- Hong Kong

- /

- Trade Distributors

- /

- SEHK:1341

Is Now The Time To Put Hao Tian International Construction Investment Group (HKG:1341) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Hao Tian International Construction Investment Group (HKG:1341), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Hao Tian International Construction Investment Group

Hao Tian International Construction Investment Group's Improving Profits

In the last three years Hao Tian International Construction Investment Group's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Hao Tian International Construction Investment Group boosted its trailing twelve month EPS from HK$0.017 to HK$0.019, in the last year. I doubt many would complain about that 13% gain.

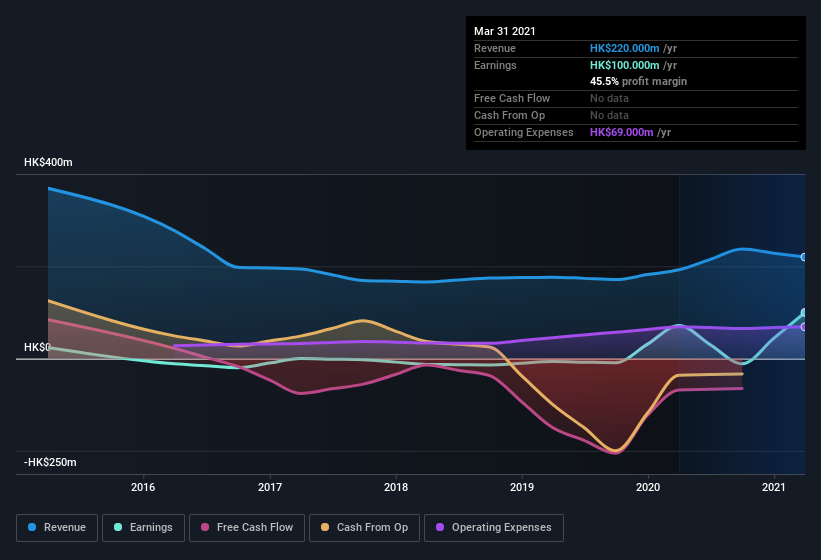

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Hao Tian International Construction Investment Group shareholders can take confidence from the fact that EBIT margins are up from -3.0% to 11%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Hao Tian International Construction Investment Group's balance sheet strength, before getting too excited.

Are Hao Tian International Construction Investment Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One shining light for Hao Tian International Construction Investment Group is the serious outlay one insider has made to buy shares, in the last year. Specifically, the , Junhao Su, accumulated HK$286m worth of shares around HK$0.33. Big insider buys like that are almost as rare as an ocean free of single use plastic waste.

Along with the insider buying, another encouraging sign for Hao Tian International Construction Investment Group is that insiders, as a group, have a considerable shareholding. Notably, they have an enormous stake in the company, worth HK$1.1b. Coming in at 29% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. So it might be my imagination, but I do sense the glimmer of an opportunity.

Does Hao Tian International Construction Investment Group Deserve A Spot On Your Watchlist?

As I already mentioned, Hao Tian International Construction Investment Group is a growing business, which is what I like to see. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. Still, you should learn about the 4 warning signs we've spotted with Hao Tian International Construction Investment Group (including 1 which shouldn't be ignored) .

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Hao Tian International Construction Investment Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hao Tian International Construction Investment Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1341

Hao Tian International Construction Investment Group

An investment holding company, engages in the rental and trade of construction machinery in Hong Kong, the United Kingdom, the People’s Republic of China, Malaysia, Cambodia, and Macau.

Mediocre balance sheet very low.

Market Insights

Community Narratives