- Hong Kong

- /

- Electrical

- /

- SEHK:1421

What Prosperity Group International Limited's (HKG:1421) 36% Share Price Gain Is Not Telling You

Prosperity Group International Limited (HKG:1421) shareholders would be excited to see that the share price has had a great month, posting a 36% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 21% over that time.

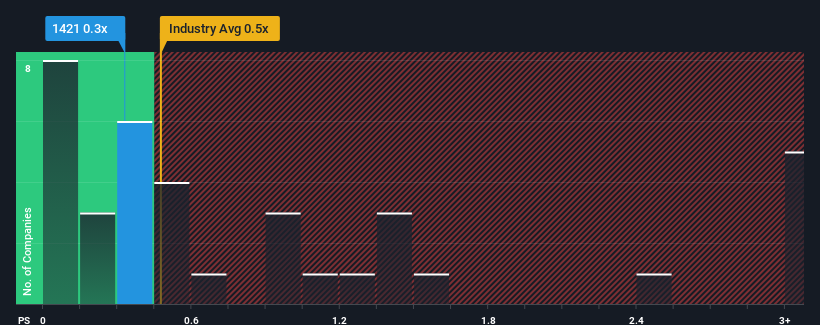

In spite of the firm bounce in price, there still wouldn't be many who think Prosperity Group International's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Hong Kong's Electrical industry is similar at about 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Prosperity Group International

What Does Prosperity Group International's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Prosperity Group International has been doing very well. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Prosperity Group International will help you shine a light on its historical performance.How Is Prosperity Group International's Revenue Growth Trending?

In order to justify its P/S ratio, Prosperity Group International would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 90%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 59% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 20% shows it's an unpleasant look.

With this in mind, we find it worrying that Prosperity Group International's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Prosperity Group International's P/S

Prosperity Group International's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at Prosperity Group International revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for Prosperity Group International you should be aware of.

If these risks are making you reconsider your opinion on Prosperity Group International, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1421

Prosperity Group International

An investment holding company, engages in the supply and installation of solar photovoltaic parts and equipment in the People's Republic of China.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives