- Hong Kong

- /

- Construction

- /

- SEHK:1499

OKG Technology (SEHK:1499) Margin Stagnation Reinforces Investor Concerns Despite H1 2026 Revenue Growth

Reviewed by Simply Wall St

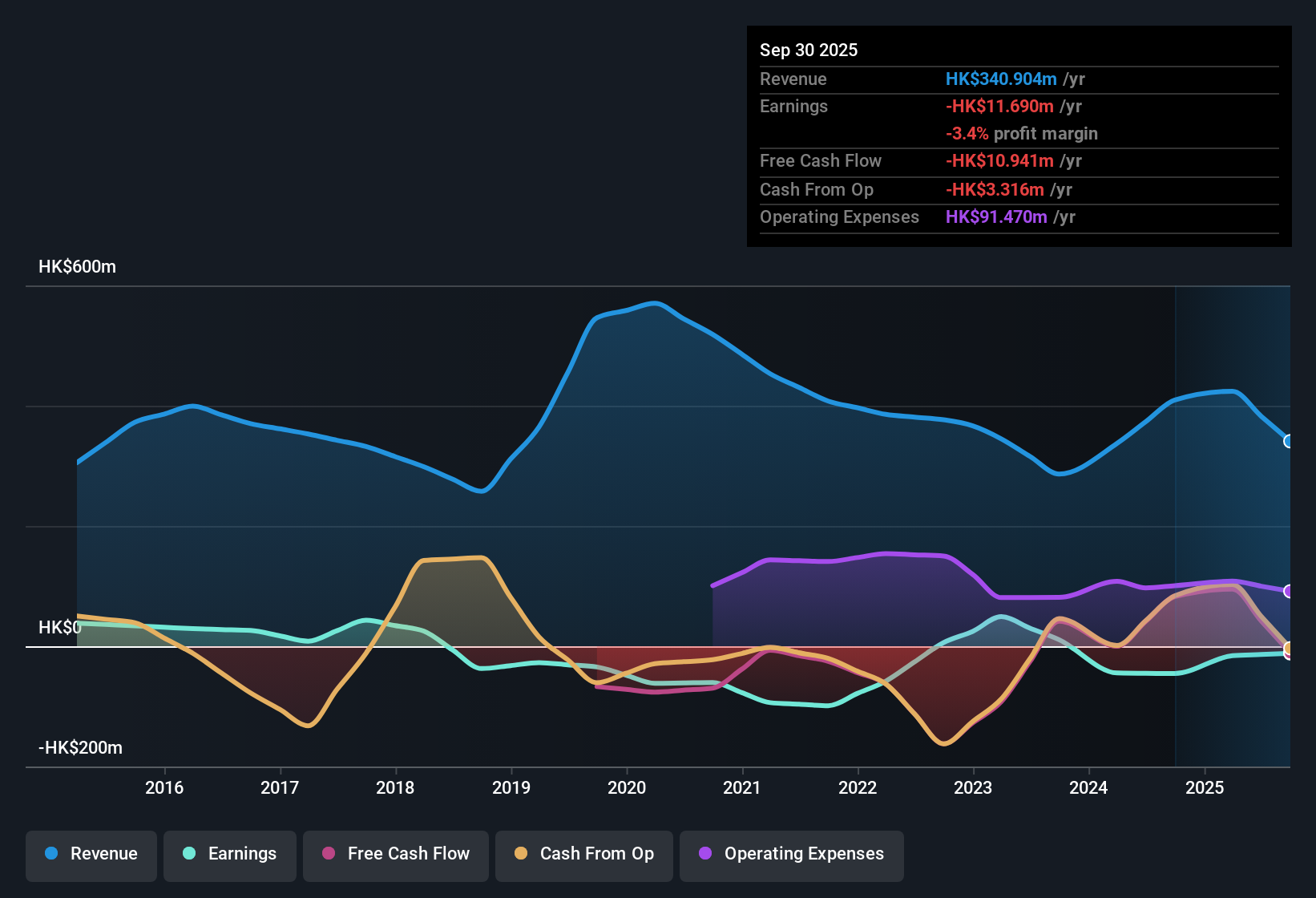

OKG Technology Holdings (SEHK:1499) has just reported its H1 2026 results, with total revenue at 340.9 million HKD and a basic EPS of -0.001994 HKD. The numbers reflect a continuation of unprofitable results for the company. Revenue has grown from 195.7 million HKD in H1 2025 and 123.5 million HKD in H1 2024. Investors will be closely watching margins as profit trends remain negative.

See our full analysis for OKG Technology Holdings.Next up, we’ll see how these results measure up against the narratives that tend to drive sentiment on Simply Wall St, and where expectations and reality may begin to diverge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Narrow Faster Than Expected

- Annual net income losses have been reduced by 32.2% per year over the last five years, signaling persistent movement toward financial stability rather than worsening results.

- Market opinion highlights that while continued unprofitability is a key concern, this improvement in annual losses creates a tension between competing viewpoints:

- Bears warn lack of profitability still overshadows progress, yet the loss reduction rate directly challenges the bearish stance that the business is stuck or deteriorating.

- Steady revenue gains have not yet tipped the company into profit, but the pace of loss reduction could build a platform for renewed optimism if maintained.

Premium Price-To-Sales Vs. Peers

- OKG Technology Holdings currently trades at a 3.2x price-to-sales ratio, notably higher than direct competitors (1.2x) and the Hong Kong Construction industry average (0.4x).

- The general market view frames this high multiple as a core valuation risk:

- Despite narrowing losses, investors pay more than triple the industry average for each dollar of company sales, which is difficult to justify without visible margin improvement or strong profit potential.

- This pricing can limit downside protection for cautious investors until the company demonstrates a clear path to sustainable profitability or outsized top-line expansion.

No Significant Risk Events, But Profit Margins Stagnant

- No major or minor risk events have been flagged in the last twelve months, according to the trailing data and risk summary.

- However, market watchers point out that the lack of margin progress limits enthusiasm:

- Net profit margins have failed to show any improvement in the past year, challenging the view that operational momentum will quickly translate to bottom-line gains.

- Without a decisive margin turnaround, even the absence of new risk events offers little reassurance for those waiting for advance in overall financial health.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on OKG Technology Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

OKG Technology Holdings faces persistent unprofitability and thin margins. Its elevated valuation makes it difficult to justify compared to sector peers with steadier results.

If you want to seek stronger value and less price risk, check out these 926 undervalued stocks based on cash flows for stocks trading at more attractive levels with better upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1499

OKG Technology Holdings

An investment holding company, provides foundation works, building construction works, and ancillary services in the People’s Republic of China and Hong Kong.

Excellent balance sheet with weak fundamentals.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success