- Hong Kong

- /

- Construction

- /

- SEHK:1499

Risks Still Elevated At These Prices As OKG Technology Holdings Limited (HKG:1499) Shares Dive 26%

Unfortunately for some shareholders, the OKG Technology Holdings Limited (HKG:1499) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 56% loss during that time.

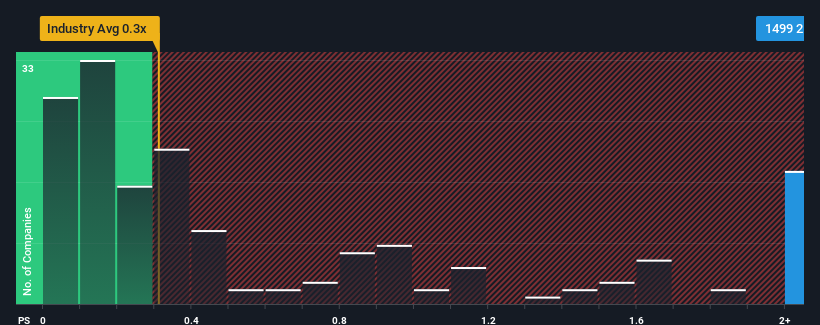

In spite of the heavy fall in price, you could still be forgiven for thinking OKG Technology Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.2x, considering almost half the companies in Hong Kong's Construction industry have P/S ratios below 0.3x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for OKG Technology Holdings

How Has OKG Technology Holdings Performed Recently?

As an illustration, revenue has deteriorated at OKG Technology Holdings over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on OKG Technology Holdings will help you shine a light on its historical performance.How Is OKG Technology Holdings' Revenue Growth Trending?

OKG Technology Holdings' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.4%. As a result, revenue from three years ago have also fallen 26% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 11% shows it's an unpleasant look.

With this information, we find it concerning that OKG Technology Holdings is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does OKG Technology Holdings' P/S Mean For Investors?

There's still some elevation in OKG Technology Holdings' P/S, even if the same can't be said for its share price recently. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of OKG Technology Holdings revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

We don't want to rain on the parade too much, but we did also find 1 warning sign for OKG Technology Holdings that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1499

OKG Technology Holdings

An investment holding company, provides foundation works, building construction works, and ancillary services in the People’s Republic of China and Hong Kong.

Excellent balance sheet with weak fundamentals.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026