D&G Technology Holding (HKG:1301) adds HK$45m to market cap in the past 7 days, though investors from five years ago are still down 47%

It's nice to see the D&G Technology Holding Company Limited (HKG:1301) share price up 11% in a week. But if you look at the last five years the returns have not been good. In fact, the share price is down 52%, which falls well short of the return you could get by buying an index fund.

The recent uptick of 11% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for D&G Technology Holding

D&G Technology Holding wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

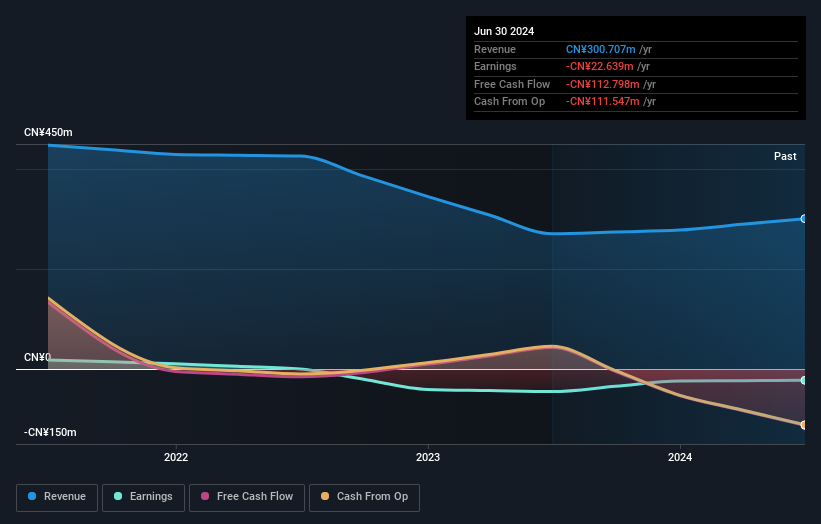

Over half a decade D&G Technology Holding reduced its trailing twelve month revenue by 7.2% for each year. While far from catastrophic that is not good. With neither profit nor revenue growth, the loss of 9% per year doesn't really surprise us. We don't think anyone is rushing to buy this stock. Ultimately, it may be worth watching - should revenue pick up, the share price might follow.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at D&G Technology Holding's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We've already covered D&G Technology Holding's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for D&G Technology Holding shareholders, and that cash payout explains why its total shareholder loss of 47%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

D&G Technology Holding shareholders are down 23% for the year, but the market itself is up 19%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand D&G Technology Holding better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for D&G Technology Holding you should be aware of, and 1 of them can't be ignored.

Of course D&G Technology Holding may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1301

D&G Technology Holding

Engages in manufacturing, distribution, research and development, and operating lease of asphalt mixing plants in the People’s Republic of China and internationally.

Adequate balance sheet low.

Market Insights

Community Narratives