- Hong Kong

- /

- Construction

- /

- SEHK:1343

Wei Yuan Holdings Limited's (HKG:1343) Shares Climb 35% But Its Business Is Yet to Catch Up

Wei Yuan Holdings Limited (HKG:1343) shareholders have had their patience rewarded with a 35% share price jump in the last month. Unfortunately, despite the strong performance over the last month, the full year gain of 4.9% isn't as attractive.

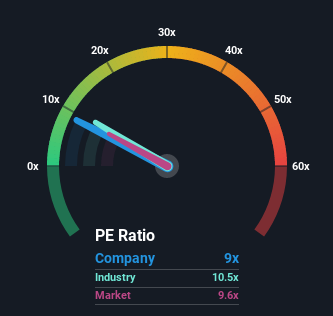

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Wei Yuan Holdings' P/E ratio of 9x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 10x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Wei Yuan Holdings certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Wei Yuan Holdings

Is There Some Growth For Wei Yuan Holdings?

Wei Yuan Holdings' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered an exceptional 41% gain to the company's bottom line. Still, incredibly EPS has fallen 76% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 23% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Wei Yuan Holdings' P/E sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Bottom Line On Wei Yuan Holdings' P/E

Wei Yuan Holdings' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Wei Yuan Holdings revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Wei Yuan Holdings is showing 3 warning signs in our investment analysis, and 1 of those doesn't sit too well with us.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

Valuation is complex, but we're here to simplify it.

Discover if Wei Yuan Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1343

Wei Yuan Holdings

An investment holding company, provides civil engineering services in Singapore.

Flawless balance sheet and good value.

Market Insights

Community Narratives