Wuxi Sunlit Science and Technology's (HKG:1289) Returns On Capital Not Reflecting Well On The Business

When it comes to investing, there are some useful financial metrics that can warn us when a business is potentially in trouble. When we see a declining return on capital employed (ROCE) in conjunction with a declining base of capital employed, that's often how a mature business shows signs of aging. This indicates to us that the business is not only shrinking the size of its net assets, but its returns are falling as well. In light of that, from a first glance at Wuxi Sunlit Science and Technology (HKG:1289), we've spotted some signs that it could be struggling, so let's investigate.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Wuxi Sunlit Science and Technology is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

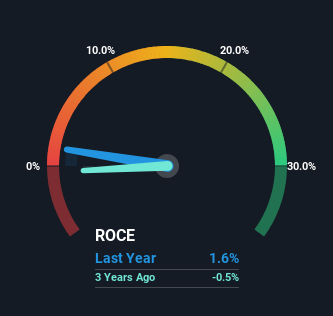

0.016 = CN¥10m ÷ (CN¥986m - CN¥334m) (Based on the trailing twelve months to June 2023).

Thus, Wuxi Sunlit Science and Technology has an ROCE of 1.6%. In absolute terms, that's a low return and it also under-performs the Machinery industry average of 7.1%.

See our latest analysis for Wuxi Sunlit Science and Technology

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Wuxi Sunlit Science and Technology, check out these free graphs here.

What Can We Tell From Wuxi Sunlit Science and Technology's ROCE Trend?

In terms of Wuxi Sunlit Science and Technology's historical ROCE movements, the trend doesn't inspire confidence. To be more specific, the ROCE was 7.6% five years ago, but since then it has dropped noticeably. And on the capital employed front, the business is utilizing roughly the same amount of capital as it was back then. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. If these trends continue, we wouldn't expect Wuxi Sunlit Science and Technology to turn into a multi-bagger.

While on the subject, we noticed that the ratio of current liabilities to total assets has risen to 34%, which has impacted the ROCE. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. While the ratio isn't currently too high, it's worth keeping an eye on this because if it gets particularly high, the business could then face some new elements of risk.

Our Take On Wuxi Sunlit Science and Technology's ROCE

In the end, the trend of lower returns on the same amount of capital isn't typically an indication that we're looking at a growth stock. Investors haven't taken kindly to these developments, since the stock has declined 44% from where it was five years ago. Unless there is a shift to a more positive trajectory in these metrics, we would look elsewhere.

One final note, you should learn about the 5 warning signs we've spotted with Wuxi Sunlit Science and Technology (including 1 which doesn't sit too well with us) .

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Sunlit Science and Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1289

Wuxi Sunlit Science and Technology

Engages in the research and development, design, supply, installation, testing, repair, and maintenance of production lines for manufacturing steel wire products in the People’s Republic of China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives