

Talking in terms of the industry, salary represented approximately 84% of total compensation out of all the companies we analyzed, while other remuneration made up 16% of the pie. Investors will find it interesting that OKG Technology Holdings pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

OKG Technology Holdings Limited's Growth

OKG Technology Holdings Limited has seen its earnings per share (EPS) increase by 81% a year over the past three years. Its revenue is down 2.2% over the previous year.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has OKG Technology Holdings Limited Been A Good Investment?

The return of -62% over three years would not have pleased OKG Technology Holdings Limited shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

OKG Technology Holdings pays its CEO a majority of compensation through a salary. Shareholders have not seen their shares grow in value, rather they have seen their shares decline. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 2 warning signs for OKG Technology Holdings that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1499

OKG Technology Holdings

An investment holding company, provides foundation works, building construction works, and ancillary services in the People’s Republic of China and Hong Kong.

Excellent balance sheet with weak fundamentals.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026